[ad_1]

Central Bank Watch Overview:

- Rates markets are fully pricing in a 50-bps rate hike by the Federal Reserve in May.

- Expectations for a 50-bps rate hike have dropped considerably since the Russian invasion of Ukraine.

- Financial conditions are at their tightest levels since late-2011, which may give the FOMC reason to take a ‘soft hawkish’ tone.

No Fed Meeting in April

In this edition of Central Bank Watch, we’ll review comments and speeches made by various Federal Reserve policymakers throughout April. With no Fed meeting this month, and thus no communications blackout period, Fed speakers have had free reign to speak several times in recent weeks. The spigot will close this weekend, however, as the communications blackout window begins on Saturday, April 23 until Thursday, May 5.

For more information on central banks, please visit the DailyFX Central Bank Release Calendar.

50-bps or 75-bps in May?

There has been a discernible shift in tone among Fed policymakers since the start of April. Whereas most officials believed that a 25-bps rate hike would be appropriate in May, recent inflation data has spurred a more hawkish shift in rhetoric, with several FOMC members openly advocating for a 50-bps rate hike – and one has even talked up the possibility of a 75-bps rate hike.

April 1 – Evans (Chicago president) said that his outlook matches the median estimate among his fellow policymakers, calling for six more 25-bps rate hikes in 2022.

April 2 – Williams (New York president) indicated that rate hikes would come gradually over the year, but markets should be prepared for continuous tightening in 2022, noting “clearly, we need to get something more like normal or neutral, whatever that means.”

April 3 – Daly (San Francisco president), who is typically on the dovish side of the spectrum, said that “the case for 50, barring any negative surprise between now and the next meeting, has grown,” and that “taking these early adjustments would be appropriate.”

April 5 – Brainard (Fed governor) called the Fed’s task of reducing inflation “paramount,” while also commenting that the balance sheet reduction would begin soon. “Given that the recovery has been considerably stronger and faster than in the previous cycle, I expect the balance sheet to shrink considerably more rapidly than in the previous recovery, with significantly larger caps and a much shorter period to phase in the maximum caps compared with 2017–19.”

April 6 – Harker (Philadelphia president) said that inflation is “far too high,” and expects “a series of deliberate, methodical hikes as theyear continues and the data evolve.”

April 7 – Bullard (St. Louis president) continued to stake out his position as the most hawkish FOMC member, noting he preferred a 50-bps rate hike in May and that he “would like the committee to get to 3-3.25% on the policyrate in the second half of this year.”

April 10 – Mester (Cleveland president) warned that “it will take some time to get inflation down,” but remained confident that the US would avoid a recession in 2022.

April 11 – Waller (Fed governor) said that the Fed was trying to raise rates “in a way that there’s not much of [collateral damage to the US economy], but we can’t tailor policy.”

Evans took a more hawkish turn from earlier in the month, saying that “if you want to get to neutral by December, that would probably require something like nine hikes this year, and you’re not going to get that if you just do 25 at each meeting,” while noting “so, I can certainly see the case.”

April 12 – Brainard said the Fed would move “expeditiously” to raise rates, and will fight inflation via “a series of interest rateincreases as well as beginning that balance sheet runoff.”

Barkin (Richmond president) suggested that “the best short-term path for us is to move rapidly to the neutral range and then test whether pandemic-era inflation pressures are easing, and how persistent inflation has become.”

April 13 – Bullard warned that if the Fed doesn’t tighten policy fast enough, it will hurt its own credibility in the long-run.

Waller said that he’d prefer to see more aggressive tightening sooner, noting that he’d “prefer a front-loading approach. So a 50 basis-point hikein May would be consistent with that and possibly more in Juneand July.”

April 14 – Williams commented that 50-bps rate hikes are a “reasonable option” given how accommodative policy has been.

Mester suggested that the Fed will be careful as its raises rates, saying “Our intent is to reduce accommodation at the pace necessary to bring demand into better balance with constrained supply in order to get inflation under control while sustaining the expansion in economic activity and healthy labor markets.”

April 18 – Bullard said that more than a 50-bps rate hike is not his “base case,” but he “wouldn’t rule it out.”

April 19 – Evans noted that the Fed is “probably…going beyond neutral,” neutral being the level of interest rates that neither supports nor hinders the economy. In doing so, he sees “3 to 3.5% inflation” by the end of2022.

Kashkari cautioned that the Fed is “going to have to do more through our monetarypolicy tools to bring inflation back down” if supply chains stayconstrained.

April 20 – Daly commented that “moving purposefully to a more neutral stance that does not stimulate the economy is the top priority,” and sees the neutral rate around 2.5%.

The Fed’s Beige Book was released, with inflation still in focus. “Inflationary pressuresremained strong since the lastreport, with firms continuing to pass swiftly rising input costs through to customers.”

