[ad_1]

British Pound, GBP/USD, GBP/JPY, Technical Analysis, Retail Trader Positioning – IGCS Update

- British Pound rose Wednesday as GBP/USD, GBP/JPY climbed

- Retail traders responded by increasing their net-short exposure

- While that may be bullish, the technical posture doesn’t match

Recommended by Daniel Dubrovsky

Get Your Free GBP Forecast

The British Pound gained 0.77 percent against the US Dollar and 1.96 percent against the Japanese Yen on Wednesday, respectively. These reflected the best days for GBP/USD and GBP/JPY since December 13th and October 13th, respectively. Looking at IG Client Sentiment (IGCS), retail traders responded by boosting short exposure. IGCS typically functions as a contrarian indicator. Is this a sign that further gains might be in store for Sterling ahead?

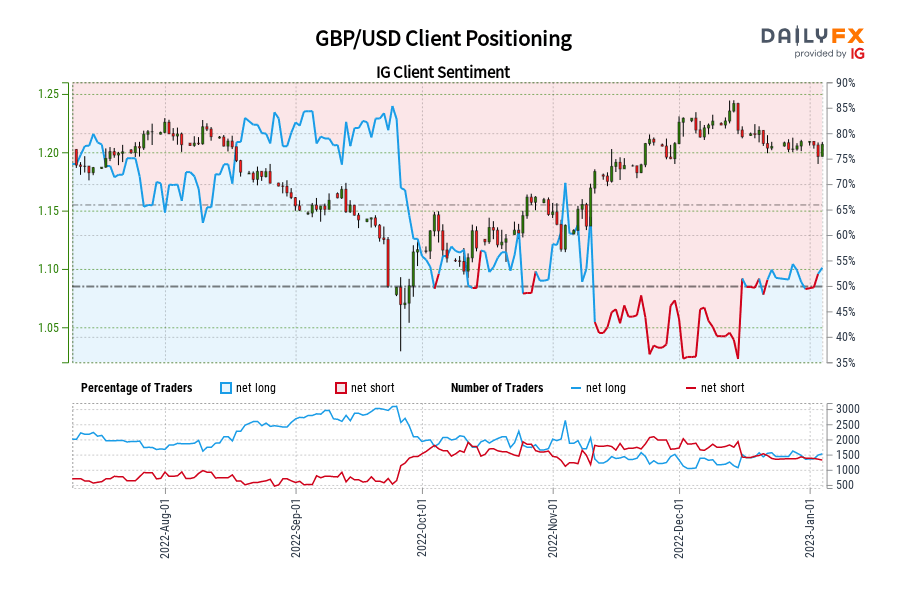

GBP/USD Sentiment Outlook – Bullish

The IGCS gauge shows that only about 48% of retail traders are net-long GBP/USD. Since most of them are still biased to the downside, this hints that prices may continue rising. Meanwhile, downside exposure increased by 11.75% and 7.88% compared to yesterday and last week, respectively. With that in mind, the combination of overall positioning and recent changes offers a stronger bullish contrarian trading bias.

