[ad_1]

BRENT CRUDE OIL (LCOc1) ANALYSIS

- China’s growth forecasts look higher as COVID-19 situation improves in Shanghai.

- Hungary stifles EU oil ban.

- Consolidatory price action continues.

CRUDE OIL FUNDAMENTAL BACKDROP

Brent crude trades marginally lower this morning after minimal headway has been made with regards to the Russian oil ban, stemming from the Hungarian governments reluctance to stop Russian oil flows from its Druzhba pipeline. This may seem insignificant at first but the pipeline in question accounts for roughly 50% of total inflows to the EU which will considerably reduce the impact of an EU ban.

On a more positive note, COVID cases in Shanghai has fallen giving a slight boost to demand-side forecasts.

Learn more about Crude Oil Trading Strategies and Tips in our newly revamped Commodities Module!

Later today, the IEA and OPEC are scheduled to release their monthly reports with focus on supply revisions (if any) in response to the EU’s proposed ban.

The U.S. dollar has been bid this morning across most major pairs thus weighing on any crude oil upside (inverse relationship), leaving prices in limbo ahead of the oil reports and U.S. PPI later today (see calendar below).

Source: DailyFX Economic Calendar

TECHNICAL ANALYSIS

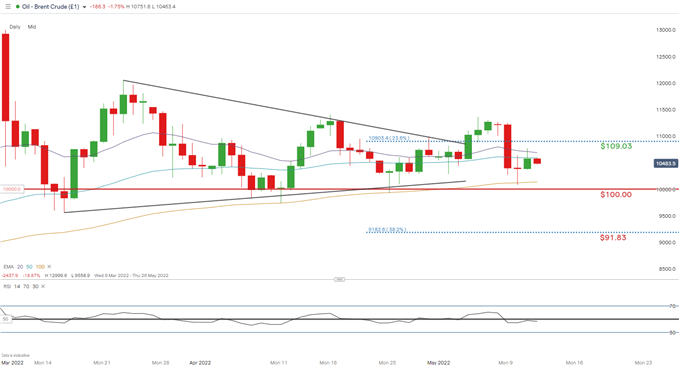

BRENT CRUDE (LCOc1) DAILY CHART

Chart prepared by Warren Venketas, IG

Daily brent crude price action highlights the markets hesitancy around the Russian oil ban after an initial breakout from the symmetrical triangle pattern (black) that was swiftly capped as the hype dissipated. Oil markets are looking for a fundamental catalyst for directional bias either from the Chinese economy or more clarity around the EU’s anticipated oil ban.

The Relative Strength Index (RSI) confirms this indecision with a reading around the 50 level which favors neither bullish nor bearish momentum.

Key resistance levels:

Key support levels:

- 100-day EMA (yellow)

- $100.00

IG CLIENT SENTIMENT: BULLISH

IGCS shows retail traders are marginally NET LONG on Crude Oil, with 51% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment however, after recent changes in positioning we settle on an upside bias.

Contact and follow Warren on Twitter: @WVenketas

[ad_2]

Source link