[ad_1]

Dow Jones, ASX 200, Bank of America, Technical Analysis – Asia Pacific Indices Briefing

- Dow Jones gained on Monday as consumer discretionary sector stocks surged

- Bank of America earnings downplaying US recession woes helped sentiment

- Australia’s ASX 200 could be looking at a rosy Tuesday trading session ahead

Recommended by Daniel Dubrovsky

Get Your Free Equities Forecast

Monday’s Wall Street Trading Session Recap

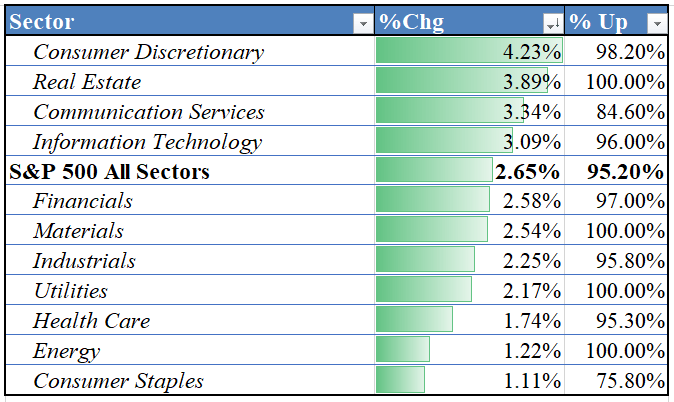

Market sentiment improved on Wall Street to wrap up Monday’s trading session. Dow Jones, S&P 500 and Nasdaq 100 futures gained 1.76%, 2.55% and 3.41%, respectively. Taking a look at the breakdown of the S&P 500 below, consumer discretionary (4.23%), real estate (3.89%) and communication services (3.34%) lead the charge.

Aiding stocks was an upbeat earnings report from Bank of America, where recession warnings were largely downplayed, playing up the American consumer. That could hint at further optimism to come from other companies as the reporting season gets underway. According to the bank, credit card spending increased 13 percent in Q3 compared to a year ago.

Consumption is the heart of the US economy. Despite the highest inflation in 40 years, which is also largely outpacing wage gains, consumers remain unperturbed it seems in the eyes of the Bank of America. This could hint at an economy that may continue absorbing rapid monetary tightening from the Federal Reserve with unemployment remaining historically low.

