[ad_1]

DAX 40, Risk, US Dollar, Iron Ore, Crude Oil, Gold, Bitcoin – Talking Points

- Germany’s DAX 40 has been caught up in a global sell down of equities

- While commodities are generally lower, gold and oil have been steady

- The US Dollar found support as risk aversion gripped markets

Germany’s DAX 40 index is under pressure today, along with all equity indices around the globe.

Risk assets have tanked as the market is seemingly coming to grips with the reality of higher interest rates and the possibility of stagflation. It is a sea of red across equity cash markets in Asia and futures markets are pointing south for the open in Europe and North America.

Comments over the weekend from respected economist Mohamed A. El-Erian shocked markets.

He stated that markets have mostly priced in interest rate risks but have so far failed to price in liquidity risk, credit risk and market functioning risk arising from tightening monetary policy globally.

He went on to say that there is no safe haven in the current market.

Risk assets sold off and the US Dollar continued on from Friday’s gains to start the week in Asian trade. The Japanese Yen and Swiss Franc also saw modest gains.

The New Zealand Dollar depreciated the most, with skittish and thin trading conditions exasperating moves.

High volatility remains in bond markets with 10-year Treasury yielding above 3.15% at one stage today.

Iron ore traded over 5% lower on both the Dalian commodity exchange (DCE) and the Singapore exchange (SGX) as the Chinese Covid-19 lockdowns further rattled the economic outlook there.

Trade data also undermined confidence with Chinese exports not as strong as expected. USD/CNY traded at its highest level since November 2020.

Gold is slightly higher, trading near US$ 1,875 an ounce while crude oil is relatively steady, despite Saudi Arabia announcing plans to deliver oil at a discount to their Asian customers.

Bitcoin futures traded as low as 33,200 in Asia today, over 50% lower than the peak above 69,000 seen in November last year.

There isn’t any data of note due out today and swings in market sentiment could see a lift in volatility in the sessions ahead.

The full economic calendar can be viewed here.

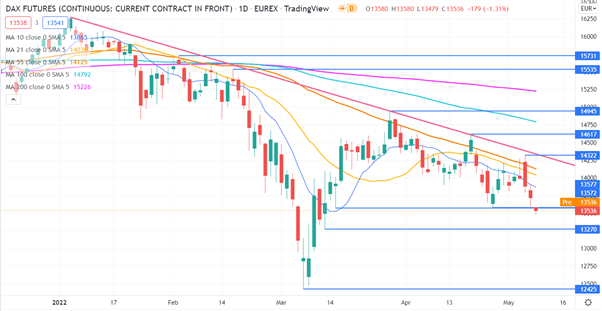

DAX 40 Technical Analysis

The DAX has breached the recent low of 13572 and the prices remains below all short, medium and long-term simple moving averages (SMA). This could indicate evolving bearish momentum.

The lows of 13270 and 12425 seen in March might provide support.

On the topside, resistance could be at the SMAs or a descending trend line, currently dissecting at a recent high of 14322. The peaks of 14617 and 14945 may also offer resistance.

— Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter

[ad_2]

Source link