[ad_1]

Crude Oil Price Analysis & News

- Weak Chinese Data Raises Demand Concerns

- Brent Crude Oil Sell-Off Exacerbated by Iran Nuclear Deal Hopes

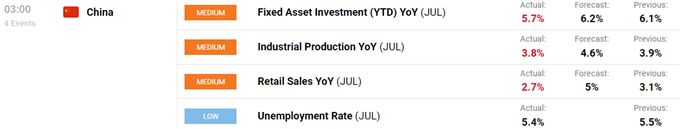

Crude oil futures have slumped this morning as Brent crude falls over 4% to start the week. Firstly, the initial move lower in oil stemmed from weak data out of China with retail sales posting a sizeable miss on expectations, raising concerns over the demand outlook for oil.

Source: DailyFX

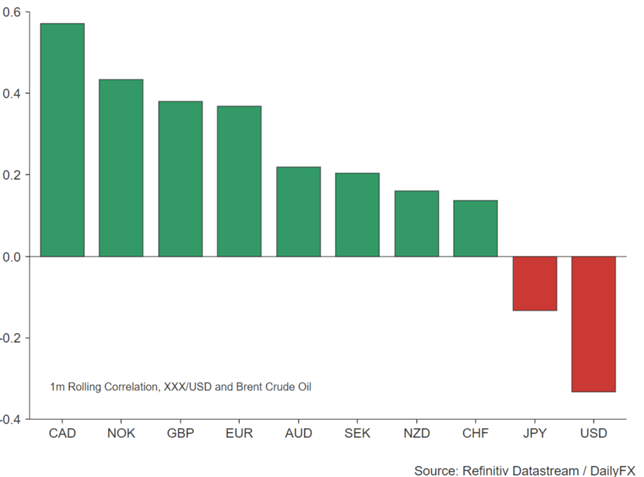

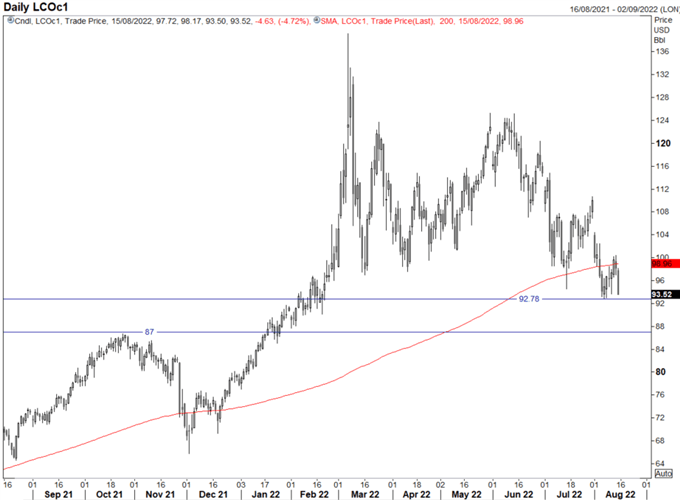

Meanwhile, recent comments made by the Iranian Foreign Minister has since exacerbated the move lower in oil, having stated that consensus is close in negotiations on the condition that Iran’s redlines are respected. This in turn, has seen markets price in a higher probability that an Iran nuclear deal can be reached and thus oil prices have come under notable pressure throughout the London session. That being said, while a deal would likely see Brent crude oil head back below $90, focus is now on the response from the US, given that it is up to the US to decide if they agree with the three remaining issues. As such, oil sensitivity to headlines has increased. For those keeping a close eye on the latest oil sources, #OOTT on Twitter is vital for short-term intra-day oil traders. A reminder that for those trading FX, the Canadian Dollar is the most sensitive to oil prices as shown in the chart below.

30-Day FX Correlation to Oil

Brent Crude Oil Chart: Daily Time Frame

Source: Refinitiv

[ad_2]

Source link