[ad_1]

Oil and gas stocks are likely in a market bubble that’s vulnerable to popping.

That’s the conclusion when applying a formula from recent academic research into the predictability of stock market bubbles and subsequent crashes.

The research, which appeared in the Journal of Financial Economics, was conducted by Robin Greenwood and Andrei Shleifer of Harvard University, and Yang You of the University of Hong Kong.

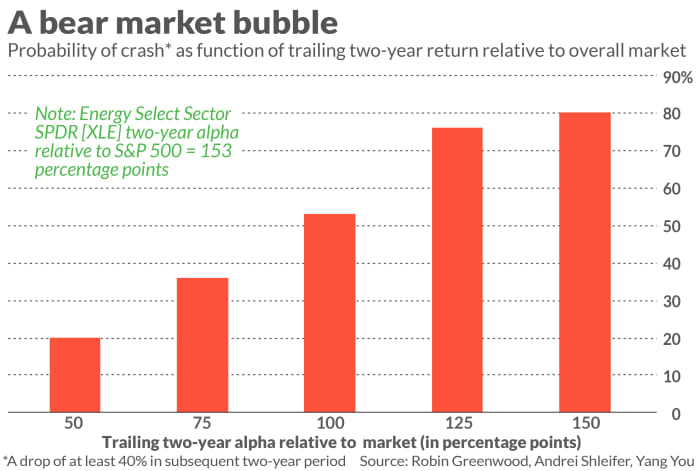

The researchers found that the probability of a market sector crashing — defined as a drop of at least 40% over the subsequent two years — was correlated with its trailing two-year performance relative to the overall market.

The chart above provides the specifics, based on U.S. data back to 1926. Whenever an industry or sector outperformed the broad market by at least 100 basis points (1 percentage point) over a two-year period, there was a 53% chance it would drop by at least 40% over the subsequent two years. When the trailing two-year outperformance was at least 150 basis points (1.5%), those odds grew to 80%.

These findings are why the energy sector is so vulnerable. The Energy Select Sector SPDR

XLE,

for example, has beaten the S&P 500

SPX,

over the past two years by 153 percentage points. Assuming the future is like the past, the odds of the energy sector falling by 40% or more in the next two years are 80%.

On several prior occasions, I’ve applied this academic research to various assets, and it’s worked every time. Here’s a brief rundown:

-

November 2017: bitcoin

BTCUSD,

+2.59% .

At one point in the two years after that column appeared, this cryptocurrency was down 61%. - June 2019: bitcoin. At one point in the two years after that column appeared, bitcoin was 60% lower.

-

February 2020:Tesla

TSLA,

+1.72% .

At one point in the two years after that column appeared, this stock was 59% lower than where it was trading then. - February 2021: S&P 500 Technology Hardware Storage & Peripherals Index. At one point over the 21 months subsequent to when that column appeared, this index was down 40%.

- February 2021: bitcoin. At one point in the 21 months subsequent to that column appearing, bitcoin was down 66%.

Do strong fundamentals apply?

Energy sector bulls might object that the energy sector is in a far different place than the assets that were the subject of those prior columns. The sector’s current valuation appears quite attractive, with P/E ratios well-below the overall U.S. stock market.

Yet I’m not sure stronger fundamentals can protect the energy sector from a much-heightened crash risk. For their Journal of Financial Economics study, the researchers could find no evidence that the probability of a crash was dependent on fundamental factors.

Harvard’s Greenwood said in an interview that he and several colleagues are continuing their search for such factors. In the meantime, he doubts there are any that significantly reduce the energy sector’s current vulnerability to a big price drop.

Don’t short energy stocks

It’s important to stress that vulnerability to a crash doesn’t automatically make energy stocks attractive short-sale candidates. Even though prices of these stocks are likely at some point in the next two years to be significantly lower, there’s no assurance that their declines will begin from current prices. On the contrary, the researchers found that sectors that satisfy their bubble criteria typically rise by an additional 30%, on average, before succumbing to the law of gravity.

So even if you’re right in predicting the existence of a bubble, you can still find yourself under water — perhaps deeply — before eventually turning a profit. The safer action would be to reduce exposure to the sector.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

Also read: How to get a guaranteed retirement spending rate of 4.3%

[ad_2]

Source link