[ad_1]

Canadian Dollar Outlook:

- The general risk-off tone across financial markets has been weighing on the Canadian Dollar in recent days.

- USD/CAD rates are pushing towards their yearly highs, while CAD/JPY rates are at their lowest level since September 5.

- However, according to the IG Client Sentiment Index, USD/CAD rates have a bullish bias in the near-term.

Recommended by Christopher Vecchio, CFA

Get Your Free Top Trading Opportunities Forecast

Strong USD, Soft Oil Prices Weigh

The Canadian Dollar has turned lower over the past few days, in line with risk appetite more broadly. Rapidly rising Fed rate hike odds have pushed up the US Dollar (via the DXY Index) and US Treasury yields, while proliferating global recession concerns have weighed on energy prices. The net-result has been that USD/CAD rates are pushing their yearly highs, while CAD/JPY rates have dropped to their lowest level in over a week.

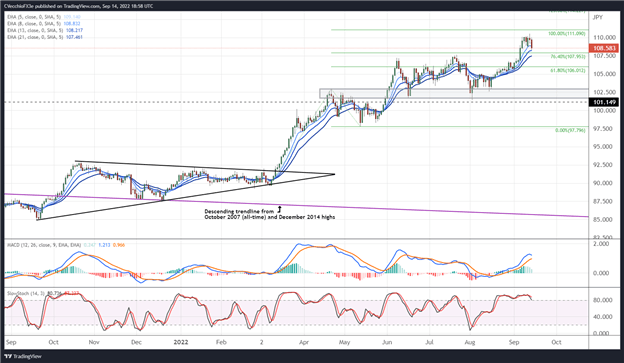

CAD/JPY Rate Technical Analysis: Daily Chart (September 2021 to September 2022) (Chart 1)

CAD/JPY rates pushed through resistance around 107.50 at the start of September, establishing a fresh yearly high at 110.52 yesterday before turning lower. The pullback has minimal thus far, with the pair sliding back to levels seen on September 5. Momentum is staring to erode, with CAD/JPY rates below their daily 5- and 8-EMAs but still above their daily 13- and 21-EMAs, while the EMA envelope remains in bullish sequential order. Daily MACD continues to trend higher above its signal line although a bearish crossover is becoming more likely, and daily Slow Stochastics are holding in overbought territory although an exit is nearing. The daily 21-EMA and the former yearly high area between 107.46/65 is first support to the downside.

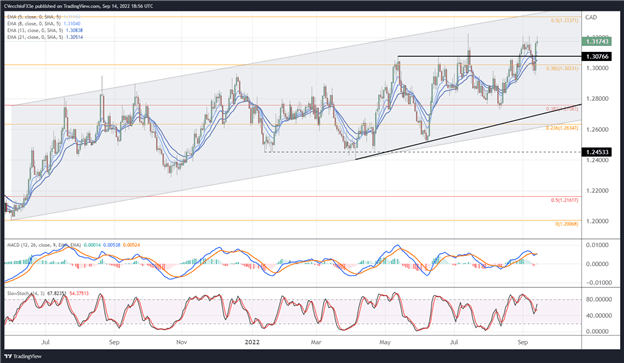

USD/CAD Rate Technical Analysis: Daily Chart (May 2021 to September 2022) (Chart 2)

In the prior note at the end of August, it was observed that “continued deterioration in US equity markets, noted by rising US 2-year yields and an elevated VIX, could help pave the path for USD/CAD rates to retest their yearly high above 1.3200 in short order.” Since then, including today, the pair has traded above 1.3200 on occasions, but has not yet reached the yearly high at 1.3224. Having broken above ascending triangle resistance that’s been forming since April, the near-term bias appears to be to the topside. USD/CAD rates are still above their daily EMA envelope, which is in bullish sequential order. Daily MACD is trending higher above its signal line, while daily Slow Stochastics are trending towards overbought territory. The yearly high at 1.3224 remains in focus.

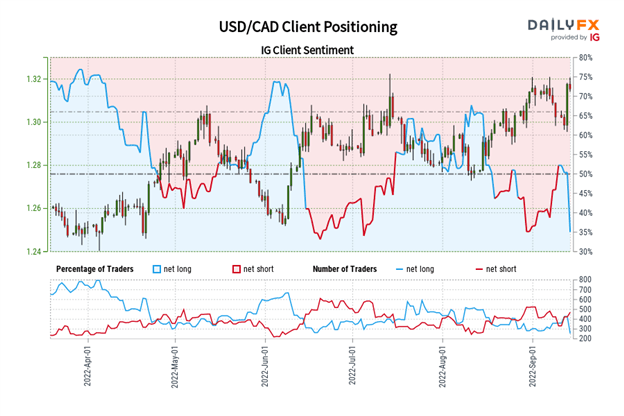

IG Client Sentiment Index: USD/CAD Rate Forecast (September 14, 2022) (Chart 3)

USD/CAD: Retail trader data shows 32.82% of traders are net-long with the ratio of traders short to long at 2.05 to 1. The number of traders net-long is 22.73% lower than yesterday and 9.89% lower from last week, while the number of traders net-short is 41.46% higher than yesterday and 0.58% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/CAD prices may continue to rise.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/CAD-bullish contrarian trading bias.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Christopher Vecchio, CFA, Senior Strategist

[ad_2]

Source link