[ad_1]

Canadian Dollar Technical Forecast: USD/CAD Weekly Trade Levels

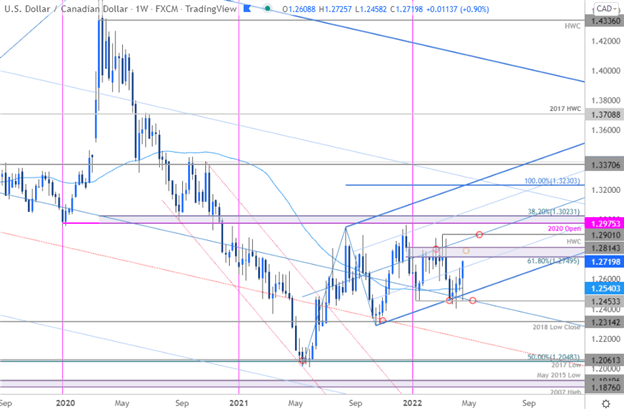

- Canadian Dollarupdated technical trade levels – Weekly Chart

- USD/CAD rally off trend support puts focus on yearly highs

- Weekly support 1.2540, 1.2453(key) – Resistance 1.2749-1.2814 (critical), 1.2901

The Canadian Dollar is off more than 0.85% against the US Dollar this week with USD/CAD attempting to mark a fourth consecutive weekly advance. A rally off uptrend support shifts the focus back towards uptrend resistance near the yearly range-highs. These are the updated targets and invalidation levels that matter on the USD/CAD weekly technical price chart. Review my latest Weekly Strategy Webinar for an in-depth breakdown of this Loonie technical setup and more.

Canadian Dollar Price Chart – USD/CAD Weekly

Chart Prepared by Michael Boutros, Technical Strategist; USD/CAD on Tradingview

Notes: In my last Canadian Dollar Weekly Technical Forecast we noted that USD/CAD was, “attempting to rebound off confluent support around the yearly range lows. From at trading standpoint, look for losses / pullbacks to be limited to this week’s open at 1.2514 IF price is heading higher with a close above 1.2814 ultimately needed to mark resumption of the broader 2021 uptrend.” Price defended the yearly range lows at 1.2453 for a third time this week before rebounding sharply higher with USD/CAD now set for a possible run back towards key resistance at the 61.8% Fibonacci retracement of the December decline / 2021 high-week close at 1.2749-1.2814 – a breach / weekly close above this threshold is needed to mark resumption of the broader uptrend towards the yearly range highs at 1.29.

Bottom line: USD/CAD is building on a rebound off pitchfork support – the focus is on this stretch back towards key resistance near the yearly high-closes. From a trading standpoint, look to reduce portions of long-exposure / raise protective stops on a stretch towards 1.2749-1.2814– an area of interest for possible price inflection IF reached. Respecting the weekly closes here will be critical. I’ll publish an updated Canadian Dollar Price Outlook once we get further clarity on the near-term USD/CAD technical trade levels.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

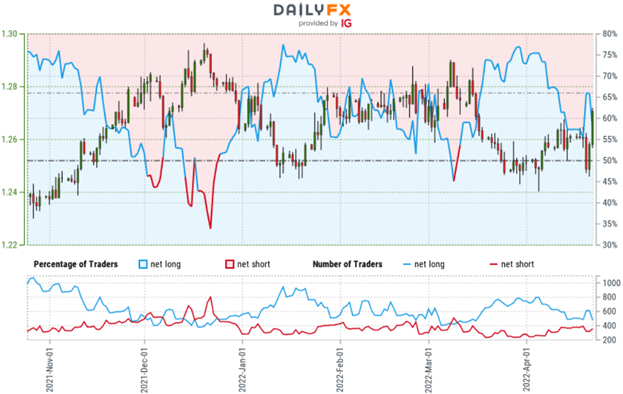

Canadian Dollar Trader Sentiment – USD/CAD Price Chart

- A summary of IG Client Sentiment shows traders are net-short USD/CAD – the ratio stands at -1.07 (51.60% of traders are long) – typically neutral reading

- Long positions are38.32% lower than yesterday and 22.61% lower from last week

- Short positions are 14.50% higher than yesterday and 1.07% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/CAD prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current USD/CAD price trend may soon reverse higher despite the fact traders remain net-long.

—

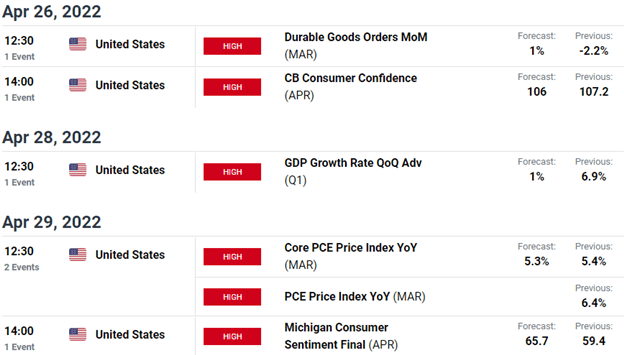

US / Canada Economic Calendar

Economic Calendar – latest economic developments and upcoming event risk.

Active Weekly Technical Charts

— Written by Michael Boutros, Technical Strategist with DailyFX

Follow Michael on Twitter @MBForex

[ad_2]

Source link