[ad_1]

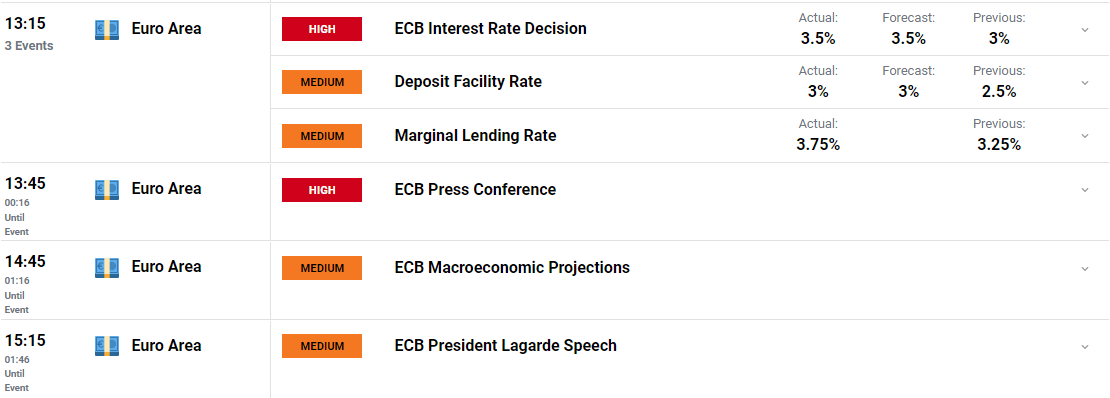

ECB RATE DECISION KEY POINTS:

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

The European Central Bank has raised interest rates by 50bps in line with expectations. The ECB reportedly told Ministers ahead of the meeting that some EU banks could be vulnerable. The Central Bank stated that the increasing uncertainty highlights the importance of a data-driven approach to monetary policy moving forward.

For all market-moving economic releases and events, see the DailyFX Calendar

The ECB staff macroeconomic projections were done before the recent emergence of financial market tensions. The staff project growth to accelerate to 1.6% in both 2024 and 2025 due to a strong labor market, improving confidence and a recovery in real incomes. Inflation is expected to average 4.6% in 2023 about half of the current inflation rate which is an increase from the December projections. Inflation is expected to remain too high for too long according to the Central Bank.

The ECB confirmed that the policy toolkit is fully equipped to provide liquidity support to the Euro area financial system if needed while confirming they are keeping a close eye on ongoing developments in the financial sector. The Central Bank has however refrained from signaling future rate moves in a statement. Market participants are pricing in a potential 15bps of hikes by July in the immediate aftermath of the decision.

Foundational Trading Knowledge

Macro Fundamentals

Recommended by Zain Vawda

The APP portfolio is declining at a measured and predictable pace, as the Eurosystem does not reinvest all of the principal payments from maturing securities. The decline will amount to €15 billion per month on average until the end of June 2023 and its subsequent pace will be determined over time. As concerns the PEPP, the Governing Council intends to reinvest the principal payments from maturing securities purchased under the programme until at least the end of 2024.

LOOKING AHEAD

The rate hike path for the European Central Bank (ECB) has been made all the more murkier moving forward along with its Central Bank peers. The recent banking sector woes and in particular the Credit Suisse story have upended market expectations and seen the probability for rate cuts in 2023 gain traction. Inflation remains persistent though and such pricing may be misplaced as the ECB still has a fight on its hands in this regard. Any rate hikes moving forward will only be a possibility if the ECB is confident that it will not come at the cost of the financial sector. Following today’s hike however it appears that price stability may trump financial stability concerns for the Central Bank.

Hopefully the ECB press conference, Macroeconomic projections expected in the next hour, as well as comments from ECB President Christine Lagarde at 15:15 GMT today may provide more clarity as to how the ECB sees the rate and inflation path moving forward. EURUSD may have to wait till next week’s Federal Reserve interest rate decision to give us a more medium-term outlook, especially heading into Q2 2023.

MARKET REACTION

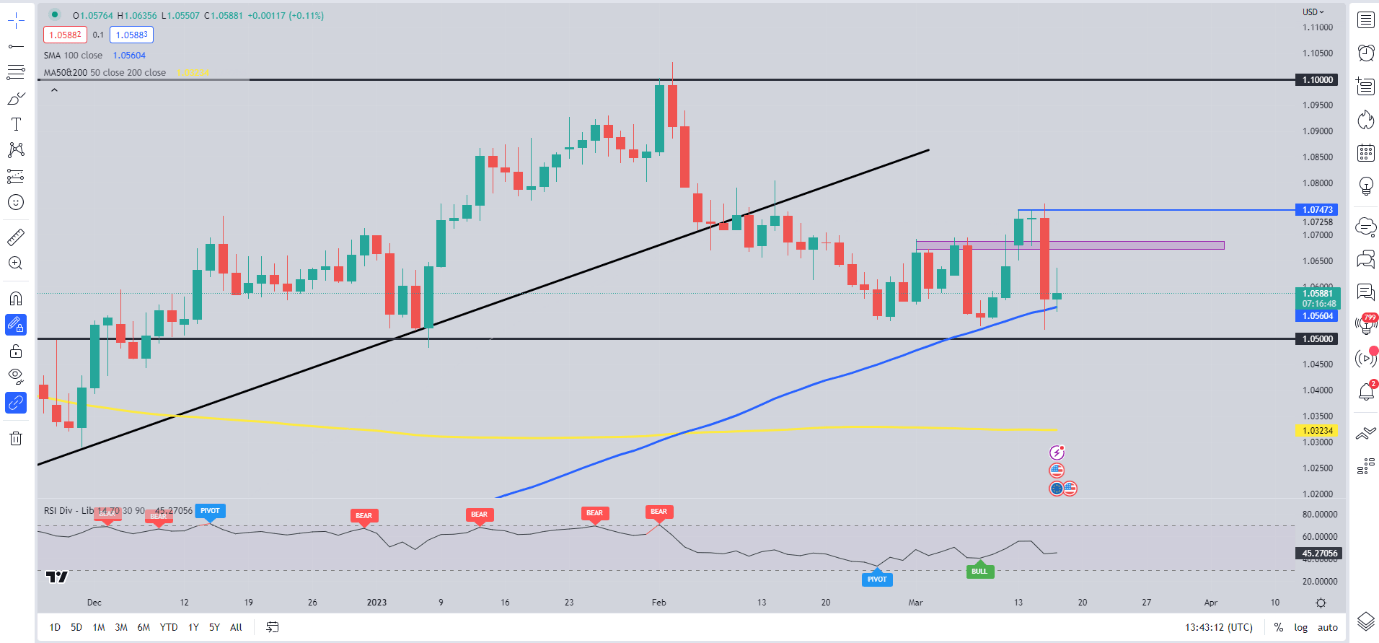

EURUSD Daily Chart

Source: TradingView, prepared by Zain Vawda

EURUSD initial reaction saw a 40 pip drop before trading flat ahead of the press conference, highlighting the indecisive nature of the pair at the moment. The bigger picture for EURUSD following yesterday’s drop still sees the pair finding strong support at the 1.05 handle. Yesterday did see the daily candle close as a bearish engulfing candlestick yet we have failed to see any kind of follow through as the 100-day MA resting at 1.0560 providing support.

The 1.05-1.08 range remains in play moving forward and without a further catalyst we could remain stuck within these price levels for the foreseeable future.

Key Levels to Keep an Eye on:

Resistance Levels

-1.0670

-1.0740

-1.0800

Support Levels

-1.0560 (100-day MA)

-1.0500

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]

Source link

.png)