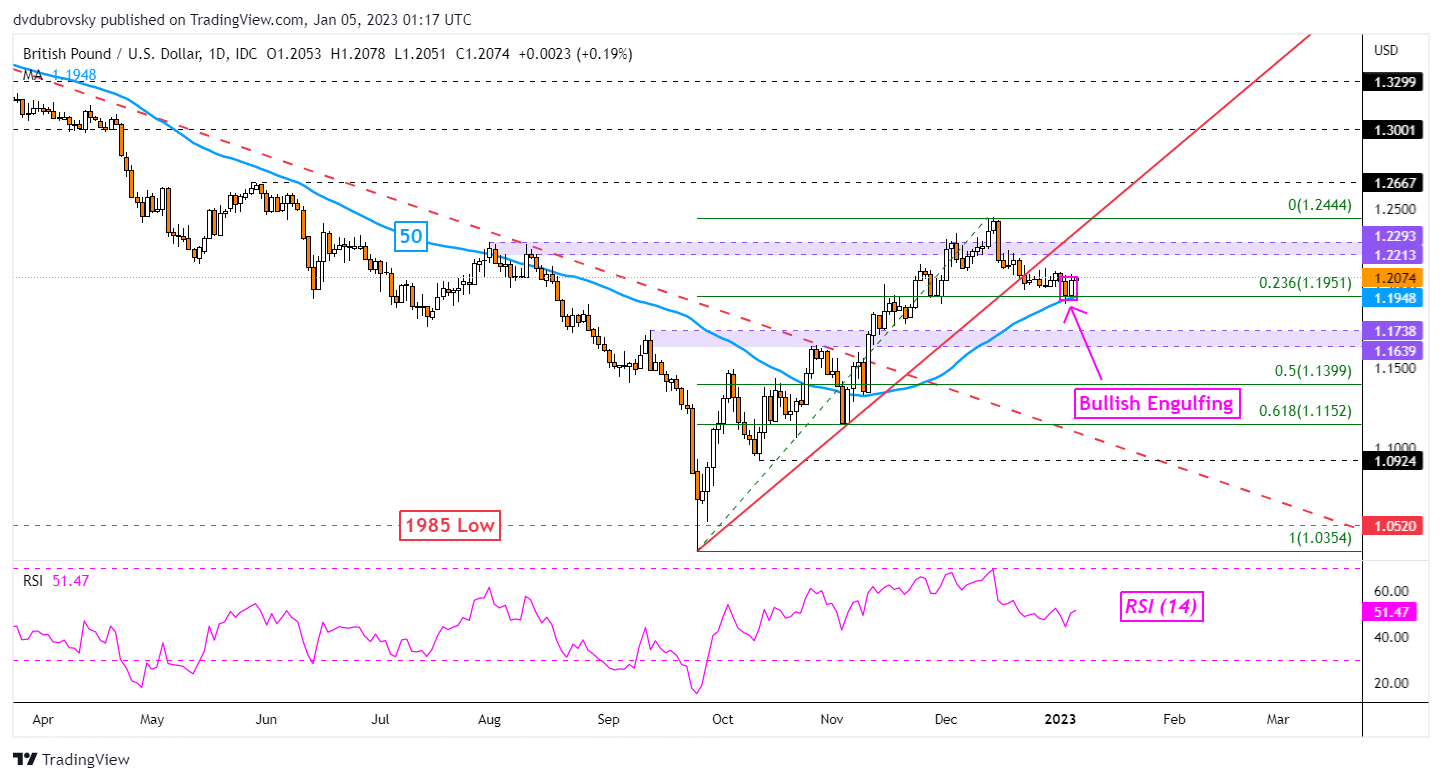

Daily Chart

GBP/USD left behind a Bullish Engulfing candlestick pattern as prices tested the 23.6% Fibonacci retracement level at 1.1951. Meanwhile, the 50-day Simple Moving Average (SMA) maintained an upside focus. While these may be early technical signs that further gains could be in store, confirmation may increasingly open the door to that outcome. More upside progress would place the focus on the 1.2213 – 1.2293 inflection zone. Otherwise, extending near-term losses exposes the 1.1639 – 1.1738 zone.

