[ad_1]

DAX/CAC Technical Highlights:

- DAX rally may be getting long in the tooth, watch upcoming trend-line

- CAC 40 has an even bigger level coming up with price/200-day MA aligning

DAX 40 and CAC 40 Technical Outlook: Rallying Towards Big Resistance

Overall, operating within the framework that we are amidst a recovery bounce amidst an extended bear market starting at the beginning of the year, we may be nearing the end of the rally. Given the lack of capitulation in the spring and timing of a summer rally into what is typically the worst performing part of the year, if we are to see the counter-trend rally stall it will likely happen in the coming weeks.

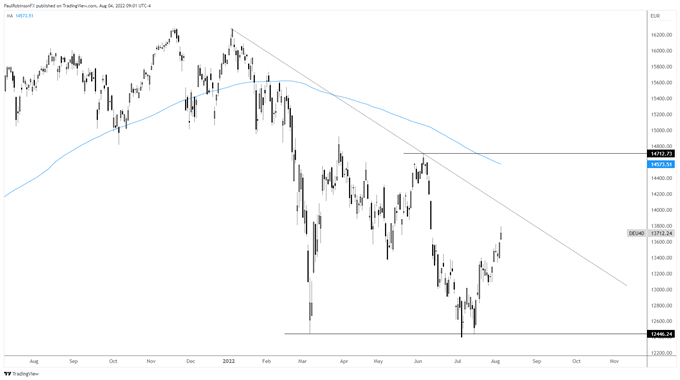

The DAX is coming up on a trend-line off the Jan ’22 high. This could make for a good spot to see the index stall and turn lower. It currently clocks in around the 14k mark. If we see a turn lower in the near future it will take a solid hit down to under 12500 before we will even get to a lower-low scenario. In the event of a significant macro-style fall sell-off, then look for the DAX to head much lower than the current yearly low in the months ahead.

For now, though, momentum is still favorable for stocks, so until we see signs of turning it may be prudent to respect the current trend.

DAX Daily Chart

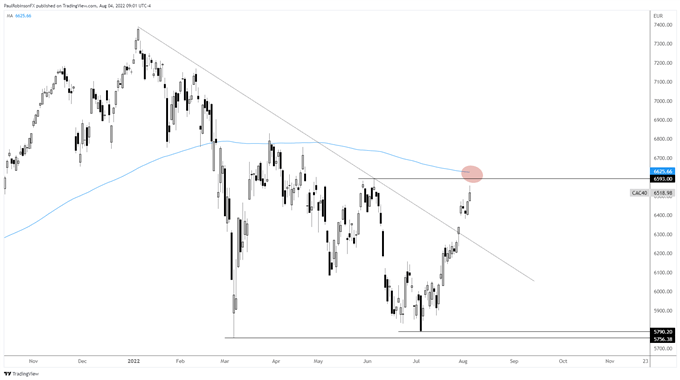

The CAC is closing in on what could be an even more promising level for shorts in terms of resistance despite it showing general relative strength compared to the DAX. The early June peak at 6593 is very near the falling 200-day moving average currently situated at 6625.

This makes the area nearby especially noteworthy for a potentially big top. What I’ll be watching for is volatile price action around resistance for signs that the market is done rallying.

CAC Daily Chart

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

—Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX

[ad_2]

Source link