April 21 – Daly suggested that aggressive tightening was around the corner, with the Fed “taking a 50 basis-point increasein a couple of the meetings, also starting our balance-sheetreduction program.”

Powell said he favored “front-loading” rates hikes, agreeing that “50 basis points will be on thetable forthe May meeting.”

{{NEWSLETTER}

Several Rate Hikes Priced-In

With a new multi-decade high in US inflation rates, markets have dragged forward expectations for a rapid pace of rate hikes over the coming months. We can measure whether a Fed rate hike is being priced-in using Eurodollar contracts by examining the difference in borrowing costs for commercial banks over a specific time horizon in the future. Chart 1 below showcases the difference in borrowing costs – the spread – for the May 2022 and December 2023 contracts, in order to gauge where interest rates are headed by December 2023.

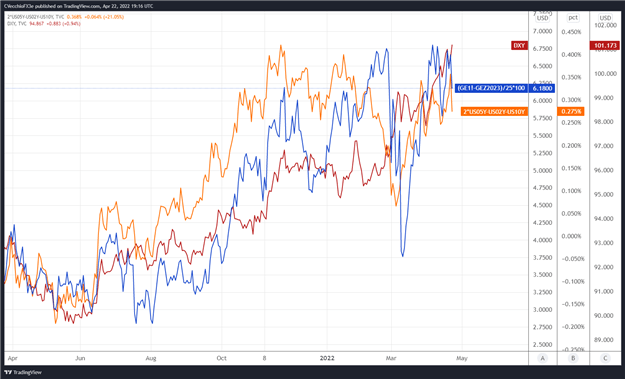

Eurodollar Futures Contract Spread (May 2022-December 2023) [BLUE], US 2s5s10s Butterfly [ORANGE], DXY Index [RED]: Daily Timeframe (April 2021 to April 2022) (Chart 1)

By comparing Fed rate hike odds with the US Treasury 2s5s10s butterfly, we can gauge whether or not the bond market is acting in a manner consistent with what occurred in 2013/2014 when the Fed signaled its intention to taper its QE program. The 2s5s10s butterfly measures non-parallel shifts in the US yield curve, and if history is accurate, this means that intermediate rates should rise faster than short-end or long-end rates.

After the Fed raises rates by 50-bps in May, there are six 25-bps rate hikes discounted through the end of 2023 thereafter. The 2s5s10s butterfly has traded sideways in recent weeks, suggesting that the market has retained its overall hawkish interpretation of the near-term path of Fed rate hikes. Focus remains more on the Fed and less on Russia’s invasion of Ukraine.

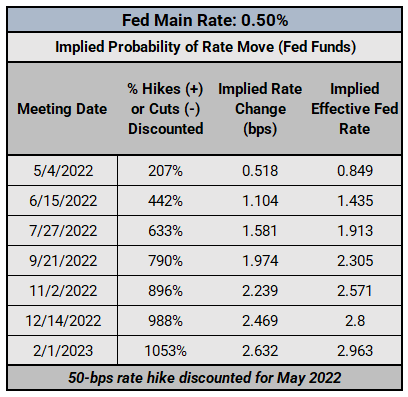

Federal Reserve Interest Rate Expectations: Fed Funds Futures (April 22, 2022) (Table 1)

Fed fund futures have remained very aggressive in recent weeks, with a rapid pace of tightening expected over the next three meetings. Traders see a 100% chance of a 50-bps rate hike in each of May, June and July, with the main Fed rate expected to rise to 2.75% (currently 0.50%) by the end of 2022.

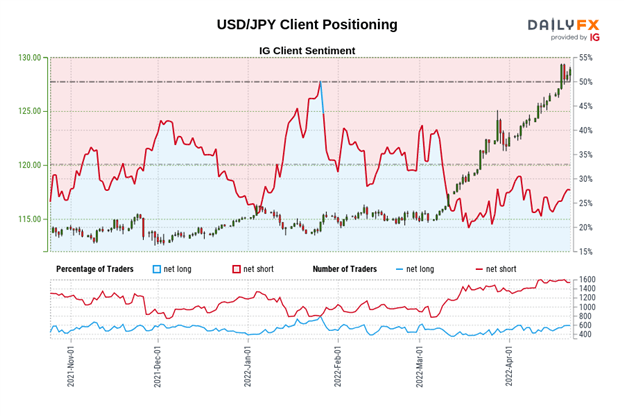

IG Client Sentiment Index: USD/JPY Rate Forecast (April 22, 2022) (Chart 2)

USD/JPY: Retail trader data shows 24.95% of traders are net-long with the ratio of traders short to long at 3.01 to 1. The number of traders net-long is 20.98% lower than yesterday and 4.67% lower from last week, while the number of traders net-short is 2.31% higher than yesterday and 0.25% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/JPY prices may continue to rise.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/JPY-bullish contrarian trading bias.

— Written by Christopher Vecchio, CFA, Senior Strategist

[ad_2]

Source link