[ad_1]

Dow Jones, S&P 500, Retail Trader Positioning, Technical Analysis – IGCS Equities Update

- Dow Jones, S&P 500 have been rising in recent weeks

- Retail traders have become more bearish Wall Street

- Is this a sign that further gains could be ins tore ahead?

Recommended by Daniel Dubrovsky

Get Your Free Equities Forecast

In recent weeks, the Dow Jones and S&P 500 have been climbing. In response retail traders have been responding by increasing downside exposure. This can be seen by looking at IG Client Sentiment (IGCS), which often functions as a contrarian indicator. With that in mind, is this a sign that further gains could be in store for Wall Street?

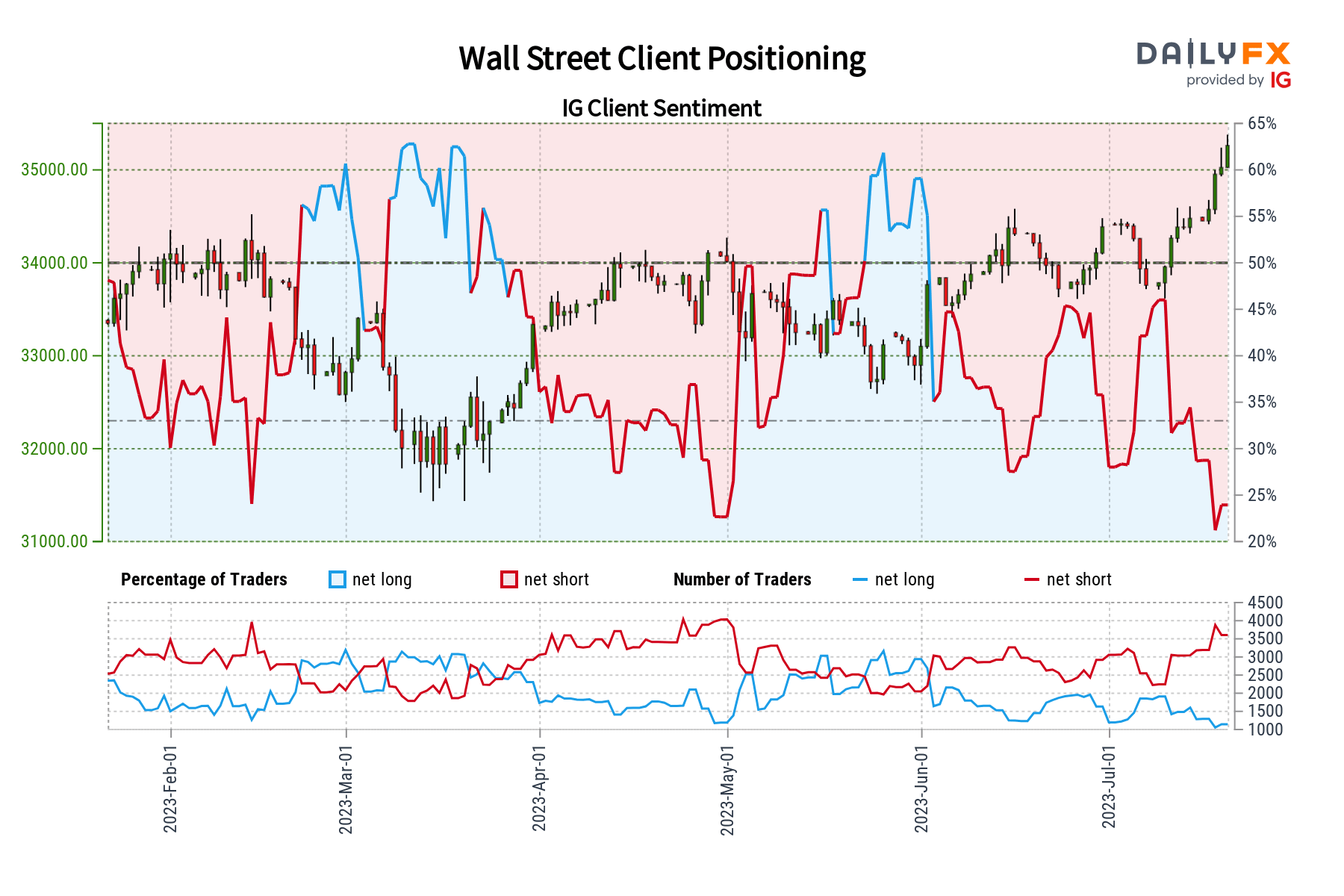

Dow Jones Sentiment Outlook – Bullish

