[ad_1]

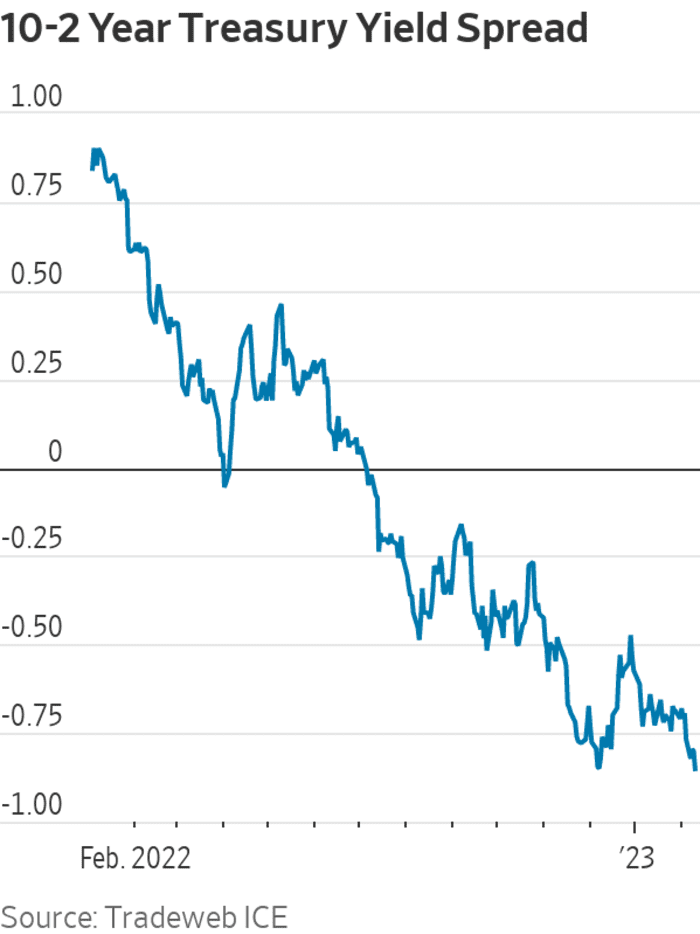

A bond-market gauge of impending U.S. recessions is heading for a 41-year milestone: its most negative reading since October 1981, when interest rates were 19% under Paul Volcker’s Federal Reserve.

That gauge, which measures the spread between 2-

TMUBMUSD02Y,

and 10-year Treasury yields

TMUBMUSD10Y,

plunged to as far as minus 87.3 basis points on Thursday. In other words, the 10-year yield was trading 87.3 basis points below the 2-year yield.

It’s on pace to surpass the recent low spread of minus 84.9 basis points set at the end of New York trading on Dec. 7, according to Dow Jones Market Data. If the spread remains around current levels, the inversion would be the most negative since Oct. 2, 1981, when it reached minus 96.8 basis points.

Source: Tradeweb ICE

The deepening inversion comes at a time when investors and policy makers are bracing for additional Federal Reserve rate hikes and a period of disinflation, or a slowing pace of inflation, that could take some time to work its way through. One possible silver lining behind Thursday’s bond-market moves is that many investors appear to believe the Federal Reserve will stick by its inflation-fighting campaign — and ultimately win it.

Stocks initially rallied on Thursday, but gave up gains around midday, with the Dow Jones Industrial Average

DJIA,

and S&P 500

SPX,

slipping into negative territory.

Stock Market Today: Dow gives up gains as rocky trading pattern continues

“Our call for 2s/10s to reach -100 bp is back on the table after appearing less realistic” at the end of last year, when the spread closed around minus 55 basis points, BMO Capital Markets strategists Ian Lyngen and Ben Jeffery said in a note Thursday.

Thursday’s deepening 2s/10s inversion was driven largely by a falling 10-year rate, which dropped to 3.6% while the 2-year yield held relatively steady. A negative 2s/10s spread simply means that the 2-year Treasury rate is trading far above its 10-year counterpart, as bond investors and traders factor in near-term Fed rate hikes along with lower inflation and/or a poor economic outlook over the long term.

Ordinarily, Treasury spreads should be sloping upward when the outlook is bright; it slopes downward and goes negative when there’s greater pessimism. The more negative the spread, the more negative the message is from the bond market, the thinking goes — although strategists at Goldman Sachs and yield-curve research pioneer Campbell Harvey have cautioned against linking inversions to recessions.

Read: Deeply inverted Treasury yield curve isn’t signaling a looming recession: Goldman Sachs

Also see: Economist who pioneered use of closely followed recession tool says it may be sending ‘false signal’

The 2s/10s spread initially reached its most negative levels in more than four decades from late November to early December, and then went less negative at the end of 2022 as investors continued to weigh the 2023 outlook.

Thursday’s levels are poised to become the most deeply negative since October 1981, when the annual headline inflation rate from the consumer-price index was above 10%, the fed-funds rate was around 19% under Volcker, and the U.S. economy was in the midst of one of its worst downturns since the Great Depression.

Traders, strategists and investors have been toggling between two narratives on the most likely path for inflation. One is that the U.S. could be heading into a period of “transitory disinflation,” in which any cooling price gains turn out to be fleeting. The other is that there could be a swift and surprising drop in inflation, with the annual headline rate on the consumer-price index heading toward 2% in a matter of months, on the view that the U.S. economy won’t be able to avoid a recession.

The main differences between the two narratives essentially boils down to one’s views on the strength of the U.S. economy and, therefore, how fast inflation could drop as a result.

In other bond-market moves on Thursday, a second recession indicator — the spread between rates on 3-month T-bills

TMUBMUSD03M,

and the 10-year Treasury yield — shrank to roughly minus 111 basis points, versus a record low of minus 127.73 basis points set on Jan. 18.

[ad_2]

Source link