[ad_1]

Dax 40, FTSE 100 Key Points:

- German inflation skyrockets but Dax resilience holds

- FTSE 100 humbled by weekly high

- European equities face challenging times as critical resistance firms

Recommended by Tammy Da Costa

Get Your Free Equities Forecast

European equities continue to whipsaw into the weekend after another volatile trading week. With DAX and CAC 40 holding onto four consecutive weeks of gains, FTSE 100 has made a decent recovery over the past two weeks.

To recap on the economic events that have rattled markets this week, the ECB rate decision and corporate earnings were met with mixed reactions from major stock indices that have priced in a large portion of geopolitical risks.

How Do politics and Central Banks Impact FX Markets? Visit DailyFX Education to Find Out

With the recent 75 basis point rate hike announced by ECB (European Central Bank) president Christine Lagarde already baked in, inflation data for both Germany and France has continued to soar.

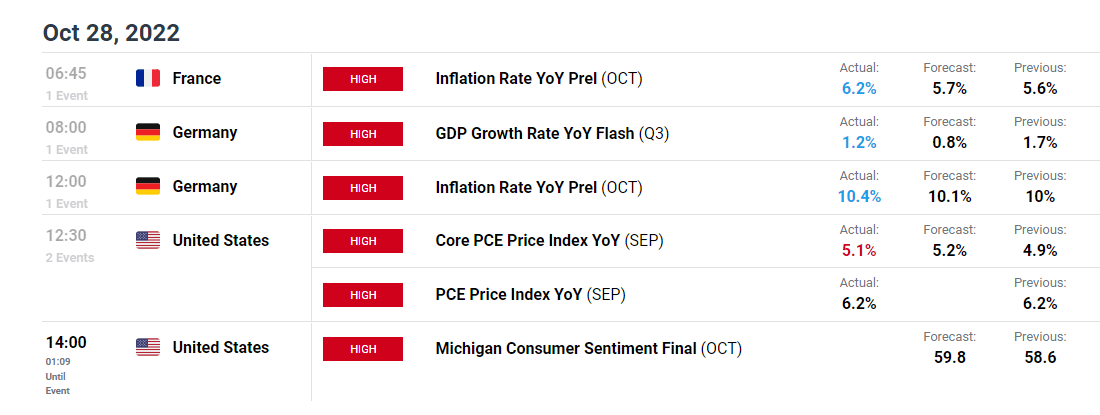

DailyFX Economic Calendar

German Dax Technical Analysis

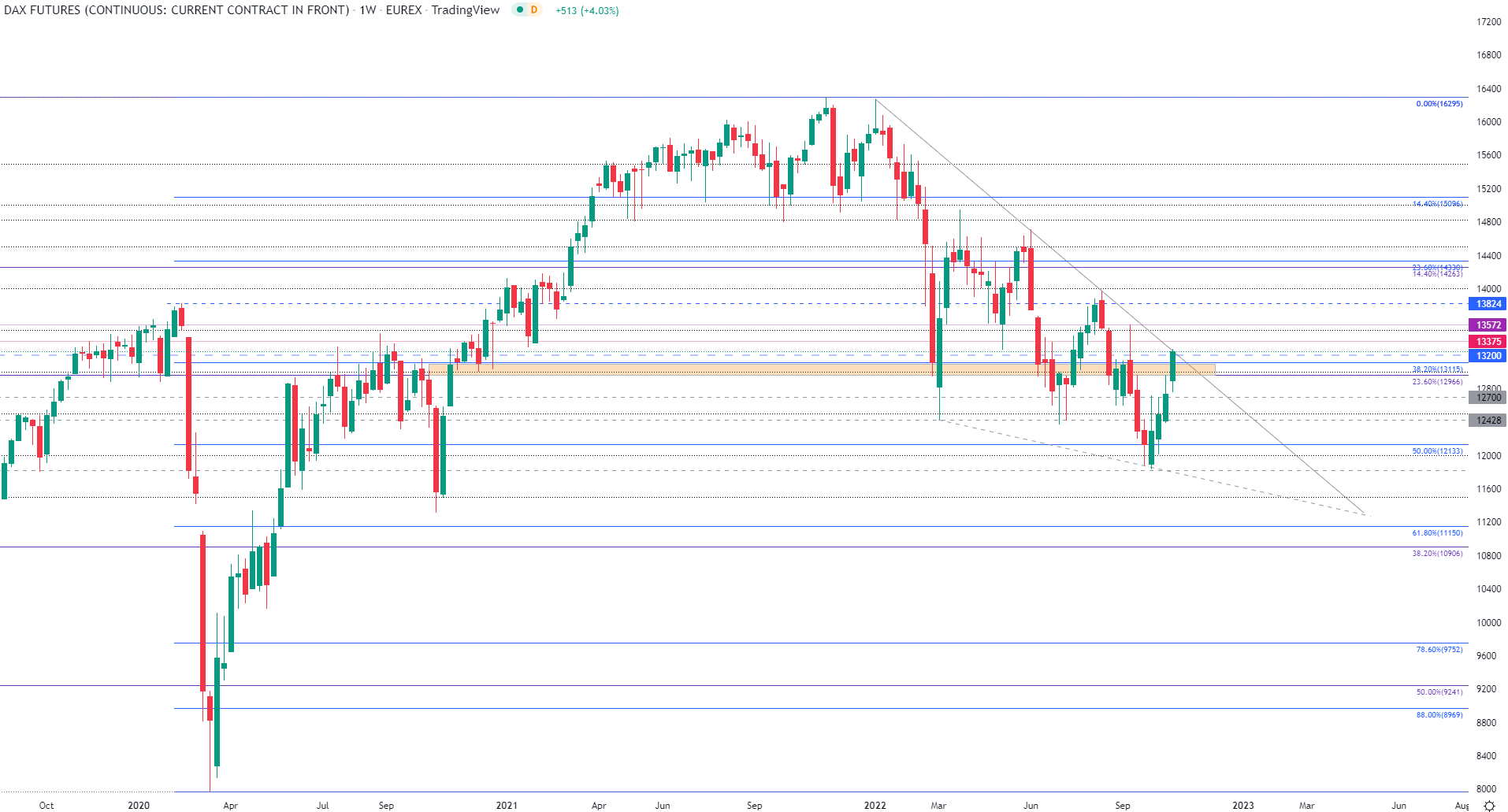

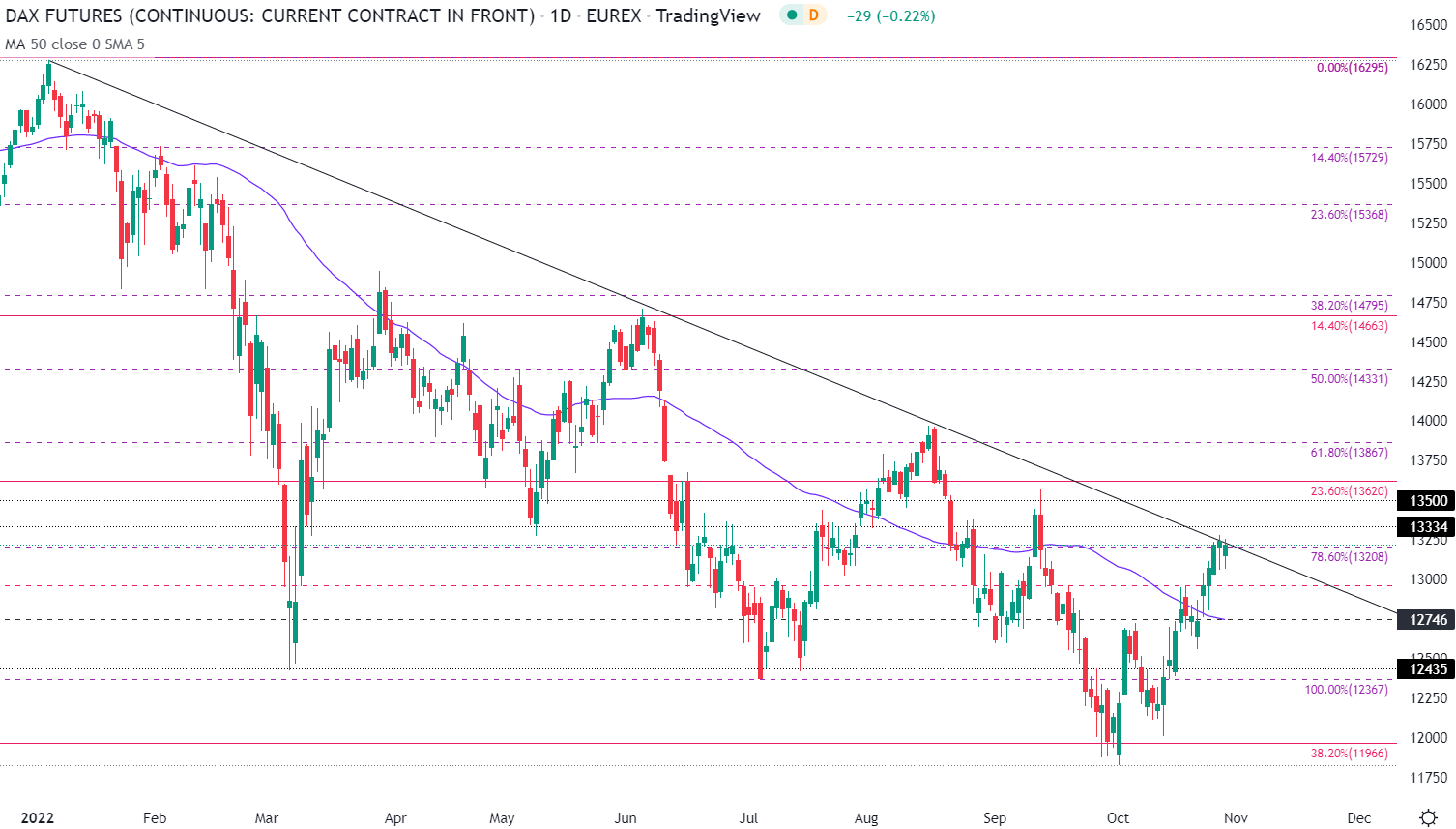

For the German Dax, the same levels of support and resistance recently discussed continue to hold. With bulls still grappling with wedge resistance at around the 13200 psychological level, a rejection of the descending trendline could see prices retreat towards 13000. For the upside to prevail, a break of 13200 and 13375 is still required with the next barrier holding at around 13572.

On the contrary, a break of the zone between 13115 and 12966 could provide further relief to bears.

German Dax 40 Weekly Chart

Chart prepared by Tammy Da Costa using TradingView

German Dax 40 Daily Chart

Chart prepared by Tammy Da Costa using TradingView

FTSE 100 Technical Analysis

While the appointment of newly elected British Prime minister Rishi Sunak helped ease fears of continual political and economic uncertainty, the future trajectory of the United Kingdom remains unknown.