According to IGCS, about 21% of retail traders are net-long the Dow Jones. Since most are biased to the downside, this suggests that prices may continue higher down the road. This is as downside exposure increased by 16.76% and 34.22% compared to yesterday and last week, respectively. With that in mind, the combination of overall positioning and recent changes offers a stronger bullish contrarian trading bias.

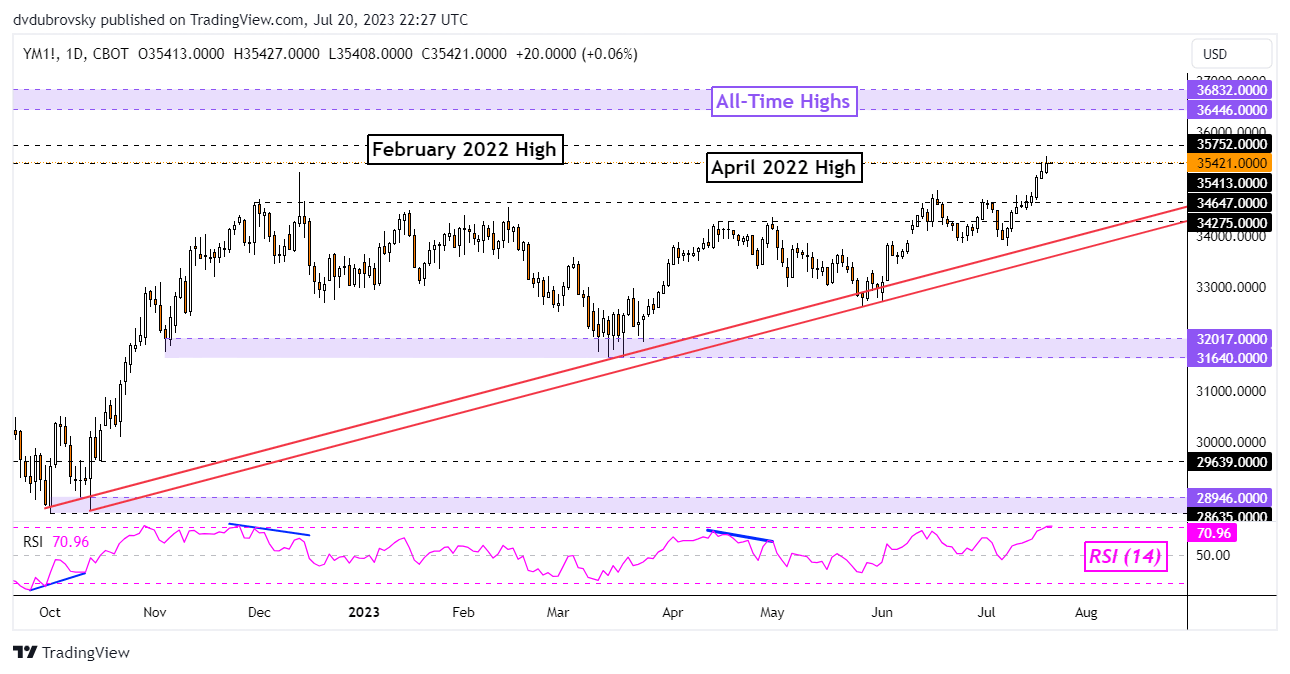

Dow Jones Technical Analysis

On the daily chart, the Dow Jones has climbed to the April 2022 high of 35413, which is immediate resistance. Just beyond this price is the February 2022 high of 35752. Beyond the latter sits the all-time high, which is the peak of the 36446 – 36832 resistance zone. In the event of a turn lower, further losses would place the focus on rising support from October.

