[ad_1]

Canadian Dollar Talking Points

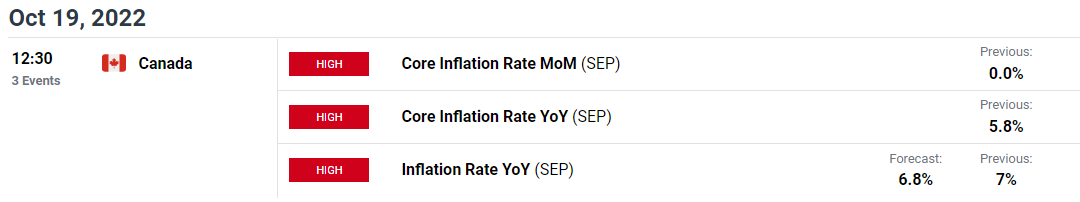

Recent developments in the Relative Strength Index (RSI) raise the scope for a near-term pullback in USD/CAD as the oscillator reverses ahead of 70, but the update to Canada’s Consumer Price Index (CPI) may keep the exchange rate afloat as inflation is expected to slow for the third consecutive month.

Canadian Dollar Vulnerable to Another Slowdown in Canada CPI

USD/CAD gives back the bullish reaction to the US Consumer Price Index (CPI) to track the rebound across commodity bloc currencies, and the exchange rate may struggle to retain the advance from the monthly low (1.3503) as the RSI moves away from overbought territory.

As a result, USD/CAD may threaten the monthly opening range as the bullish momentum abates, but another downtick in Canada’s CPI may prop up the exchange rate as the headline reading for inflation is expected to narrow to 6.8% in September from 7.0% per annum the month prior.

Signs of easing price pressures may drag on the Canadian Dollar as it encourages the Bank of Canada (BoC) to winddown its hiking-cycle, and it remains to be seen if Governor Tiff Macklem and Co. will adjust the forward guidance at the next rate decision on October 27 as the central bank is scheduled to release the updated Monetary Policy Report (MPR).

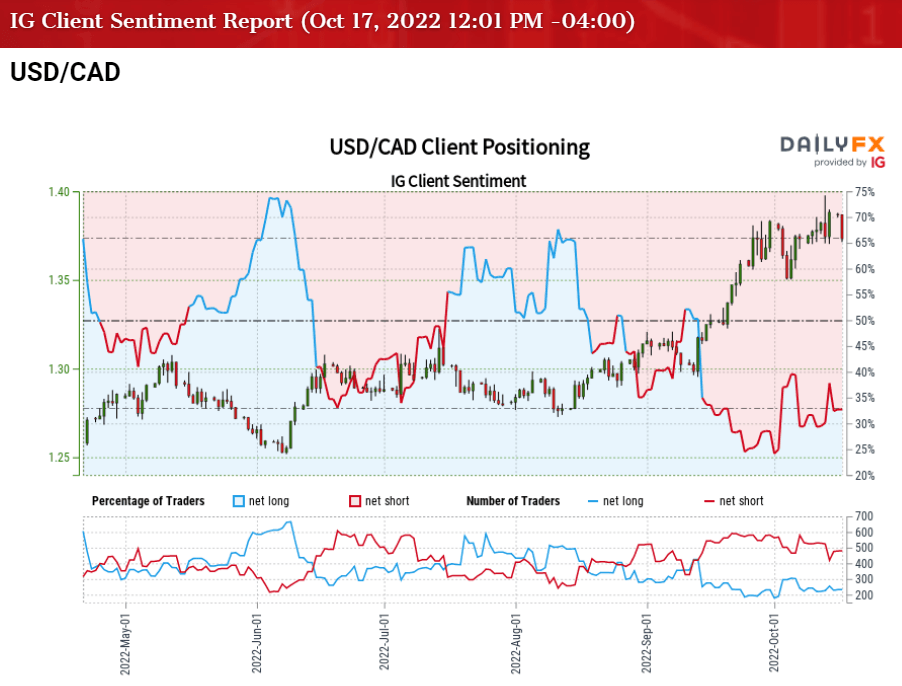

Until then, speculation for smaller BoC rate hikes may keep USD/CAD afloat as the Federal Reserve pursues a restrictive policy, but a larger pullback in the exchange rate may continue to alleviate the tilt in retail sentiment like the behavior seen earlier this year.

The IG Client Sentiment (IGCS) report shows 42.86% of traders are currently net-long USD/CAD, with the ratio of traders short to long standing at 1.33 to 1.

The number of traders net-long is 37.39% higher than yesterday and 19.78% higher from last week, while the number of traders net-short is 10.29% lower than yesterday and 23.24% lower from last week. The rise in net-long interest has helped to alleviate the crowding behavior as only 31.05% of traders were net-long USD/CAD last week, while the decline in net-short position comes as the exchange rate gives back the advance from last week.

With that said, another slowdown in Canada’s CPI may curb the recent decline in USD/CAD as it fuels speculation for a smaller BoC rate hike, but recent developments in the RSI raise the scope for a near-term pullback in the exchange rate as the oscillator reverses ahead of overbought territory.

