[ad_1]

If the Dow Jones Industrial Average manages to pull off a 13th day in the green on Wednesday, it would cement the blue-chip gauge’s longest winning streak since Jan. 20, 1987.

Even if it falls short, the Dow’s

DJIA,

come-from-behind streak of uninterrupted gains has already made it into the markets history books. At 12 days as of Tuesday’s close, it’s the longest winning streak since Feb. 27, 2017, according to Dow Jones Market Data.

It’s a notable reversal of fortune for a U.S. equity index that has lagged its peers all year.

Perhaps the biggest issue facing the Dow as opposed to the S&P 500 index and Nasdaq Composite is that the Dow isn’t nearly as heavily weighted toward the so-called Big Seven U.S. technology giants that have powered much of this year’s stock-market rally, even prompting the Nasdaq Exchange to reduce their weightings in the Nasdaq 100 to combat overconcentration risks after their market capitalization ballooned thanks to the artificial-intelligence craze.

Of the Big Seven — a term that refers to Microsoft Corp.

MSFT,

Apple Inc.

AAPL,

Alphabet Inc. (both Class A

GOOGL,

and Class C

GOOG,

shares), Nvidia Corp.

NVDA,

Amazon.com Inc.

AMZN,

Tesla Inc.

TSLA,

and Meta Platforms Inc.

META,

— only Microsoft and Apple are Dow constituents. And because the Dow is weighted by share price, insurance giant UnitedHealth Group Inc.

UNH,

has more influence than Apple and Microsoft do.

But the blue-chip gauge’s gains over the past three weeks have narrowed the gap. Before the streak began, the blue-chip was sporting a year-to-date gain of less than 2%. As of Tuesday’s close, the blue-chip gauge was up 7% in 2023, and has recently smashed through a series of 52-week highs, according to FactSet data.

Of course, the Dow is still trailing the S&P 500

SPX,

and Nasdaq Composite

COMP,

in 2023 by a hefty margin, with the S&P 500 up 18.6% and the Nasdaq Composite’s gain of 34.3%.

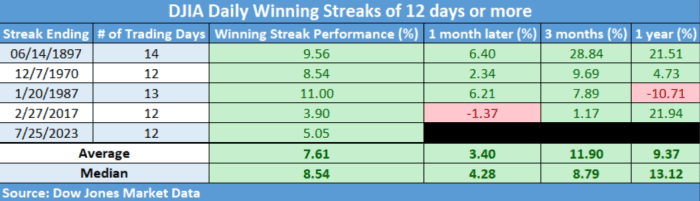

What does the Dow’s performance so far tell us about how stocks’ might perform over the next year? Generally speaking, the index was higher one year later after rising for 12 days or more, according to Dow Jones Market Data. Meanwhile, the index was higher three months after each 12-day streak of gains.

Although since the late 19th Century, there have only been five such streaks, including the current one.

DOW JONES MARKET DATA

On average, the blue-chip gauge has been 9.4% higher one year later, with at least one notable exception: The Black Monday market crash, which saw the Dow drop more than 22% in a single day, occurred nine months after a 13-day Dow winning streak ended in January 1987. One year later, the index was down 10.7%.

What’s more, the Dow narrowly missed another 12-day streak during the month of July 1929, when it climbed for 11 days through July 8, 1929 (this was back when the New York Stock Exchange still offered U.S. stock trading on Saturdays), according to DJMD. Three months afterward, the stock market collapsed, ushering in the start of the Great Depression.

That the Dow recorded outsize winning streaks in 1929 and 1987 means there’s “something for everyone if you want to play the analogy game,” said Jonathan Krinsky, chief technical strategist at BTIG, in a Wednesday research note.

It’s also notable that none of the 12- or 13-day streaks, when they ended, marked the end of the rally. Of course, 1929 and 1987 did see historic crashes later in the year. So something for everyone if you want to play the analogy game.

And one 12-day winning streak that concluded on Dec. 7, 1970 occurred just as a recession was ending, according to data from the National Bureau of Economic Research, the official arbiter of what constitutes a recession in the U.S.

But generally speaking, lengthy Dow winning streaks have occurred during good economic times.

Since 1950, there have been 25 Dow winning streaks of at least 9 days, excluding the current one, according to data compiled by eToro’s U.S. equity strategist Callie Cox. Only three of those occurred either during a recession, or the year before one would begin.

Of course, past performance is no indicator of future success. With the Federal Reserve expected to raise interest rates once again on Wednesday, a lack of clarity surrounding the path forward for monetary policy is making some investors understandably nervous.

“The Fed is still determined to get inflation back down to 2%, and that could mean that rates stay around these levels until something breaks,” Cox said in emailed commentary.

The Dow was up 60 points, or 0.2%, in recent trade at 35,500.14. Meanwhile, the Nasdaq Composite

COMP,

was down 34 points, or 0.3%, while the S&P 500

SPX,

was off by 4 points, or 0.1%, FactSet data show.

[ad_2]

Source link