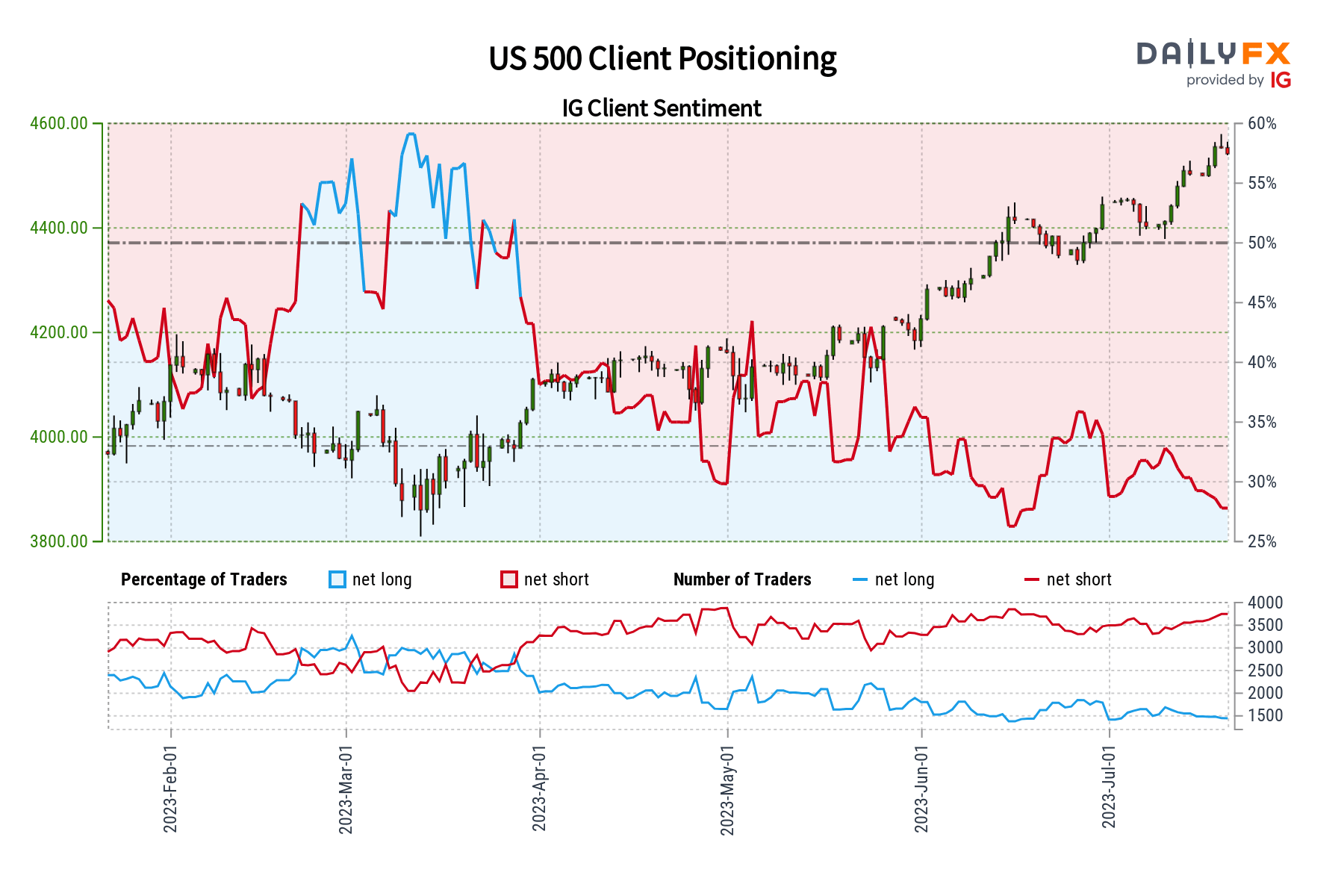

S&P 500 Sentiment Outlook – Bullish

According to IGCS, about 27% of retail traders are net-long the S&P 500. Since most traders are biased lower, this hints that prices may continue rising down the road. Meanwhile, downside exposure has increased by 5.23% and 8.25% compared to yesterday and last week, respectively. With that in mind, the combination of current sentiment and recent changes produces a stronger bullish contrarian trading bias.