Introduction to Technical Analysis

Market Sentiment

Recommended by David Song

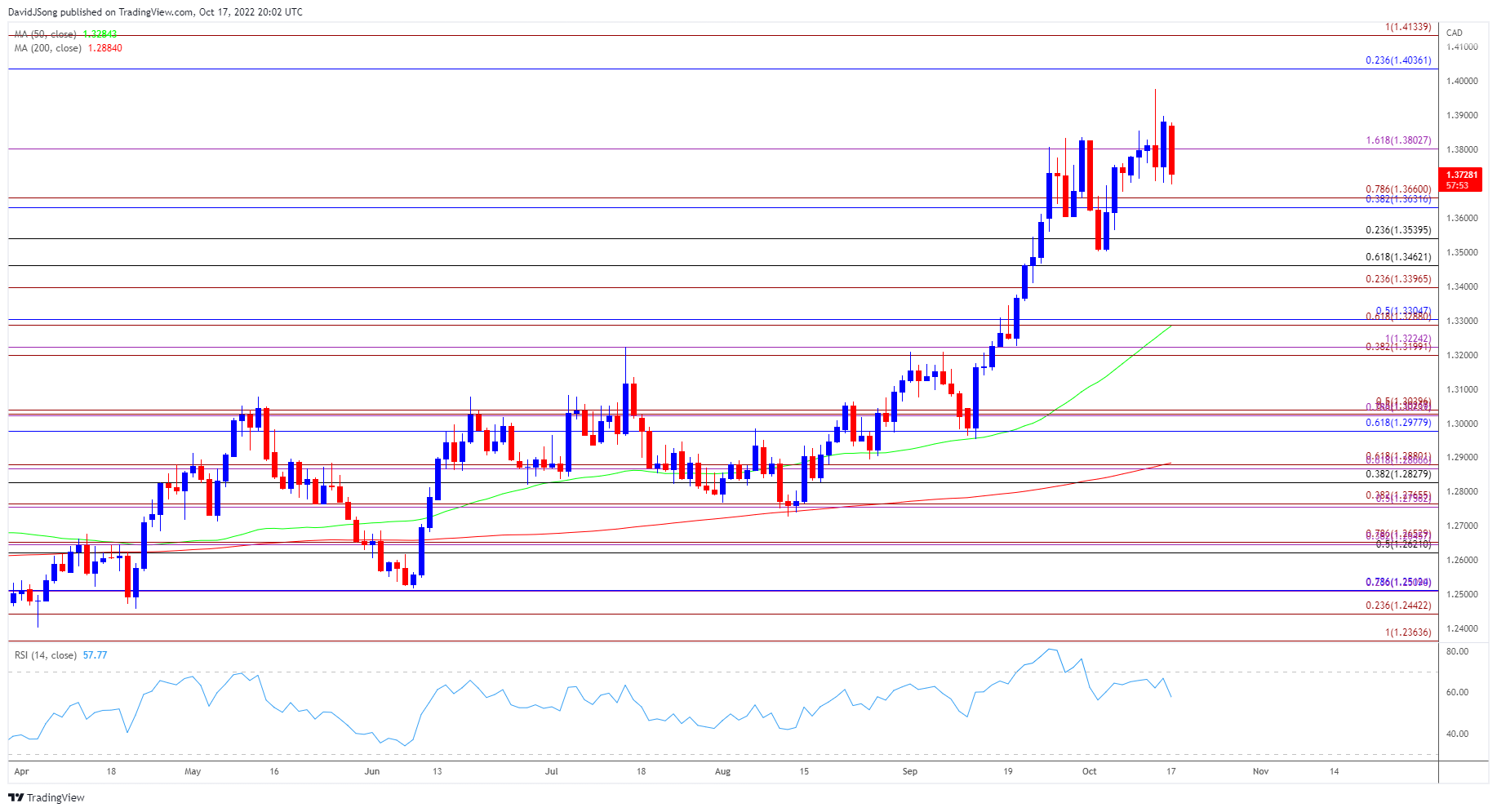

USD/CAD Rate Daily Chart

Source: Trading View

- USD/CAD consolidates after clearing the opening range for October, but lack of momentum to hold the 1.3630 (38.2% retracement) to 1.3660 (78.6% expansion) region may lead to a larger pullback in the exchange rate as the Relative Strength Index (RSI) reverses ahead of 70.

- A break/close below 1.3540 (23.6% retracement) may lead to a test of the monthly low (1.3503), with the next area of interest coming in around 1.3460 (61.8% retracement).

- However, USD/CAD may continue to consolidate as long as it holds above the 1.3630 (38.2% retracement) to 1.3660 (78.6% expansion) region, with a move back above the 1.3800 (161.8% expansion) handle bringing the yearly high (1.3978) on the radar.

Trading Strategies and Risk Management

Becoming a Better Trader

Recommended by David Song

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

[ad_2]

Source link