[ad_1]

For years, Elon Musk has used hype to prop up Tesla’s stock. It’s worked so well that other companies have followed his lead. But now we think the world has seen that the emperor has no clothes.

The attempted Twitter

TWTR,

takeover is yet another example of Musk bullying his way into what he wants and underscores how his superstar status cannot always convince people to overlook his irreverent, reckless and potentially illegal behavior. As the recent lawsuit against Musk shows, he is not completely immune from the consequences of his actions.

Therefore, despite recent gains, investors should consider selling Tesla

TSLA,

before institutional money bails.

End of the road for Musk

Most investors are keenly aware of Musk’s long history of making grand promises that don’t come true – such as the Roadster, the Semi, the Cybertruck, full-self driving (FSD) – and at times are blatantly unethical, such as tweeting “funding secured” to go private and pumping Dogecoin.

Institutional investors own Tesla stock more often because they must, given its influence on their performance, than because they see it as a good investment. Any investor with a rigorous process can see the stock is ridiculously overvalued; you own it for the “Musk effect”. Accordingly, institutional investors’ decision to sell Tesla stock will be based on when Musk’s outsize influence begins to wane.

We think that moment has come.

Trouble on the horizon

All the hype around Musk’s large stake in Twitter and the speculation around his plans for the social media platform takes focus away from Tesla’s troubles, which are many. Of course, that is precisely his goal. Below we discuss the fundamentals of Tesla’s business, which cannot be wished away or made irrelevant with hype.

Incumbents are catching up: Tesla’s first-mover advantage has long been cited as reason enough for investors to pile their money into the company. However, that advantage is gone, and in some cases turning into a lag. Ford

F,

Rivian

RIVN,

and General Motors

GM,

aim to produce EV trucks in 2022, but Tesla will need until at least 2023 before launching its Cybertruck.

The rising competition from incumbents means the days of Tesla’s rising profitability could be numbered. For starters, 26% of the company’s GAAP earnings in 2021 were from the sale of regulatory credits, not from the underlying economics of making and selling vehicles and other ancillary services.

Once incumbents increase production of EVs, they will need to purchase fewer credits from Elon. That means Tesla needs to actually start selling cars to make money. The Catch-22 is that for the company to sell more cars, it first needs to increase its production capacity. If Tesla succeeds in selling more cars, capital expenditure and working capital are primed to grow along with sales. Tesla needs to build economies of scale before it can benefit from them.

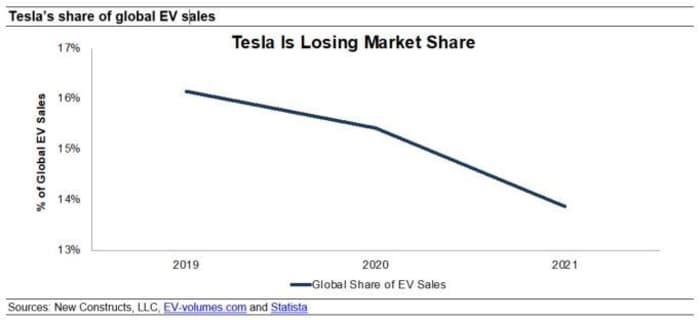

Market-share losses continue: Incumbent auto makers have entered the EV market with scale and are already taking market share from Tesla. Tesla’s share of global EV sales fell from 16% in 2019 to 14% in 2021.

Tesla’s share of the U.S. EV market fell from 79% in 2020 to 70% in 2021. With light truck sales comprising more than three out of every four vehicles sold in the U.S. in January 2022, Tesla falling behind in truck EVs means its share of the U.S. market could fall further.

Slow start to 2022: Though Tesla forecasted a year-over-year rise in deliveries of at least 50% in 2022, the company is feeling the effects of supply-chain problems – just like every other auto maker. The company delivered 310,000 vehicles in the quarter, while consensus estimates were for 313,000.

Reverse DCF math: What Tesla’s valuation implies

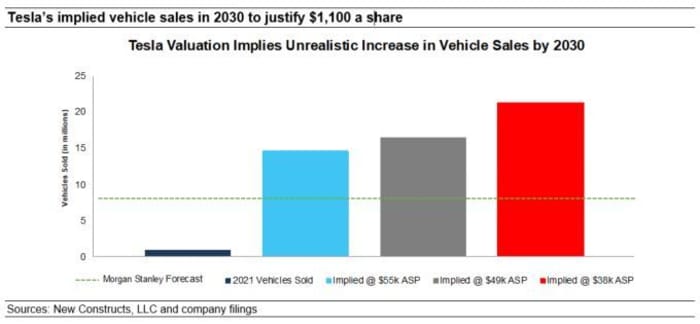

Despite the increased competition, failure to meet delivery expectations and diminutive share of the global EV market in 2021, Tesla’s valuation implies the company will own 57% of the global passenger EV market in 2030.