Recommended by Daniel Dubrovsky

Improve your trading with IG Client Sentiment Data

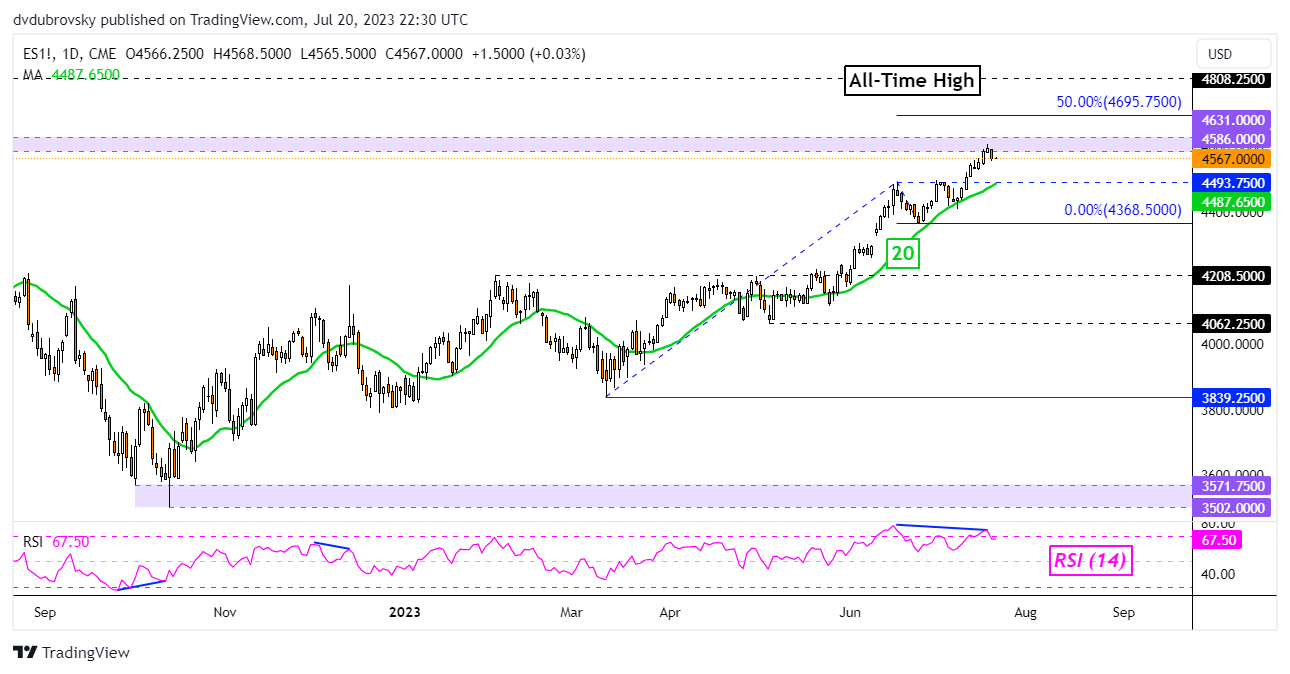

S&P 500 Technical Analysis

The S&P 500 recently tested the key 4586 – 4631 resistance zone which contains highs from early 2022. A turn lower from here places the focus on the 20-day Simple Moving Average. This could hold as support, reinstating the upside technical bias. Otherwise, pushing through resistance exposes the midpoint of the Fibonacci extension level at 4695.

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

[ad_2]

Source link