Recommended by Tammy Da Costa

Trading Forex News: The Strategy

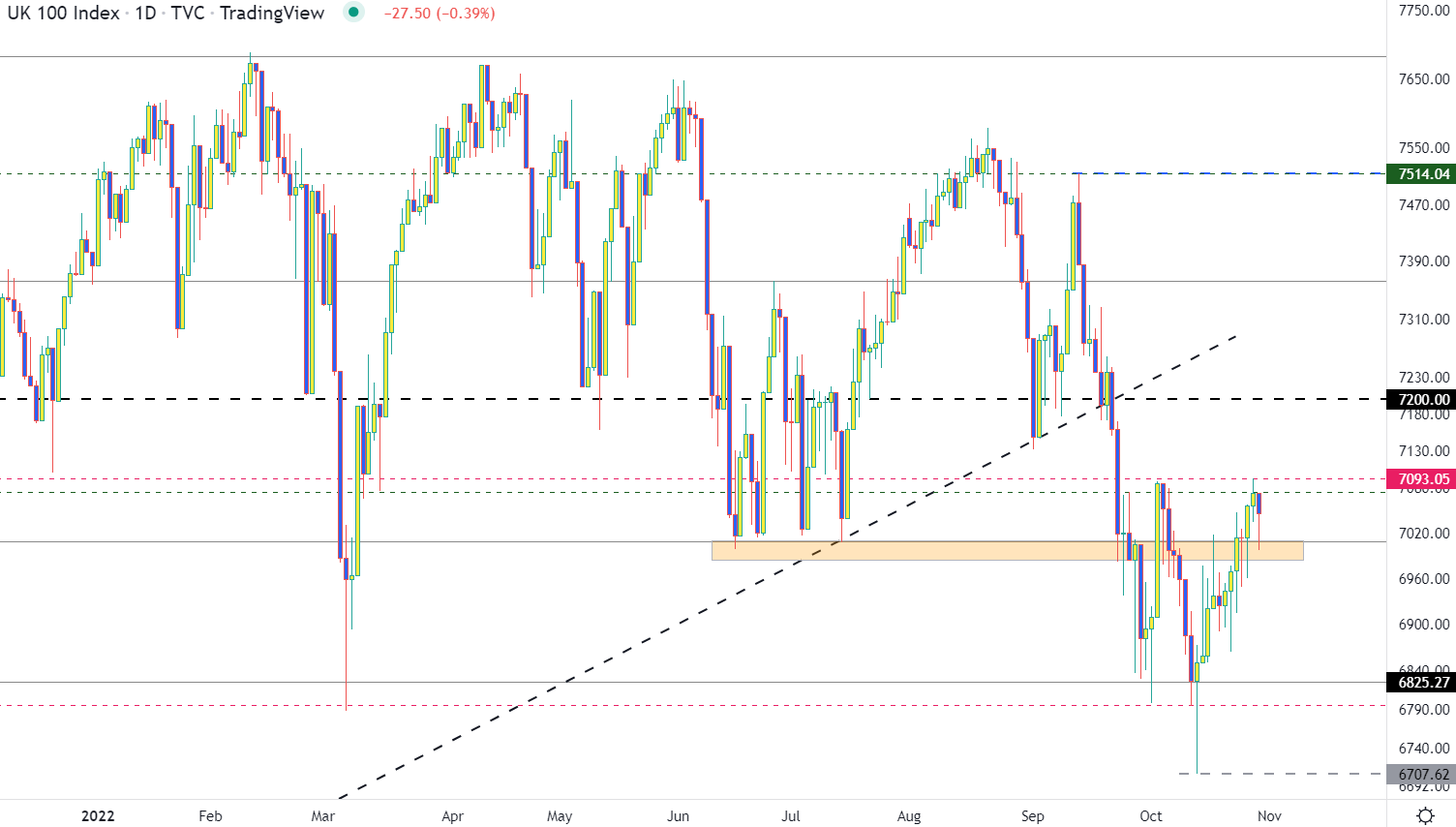

With the recent move above the 7000 psychological level providing a glimmer of hope for bulls, failure to drive prices above 7093 (the weekly high) has resulted in the formation of a candle that has engulfed the body of the prior candle (indicative of strong retaliation from bears).

FTSE 100 Daily Chart

Chart prepared by Tammy Da Costa using TradingView

Much like the levels that have been discussed throughout the week, a move above this week’s high at 7093 draws attention to the psychological level of 7200.

If the downside persists, a move below 7000 and below 6850 could allow for a retest of 6825 and potential bearish continuation to the next zone of support at 6790.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707

[ad_2]

Source link