Recommended by Daniel Dubrovsky

Get Your Free GBP Forecast

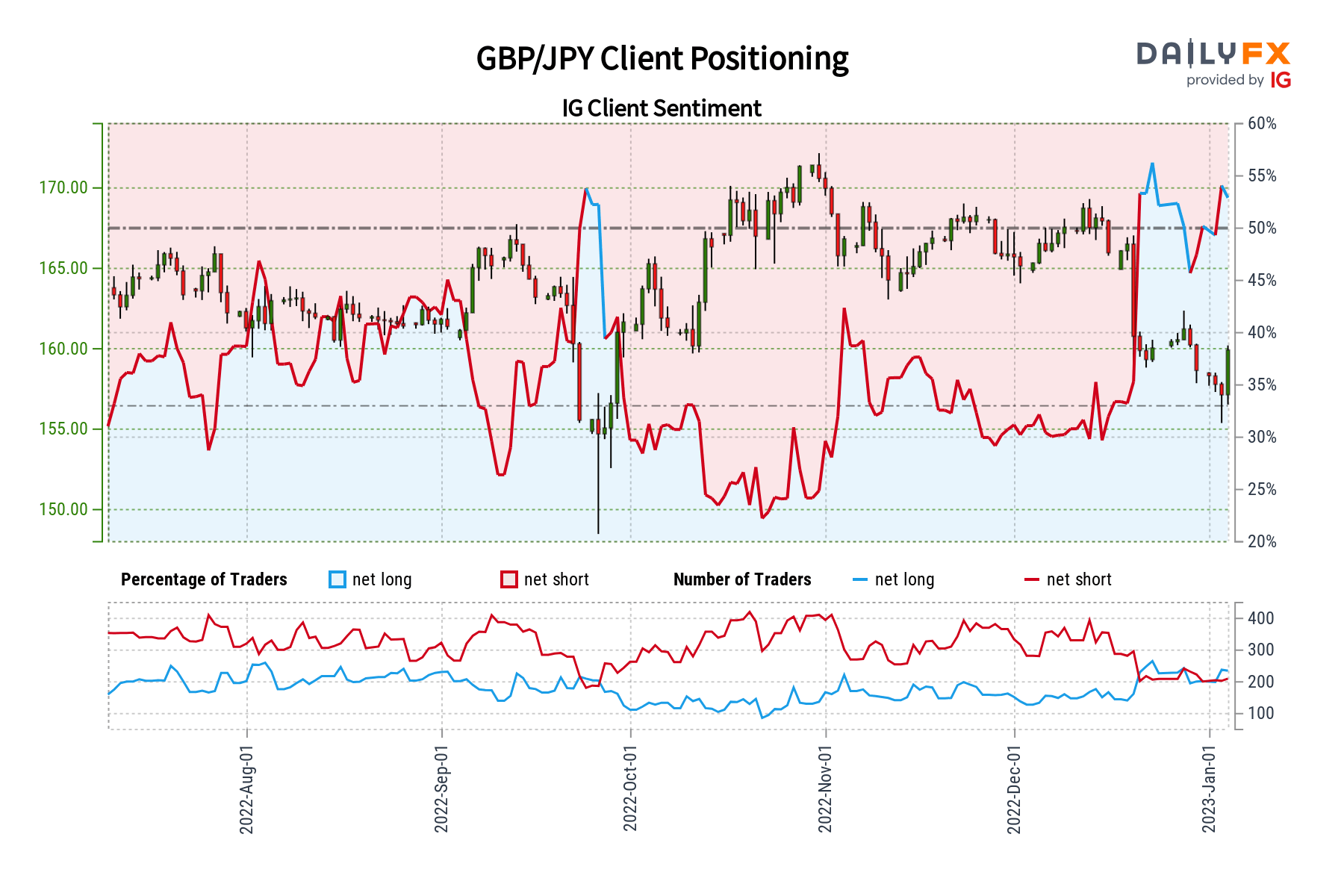

GBP/JPY Sentiment Outlook – Bullish

The IGCS gauge reveals that about 48% of retail traders are also net-long GBP/JPY. Since most remain biased to the downside, this hints prices may continue rising. This is as downside exposure increased by 3.95% and 6.76% compared to yesterday and last week, respectively. With that in mind, overall positioning and recent changes offer a stronger bullish contrarian trading bias.

