[ad_1]

Dax 40 Talking Points

- German Dax hits a daily high of 15,693 ahead of German inflation (Prel) print

- European equities surge after China’s optimistic outlook eases recession fears

- Dax 40 recovers over 7% of March losses with bulls aiming to retest the monthly high of 15,720.

Discover what kind of forex trader you are

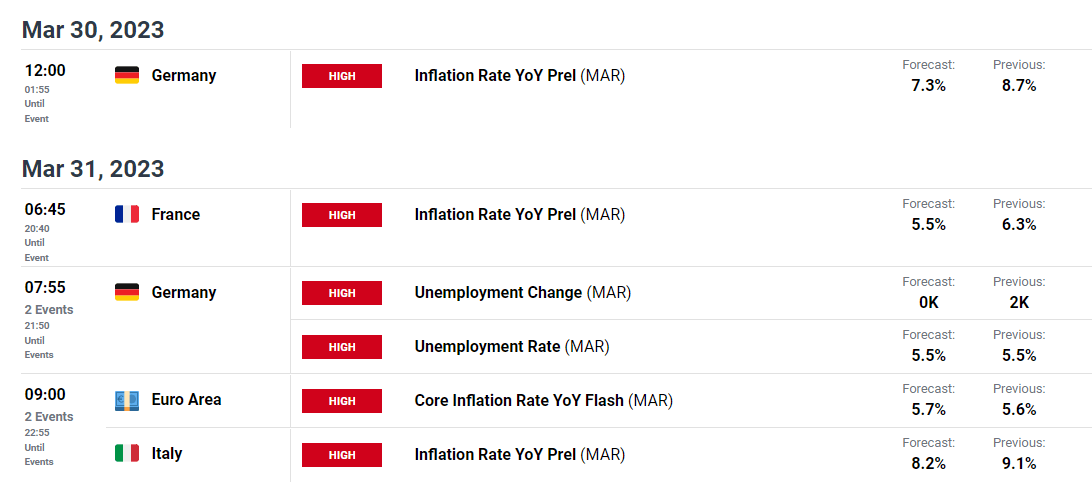

European equities are trading higher, following Wednesday’s Wall Street rally. With the Dax 40 currently gaining roughly 1.40%, the release of German inflation may assist in the catalyzation of price action. After Spanish inflation fell at a faster pace in March, analysts are expecting Germany’s March data to follow suit.

DailyFX Economic Calendar

As concerns over the banking sector show positive signs of easing, China’s recovery has boosted sentiment. At the Boao Forum in Asia, top Chinese leader, Premier Li Qiang said that the world’s second largest economy has shown “encouraging momentum of rebounding” that has picked up pace in March.

In response to the optimistic outlook, recession fears cooled, supporting a bullish move in risk assets.

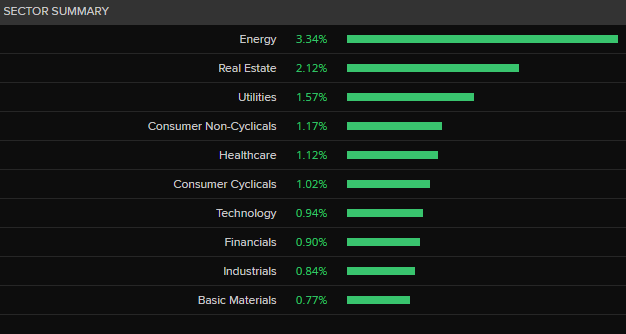

At the time of writing, all sectors of the DAX are in the green, with energy and real estate leading gains.