Even if Tesla increases the average selling price (ASP) per vehicle to $55,000 vs. $49,000 in 2021, Tesla’s stock price around $1,100 a share implies the firm will sell 15 million vehicles in 2030 versus around 936,000 in 2021. That figure represents 57% of the projected base case global EV passenger vehicle market in 2030, and the implied vehicle sales based on a lower ASP looks even more unrealistic.

Tesla must generate more profit than Apple for investors to make money

Below are the assumptions we use in our reverse discounted cash flow (DCF) model to calculate the implied production levels above.

Bulls should understand what Tesla needs to accomplish to justify about $1,100 a share:

In this scenario, Tesla generates $811 billion in revenue in 2030, which is 116% of the combined revenues of Toyota

7203,

TM,

Stellantis

STLA,

Ford, General Motors and Honda

HMC,

7267,

over the past 12 months.

In other words, Tesla must replace the U.S. auto industry before 2030 to justify current valuations.

This scenario also implies Tesla grows net operating profit after-tax (NOPAT) by 2,458% from 2021 to 2030. In this scenario, Tesla generates $112 billion in NOPAT in 2030, or 12% higher than Apple’s

AAPL,

trailing-12-month NOPAT, which, at $100 billion, is the highest of all companies we cover, and 65% higher than Microsoft

MSFT,

the second-highest. Those companies have intertwined themselves in the lives of consumers and businesses around the world, which seems an unlikely feat for Tesla at this point.

Tesla has 50% downside if Morgan Stanley is right about sales

If we assume Tesla reaches Morgan Stanley’s estimate of selling 8.1 million cars in 2030 (which implies a 31% share of the global passenger EV market in 2030), at an ASP of $55,000, the stock is worth just $542.

If, on the other hand, NOPAT margin improves to 14% and revenue grows 27% compounded annually over the next decade, then the stock is worth just $547 today – a 50% downside to the current price. See the math behind this reverse DCF scenario.

In this scenario, Tesla grows NOPAT to $62 billion, or nearly 14 times its 2021 NOPAT, and just 7% below Alphabet’s

GOOG,

GOOGL,

2021 NOPAT.

Tesla has 82%+ downside even with 27% market share and realistic margins

If we estimate more reasonable (but still very optimistic) margins and market share achievements for Tesla, the stock is worth just $200. Here’s the math:

- NOPAT margin improves to 9% (equal to Toyota’s TTM margin) and

- revenue grows by consensus estimates from 2022 to 2024 and

- revenue grows 17% a year from 2025 to 2030, then

the stock is worth just $200 today – an 82% downside to the current price.

In this scenario, Tesla sells 7 million cars (27% of the global passenger EV market in 2030) at an ASP of $47,000 (average new car price in U.S. in 2021) and grows NOPAT by 24% compounded annually from 2022 to 2030.

We also assume a more realistic NOPAT margin of 9% in this scenario, which is 1.3 times higher than Toyota’s industry-leading five-year average NOPAT margin of 7%. Given the required capital requirements to fund manufacturing and match increased competition in the EV market, Tesla is unlikely to achieve and sustain a margin as high as 9% from 2022 to 2030.

If Tesla fails to meet these expectations, then the stock is worth less than $200.

David Trainer is the CEO of New Constructs, an independent equity research firm that uses machine learning and natural language processing to parse corporate filings and model economic earnings. Kyle Guske II and Matt Shuler are investment analysts at New Constructs. They receive no compensation to write about any specific stock, style or theme. New Constructs doesn’t perform any investment-banking functions and doesn’t operate a trading desk. Follow them on Twitter@NewConstructs. This is an abridged version of “Is the End Near for Tesla and Other Meme-Stocks?“ published on April 14.

More from MarketWatch

Opinion: Twitter’s board owes it to shareholders to accept Elon Musk’s offer

Twitter has a user problem — and it’s got nothing to do with Elon Musk

If Musk’s $43 billion Twitter takeover falls apart, who else has enough money to buy the company?

[ad_2]

Source link