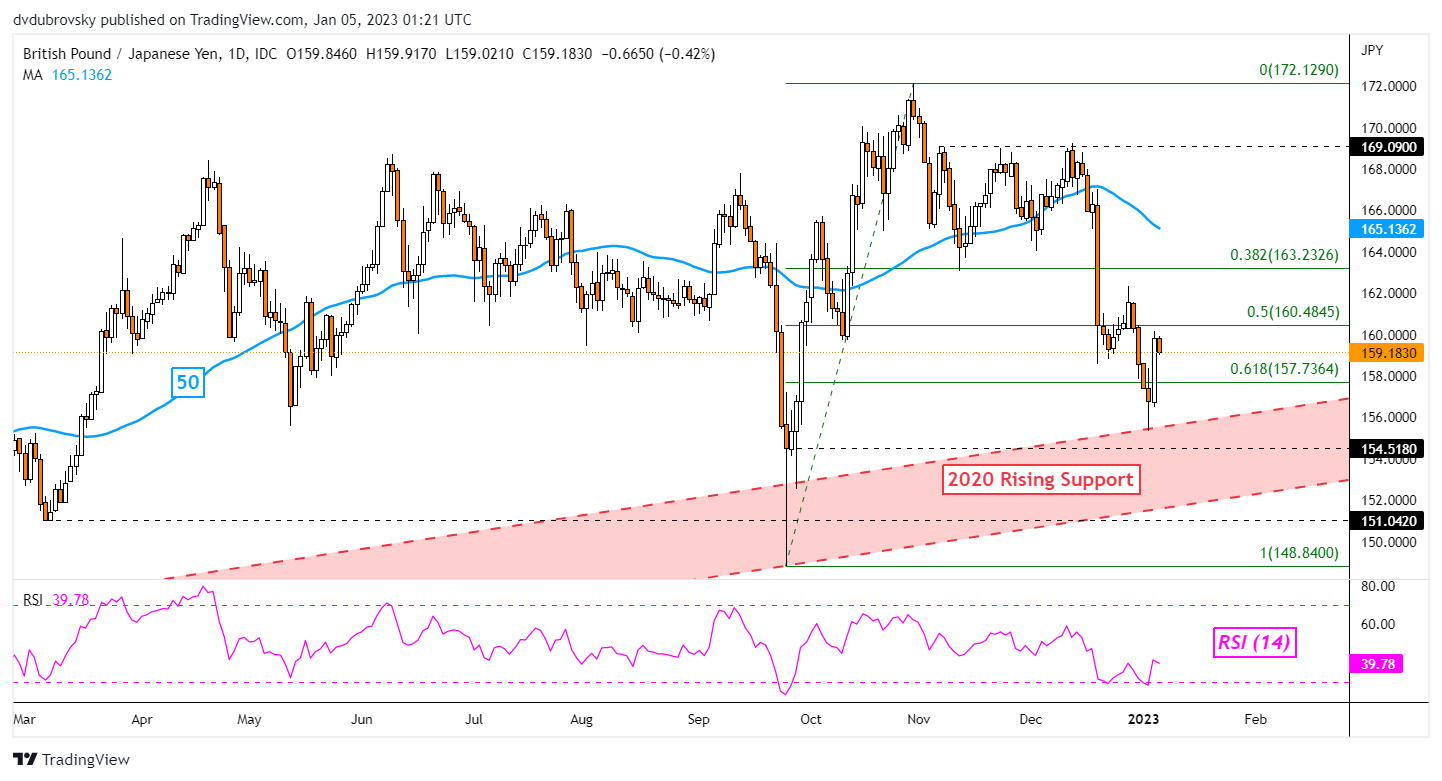

Daily Chart

GBP/JPY aimed higher after prices tested the outer layer of a rising channel of support from 2020. It also marked a false breakout under the 61.8% Fibonacci retracement level at 157.73. This left the pair facing the midpoint of the retracement at 160.48 as immediate resistance. A confirmatory breakout above the latter would offer an increasingly bullish bias, exposing the 50-day SMA. But, the near-term trend arguably remains bearish.

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

To contact Daniel, follow him on Twitter:@ddubrovskyFX

[ad_2]

Source link