[ad_1]

DAX, FTSE 100 Talking Points:

- DAX 40 bounces back, 14,000 – 14,400 remains key

- FTSE 100 strengthens, retests 7,500

- Technical levels provide additional support and resistance despite fundamental backdrop

DAX, FTSE Extends Gains, Upbeat Earnings Boosts Sentiment

European equities are currently in the green despite intensifying fears that the Kremlin will cut off oil and gas supplies to Europe unless buyers agree to make payments in Rubles.

Visit the DailyFX Educational Center to discover the impact of politics on global markets

In response to embargo’s recently imposed against Russia, Gazprom (Russia’s energy company) announced that it would halt the supply of natural gas to Poland and Bulgaria, threatening to cut off supplies to Europe entirely unless Putin’s demands are met.

Despite the uncertainty that will likely to persist for the remainder of the year, recent earnings out of both the US and Europe has boosted sentiment, lifting stocks higher.

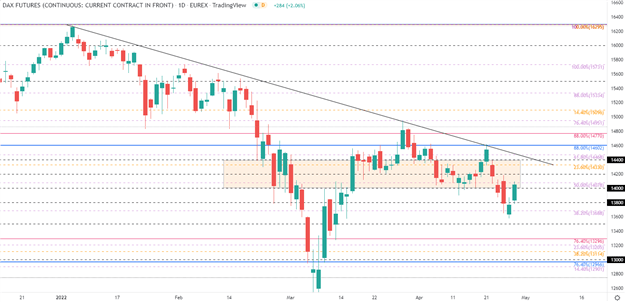

Dax (Germany 40) Technical Analysis

A slightly optimistic shift in sentiment has enabled Dax futures to rebound off of prior support at 13,600 allowing bulls to drive prices back into the narrow range between 14,000 – 14,058 that continues to come into play.

As discussed in my recent analysis, the 14,000 – 14,400 remains key for both bulls and bears, with key Fibonacci levels forming additional zones of confluency. As these levels provide support and resistance for price action, the short-term levels of resistance continue to hold at 14,200 and 14,330 respectively with the next big level at 14,474, the 61.8% Fibonacci level of the Feb – March move.

If downward momentum does gain traction and bears successfully clear the 14k handle, the next level of support may hold at the psychological 13,800 handle with the 38.2% Fib of Feb – March move providing additional support at 13,696.

Dax 40 Daily Chart

Chart prepared by Tammy Da Costa using TradingView

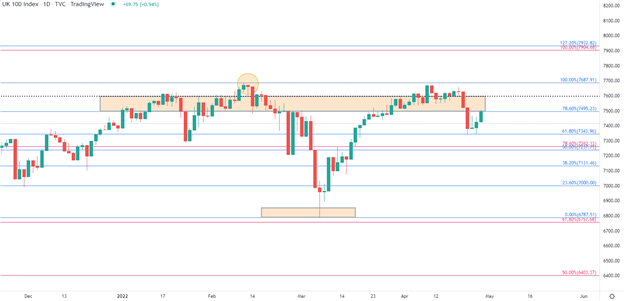

FTSE 100 Technical Analysis

Similarly, the UK FTSE 100 is currently testing the 7,500 which is both a key psychological level and a key Fib of the Feb – March move. With price action gearing up to reenter that tight range between 7,500 and 7,600, an increase in risk appetite may allow the Index to continue to rise in an effort to retest the Feb high of 7,687.

FTSE 100 Daily Chart

Chart prepared by Tammy Da Costa using TradingView

Meanwhile, at the time of writing, retail trader data shows 42.44% of traders are net-long FTSE 100 with the ratio of traders short to long at 1.36 to 1. The number of traders net-long is 17.73% lower than yesterday and 83.16% higher from last week, while the number of traders net-short is 9.90% higher than yesterday and 40.63% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests FTSE 100 prices may continue to rise.

Positioning is more net-short than yesterday but less net-short from last week. The combination of current sentiment and recent changes gives us a further mixed FTSE 100 trading bias.

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707

[ad_2]

Source link