S&P 500 Sector Breakdown 10/17/2022

Data Source: Bloomberg, Chart Prepared by Daniel Dubrovsky

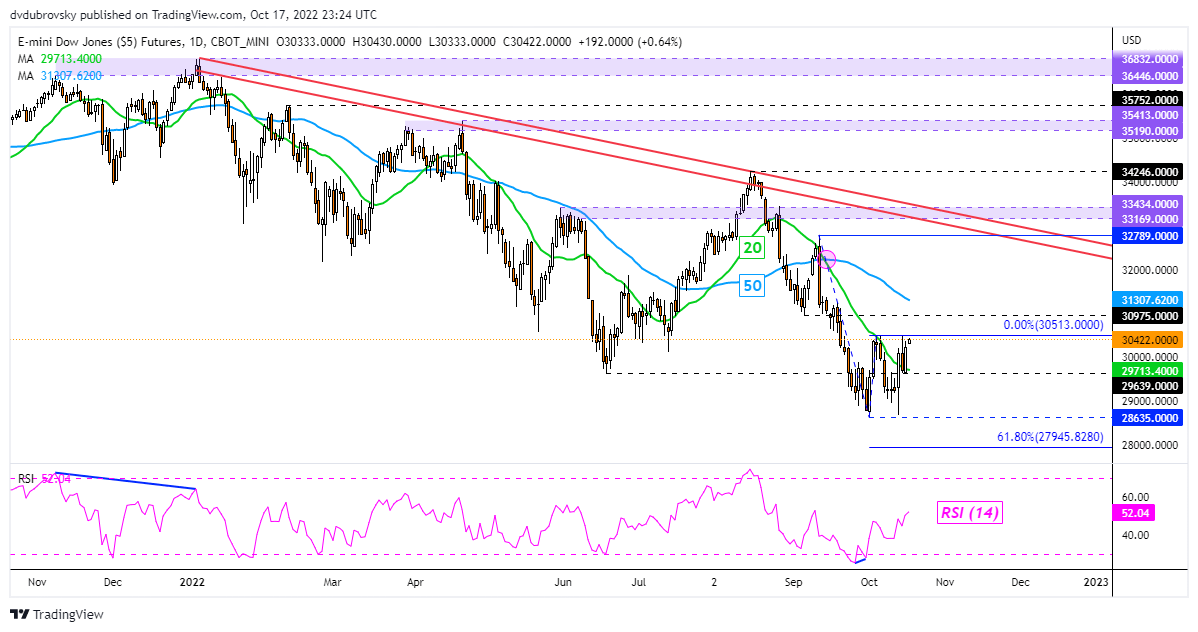

Dow Jones Technical Analysis

On the daily chart, Dow Jones futures are back to pressuring key resistance around 30513. This follows a break above the 20-day Simple Moving Average (SMA). Confirming a breakout above resistance exposes the 50-day SMA, which could reinstate the downside focus. Even if it does not, the more important test will likely be the falling trendline from the beginning of this year.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Dow Jones Futures Daily Chart

Tuesday’s Asia Pacific Trading Session

Asia-Pacific markets could be looking forward to a rather upbeat session following strong gains from the Wall Street trading session. China reportedly announced that it will delay the release of third-quarter GDP data, leaving the economic docket light. As such, traders may focus on general sentiment. Prospects of the US economy holding up may bode well for Australia’s ASX 200. Australia is an economy tied to the global business cycle. A resilient US economy could have positive spillover effects for the nation.

Recommended by Daniel Dubrovsky

Get Your Free Top Trading Opportunities Forecast

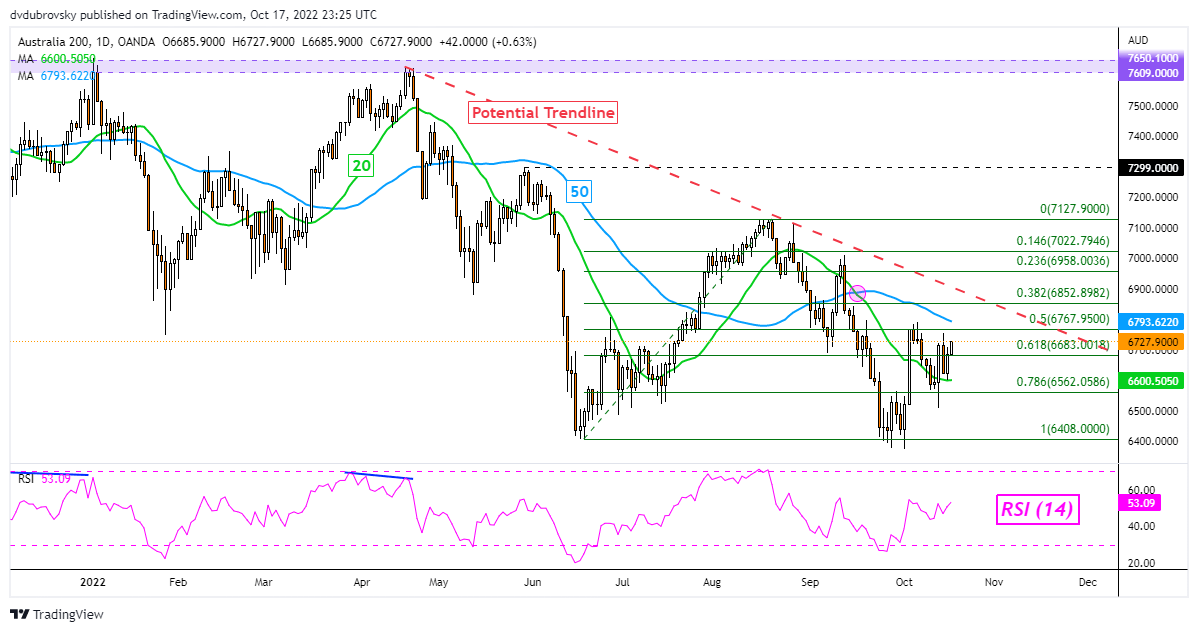

ASX 200 Technical Analysis

The ASX 200 continues to trade above the 20-day SMA, with the 50-day line above. The latter could hold as resistance, reinstating the downside focus. But, a potential falling trendline from April could be the more important technical challenge down the road. In the event of a turn lower, key support seems to be the 78.6% Fibonacci retracement at 6562.

ASX 200 Daily Chart

— Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or@ddubrovskyFXon Twitter

[ad_2]

Source link