Source: Refinitiv

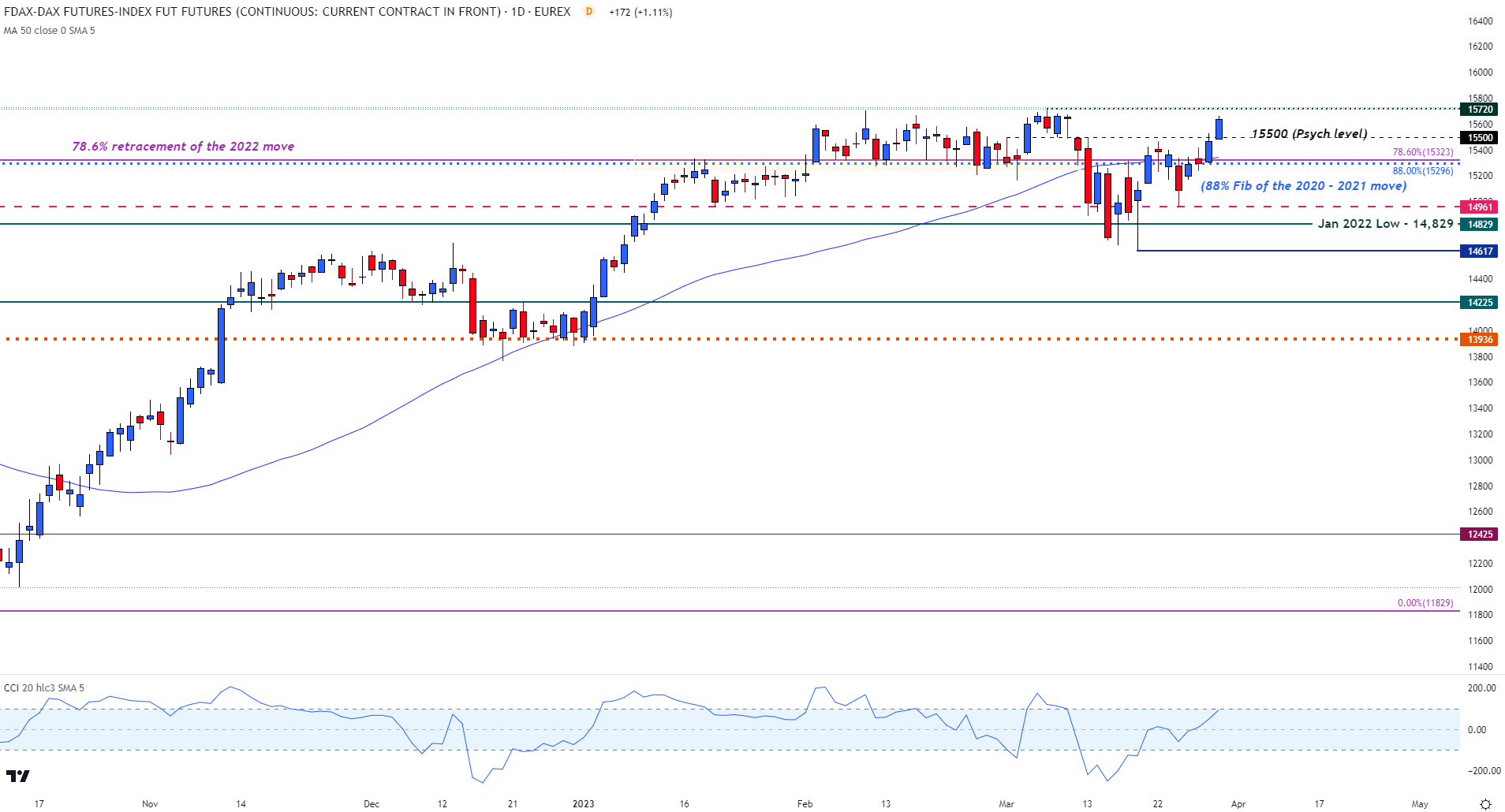

German Dax Technical Analysis

While the major European stock index has made a strong recovery from the March low, a move above the 50-day moving average (MA) has supported higher prices. With today’s surge allowing bulls to break through prior psychological resistance at 15500, the next level of technical resistance is currently holding at the monthly high of 15720.

As the swift rebound reflects the shift in sentiment following the mild banking crisis, the CCI (commodity channel index) has been pushed to the boarder of oversold territory.

DAX 40 (FDAX!) Daily Chart

Chart prepared by Tammy Da Costa using TradingView

Dax 40 Technical Levels

| Support | Resistance |

|---|---|

| 15,500 (Psychological support) | 15,720 (March high) |

| 15,343 (50-day MA) | 16,000 (Psych level) |

| 15,000 (Psych level) | 16,274 (Jan ‘22 high) |

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707

[ad_2]

Source link