[ad_1]

Canadian Dollar Technical Forecast: USD/CAD Weekly Trade Levels

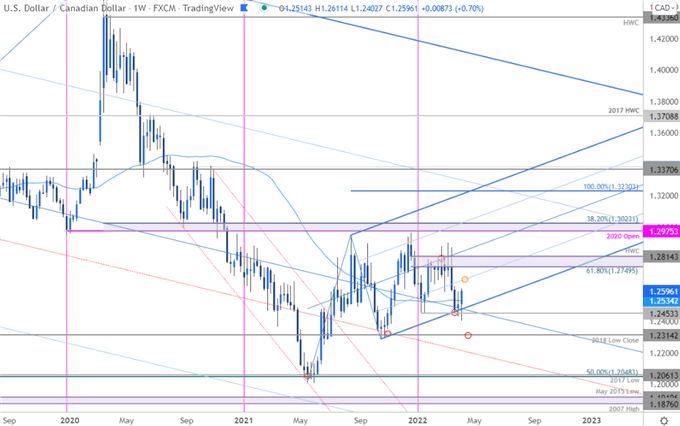

- Canadian Dollar updated technical trade levels – Weekly Chart

- USD/CAD defends yearly lows for a third time- focus is on recovery off confluent trend support

- Weekly support 1.2453 (key), 1.2314 – Resistance 1.2749-1.2814 (critical), 1.2975-1.3023

The Canadian Dollar is off more than 0.70% against the US Dollar since the start of the week with USD/CAD attempting to close out the second weekly advance. A rebound off uptrend support / the yearly lows is now in focus with battle-lines drawn heading into the close of the week. These are the updated targets and invalidation levels that matter on the USD/CAD weekly technical price chart. Review my latest Weekly Strategy Webinar for an in-depth breakdown of this Loonie technical setup and more.

Canadian Dollar Price Chart – USD/CAD Weekly

Chart Prepared by Michael Boutros, Technical Strategist; USD/CAD on Tradingview

Notes: In last month’s Canadian Dollar Weekly Technical Forecast we noted that USD/CAD was, “attempting to breakout above a major technical pivot zone that has capped price since the start of the year. Keep in mind the US Dollar attempted this breach two-weeks ago but closed lower on the week- watch the close.” The region in focus was 1.2768-1.2814 and as warned, price never marked a close above with a Loonie counteroffensive taking price back into support at the yearly opening-range lows around 1.2453.

Note that a modified pitchfork we’ve been tracking off the 2021 lows remains in play with the lower parallel further highlighting key support at 1.2453– a rebound off this level this week is in focus here. Initial resistance eyed along the 25% parallel (currently ~1.2660s) backed by key resistance again at the 61.8% Fibonacci retracement of the December decline / 2021 high-week close at 1.2749-1.2814 – a breach / weekly close above this threshold is needed to suggest a more significant low was registered this week. A break lower from here would be extremely damaging from a technical standpoint with such a scenario risking a steeper drop towards the 2018 low-close at 1.2314 and beyond.

Bottom line: USD/CAD is attempting to rebound off confluent support around the yearly range lows. From at trading standpoint, look for losses / pullbacks to be limited to this week’s open at 1.2514 IF price is heading higher with a close above 1.2814 ultimately needed to mark resumption of the broader 2021 uptrend. Keep in mind Canada emplolyment figures are on tap tomorrow morning. I’ll publish an updated Canadian Dollar Price Outlook once we get further clarity on the near-term USD/CAD technical trade levels.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

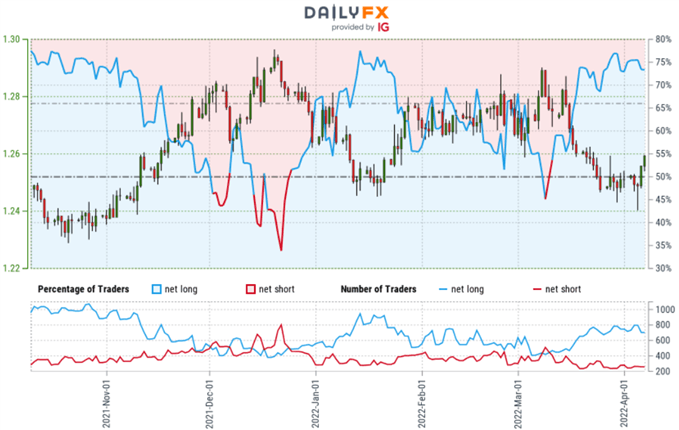

Canadian Dollar Trader Sentiment – USD/CAD Price Chart

- A summary of IG Client Sentiment shows traders are net-short USD/CAD – the ratio stands at -1.22 (45.07% of traders are long) – typically weak bullish reading

- Long positions are2.02% lower than yesterday and 1.36% lower from last week

- Short positions are 4.01% lower than yesterday and 14.76% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/CAD prices may continue to fall. Traders are more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed USD/CAD trading bias from a sentiment standpoint.

—

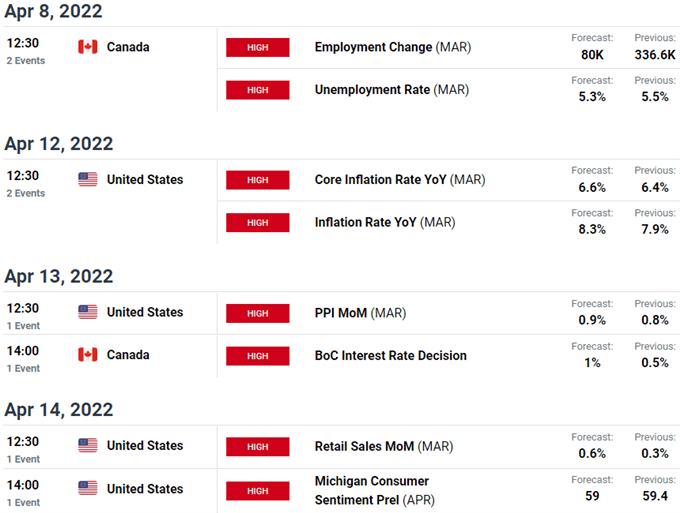

US / Canada Economic Calendar

Economic Calendar – latest economic developments and upcoming event risk.

Active Weekly Technical Charts

— Written by Michael Boutros, Technical Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex

[ad_2]

Source link