[ad_1]

Multinational is one thing, but 2022 hasn’t been the year for stocks to have a truly international presence.

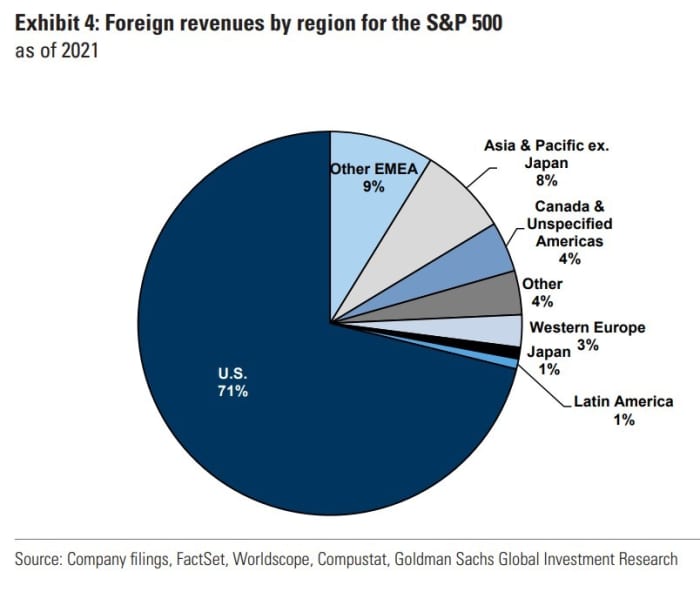

According to analysis from Goldman Sachs, S&P 500 companies with high domestic sales exposure have been outperforming stocks with a high international sales by 9 percentage points. Granted, it isn’t a great performance, with the domestic basket losing 15%, but it is better than the 24% slide for international-facing companies.

Part of the reason the domestic companies have fared better is the strengthening of the U.S. dollar. The other major reason is simply the sector breakdown — the sector with the highest percentage of foreign sales is information technology, which has been dragged lower by the surge in interest rates making long-duration assets less attractive.

What the analysis also finds is that just 3% of S&P 500 revenue was explicitly derived from China, which compares to the roughly 18% share of global gross domestic product the country has. Companies do have discretion in how they report international exposure — accounting rules require them to identify any geographic segment contributing at least 10% of sales, and they can choose whether to report by region or country.

The Goldman analysis was done by poring over 10-K filings, and even so, the bank was only able to get revenue, and not profit figures, by country. So for profits, they rely on U.S. government data to show that only 17% of profits are from overseas.

The investment bank has sliced the findings out into different investible baskets. Goldman’s domestic sales basket includes Verizon Communications

VZ,

T-Mobile US

TMUS,

Target

TGT,

Altria

MO,

Wells Fargo

WFC,

Charles Schwab

SCHW,

CVS Health

CVS,

Anthem

ANTM,

and Intuit

INTU,

and its international sales basket includes Alphabet

GOOGL,

Meta Platforms

META,

Philip Morris International

PM,

Exxon Mobil

XOM,

Abbott Laboratories

ABT,

Caterpillar

CAT,

Nvidia

NVDA,

Broadcom

AVGO,

and Qualcomm

QCOM,

The buzz

The final reading of the University of Michigan’s consumer sentiment index is due for release on Friday. The preliminary version of the index showed inflation expectations rising. “The preliminary University of Michigan reading — it’s a preliminary reading, it might be revised — nonetheless, it was quite eye-catching, and we noticed that,” Federal Reserve Chair Jerome Powell said at this month’s press conference after hiking rates by 75 basis points.

New-home sales data also are due for release.

The Fed said 33 financial institutions including JPMorgan Chase

JPM,

Bank of America

BAC,

and Citi

C,

passed their annual stress tests. Banks next week will be able to announce their dividend and stock buyback plans. “Clearly, the days of payout ratios greater than 100% are long-gone for most,” said Mark Conrad, portfolio manager at Algebris Investments, who said the regional banks received the stronger grades.

Ukraine ordered forces to retreat from the eastern city of Severodonetsk. President Joe Biden is traveling to Germany for the Group of Seven meeting this weekend, in which energy and the Russia-Ukraine war are expected to be discussed.

Zendesk

ZEN,

is close to a deal to be sold to private-equity firms for about $7 billion, according to The Wall Street Journal.

The U.S. Senate passed a bipartisan gun bill, in the most significant firearms legislation in decades.

The market

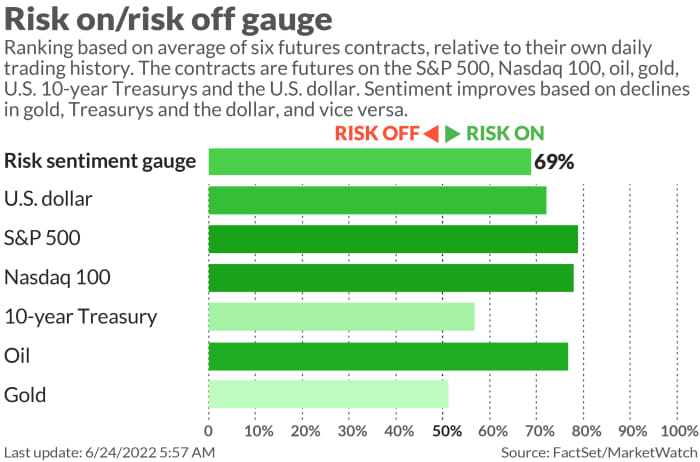

U.S. stock futures

ES00,

NQ00,

advanced, after gains in three of the last four sessions for the S&P 500

SPX,

Oil

CL.1,

futures rose, the dollar

DXY,

fell, and the yield on the 10-year Treasury

TMUBMUSD10Y,

was 3.09%.

Top tickers

Here are the most active stock-market tickers as of 6 a.m. Eastern.

| Ticker | Security name |

|

GME, |

GameStop |

|

TSLA, |

Tesla |

|

AMC, |

AMC Entertainment |

|

NIO, |

NIO |

|

AAPL, |

Apple |

|

TWTR, |

|

|

AMZN, |

Amazon.com |

|

BABA, |

Alibaba |

|

MULN, |

Mullen Automotive |

|

BHAT, |

Blue Hat Interactive Entertainment Technology |

Random reads

The most-squeaky clean accounting firms have connections with the mafia, an Italian study finds.

Billionaire Bill Gates has angered the locals by buying 2,100 acres of potato farmland in North Dakota.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.

[ad_2]

Source link