[ad_1]

BRENT CRUDE OIL (LCOc1) ANALYSIS

- Impending Russian oil embargo has markets on the edge.

- Safe haven dollar muting crude oil gains.

- Key technical pattern unfolding.

BRENT CRUDE OIL FUNDAMENTAL BACKDROP

Brent crude oil remains elevated despite trading marginally lower post-Asia. The U.S. dollar has found some upside after markets react to an increasingly hostile situation in Ukraine, driving investors to safety in the form of U.S. Treasury bonds (10-year) and increasing the demand for the greenback.

Staying on the topic of Russia and Ukraine, the much talked about oil ban by the EU is due to be decided in the upcoming days according to European Commission President Ursula von der Leyen. Thus far, the ban has proven more difficult than initially expected with landlocked countries like Hungary concerned about negative implications should the ban go through, meaning brent crude should remain around current levels leading up to the announcement.

Learn more about Crude Oil Trading Strategies and Tips in our newly revamped Commodities Module!

Another interesting development that arose yesterday was the Russians strategy to increase exports to its fellow BRICS member states including Brazil, India, China and South Africa at attractive price points, along with creating joint refineries with the block.

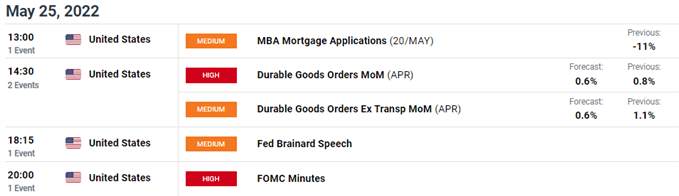

ECONOMIC CALENDAR

U.S. data dominates the calendar for the rest of the day with focus on the FOMC minutes from the May meet (see calendar below). I will be looking for clues around upcoming rate hikes concerning 50bps and 75bps increases respectively.

Source: DailyFX Economic Calendar

TECHNICAL ANALYSIS

BRENT CRUDE (LCOc1) DAILY CHART

Chart prepared by Warren Venketas, IG

Technically, brent crude price action continues to mimic an ascending triangle pattern (black) generally associated with an extension of a prior bullish trend. In this case, we have seen bulls test triangle support on three previous occasions (blue) and could only be a matter of time before the barrier is breached.

Key resistance levels:

- $115.00

- Triangle resistance

Key support levels:

IG CLIENT SENTIMENT: BULLISH

IGCS shows retail traders are marginally NET LONG onCrude Oil, with 42% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment however, after recent changes in positioning we settle on a short-term bullish bias.

Contact and follow Warren on Twitter: @WVenketas

[ad_2]

Source link