[ad_1]

Crude Oil Prices and Analysis

- Oil benchmarks looked set for early gains but have slipped back in the European morning

- The $77 support region has come back into play having been topped on Monday

- The overall uptrend endures but WTI looks more range-bound

Recommended by David Cottle

Get Your Free Oil Forecast

Crude Oil Prices failed to hold early gains on Tuesday although concerns about supply disruptions in the crucial Red Sea trade link continue to dominate the market.

Attacks on shipping by Iranian-backed Houthi militia from Yemen, in support of the Palestinian cause in Gaza, continue, despite airstrikes aimed at stopping them by the United States and United Kingdom. Shipping is now avoiding the region if possible, pushing up journey times and costs. Nearly two billion metric tons of crude is moved by sea every year.

US President Joe Biden has said that a ceasefire between Israel and Hamas is ‘close’ but the extent to which any limited cessation would halt Houthi attacks remains unclear.

Prices have topped $77/barrel in the past two sessions for US benchmark West Texas Intermediate crude, with broad oil prices lifted further by signs of some demand resilience in China. Refineries there are reportedly still buying plenty of crude which has gone some way to lift the gloom over likely Chinese energy demand, a major headwind for oil prices in the past year.

The market, like all others, still faces the likelihood that interest rates in the industrial economies are going to remain high for longer than many hoped at the start of the year. The extent to which incoming data and central bank commentary underpins this will be key. There’s plenty of both out of the US this week, along with more oil-specific inventory numbers from the Energy Information Administration. They’re coming up on Wednesday.

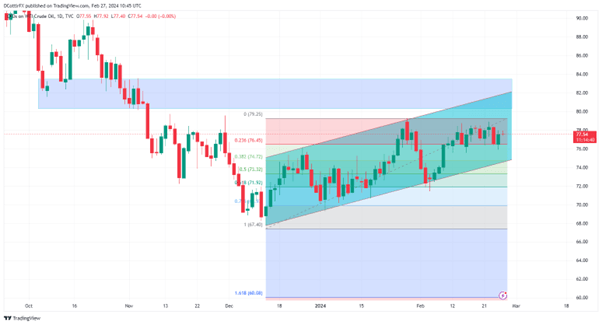

US Crude Oil Technical Analysis

Crude Oil Daily Chart Compiled Using TradingView

Recommended by David Cottle

How to Trade Oil

The broad uptrend channel from the lows of December 14 remains in place but the market has become more obviously rangebound since February 8 and its this range which now seems more relevant, at least in the near term.

It’s bounded to the topside by January 29’s intraday top of $79.25 which still stands out as the most significant recent high. To the downside we have $76.45, which is the first, Fibonacci retracement of the rise up that peak from the lows of December 14. The market has been below it on an intraday basis on four occasions this months but has always declined to close there.

Failure of this support would put the upside channel base of $74.38 in focus. Bulls will need to consolidate their position above the psychological $78 mark if they’re going to push on to those highs of late January. They might do so, but they haven’t yet. Whether or not they can manage to keep the market above that point into month-end might be instructive.

[ad_2]

Source link