[ad_1]

EUR/GBP – Prices, Charts, and Analysis

- UK new jobs data show wages rising sharply.

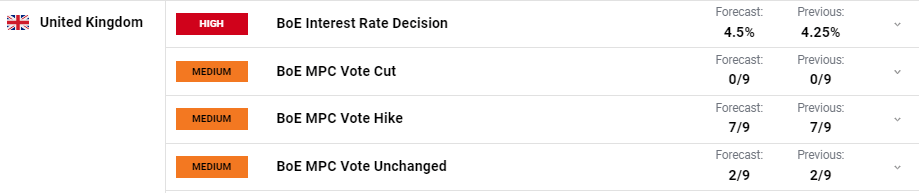

- BoE is set to hike rates by 25 basis points tomorrow.

- EUR/GBP slips to a multi-month low.

Recommended by Nick Cawley

Get Your Free GBP Forecast

Most Read: GBP/USD Price Forecast: 1.2600 Holding Firm as Bulls Eye a Fresh Catalyst

A recent Bloomberg report using Reed Recruitment Jobs data shows that the UK jobs market remains buoyant with people changing jobs seeing a 10% boost to their wages on average. This is markedly higher than last month’s official UK data that showed average earnings including bonus (3Mnth/Year) rising by 5.9% in February, while average earnings excluding bonus rose by 6.6% over the same time frame.

The Bank of England: A Forex Trader’s Guide

The Bank of England is set to hike the UK Bank Rate by a further 25 basis points to 4.50% tomorrow. Recent inflation data has shown price pressures remaining stubbornly high and today’s Reed Report, while not an official data point, will have many in Threadneedle Street worried that a robust wage market may keep inflation higher for longer. The post-decision commentary and press conference should see BoE governor Andrew Bailey point towards the jobs market as an area of ongoing concern.

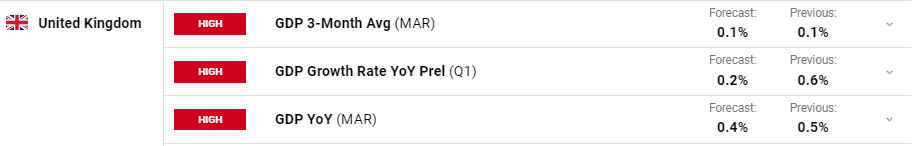

The latest UK GDP data will be released on Friday this week and is expected to show that the UK missed going into a technical recession in the first three months of this year. Preliminary year-on-year Q1 data is expected to show growth of 0.2%, compared to 0.6% in Q4 2022, with year-on-year growth slowing to 0.4% in March from 0.5%.

For all market-moving data releases and events, see the DailyFX Economic Calendar

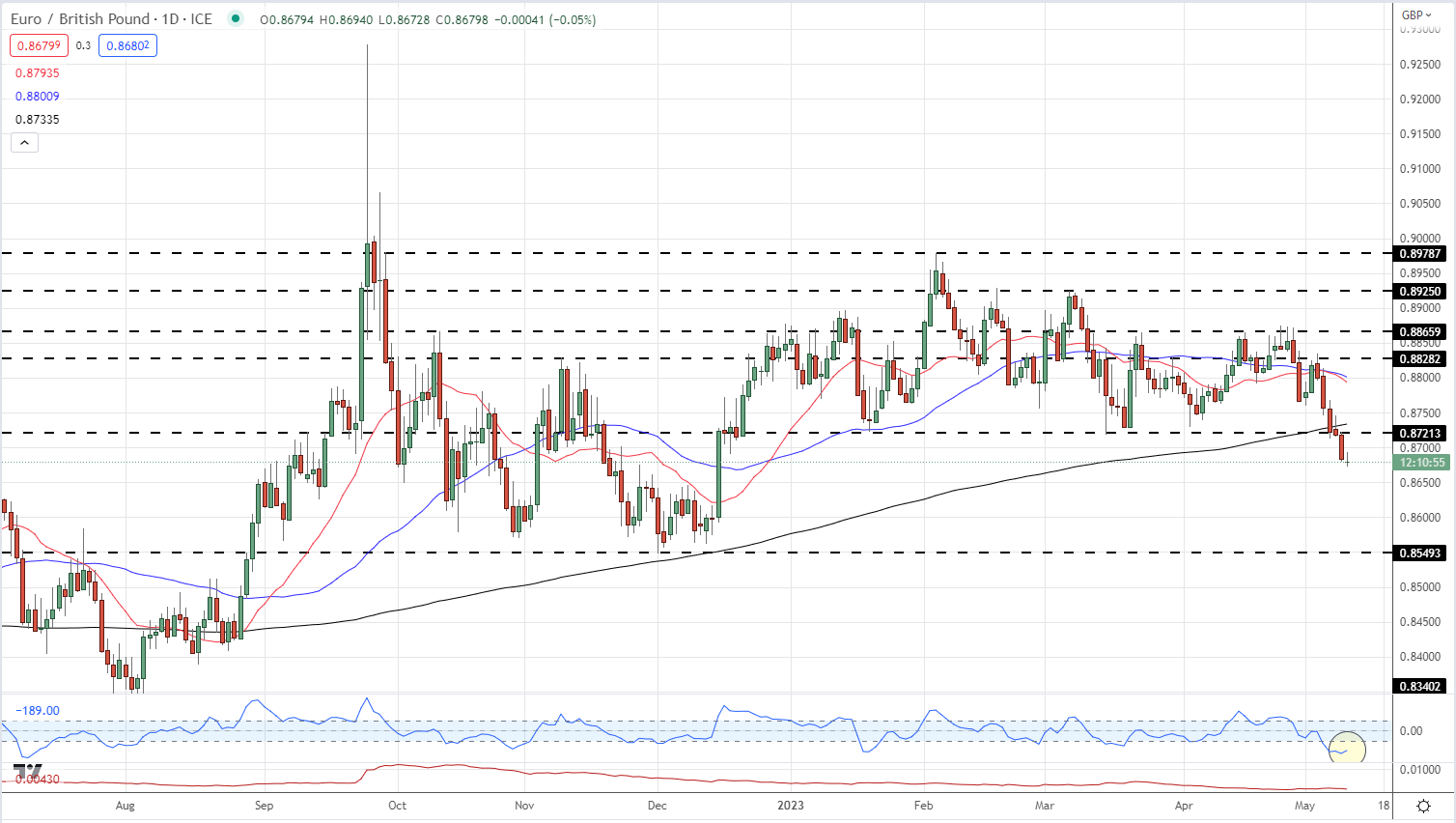

EUR/GBP broke below a multi-month level of horizontal support on Tuesday, and with it opened below the 200-day moving average for the first time since August 2022. The range-break move happened despite hawkish commentary from a number of ECB board members who see further rate hikes in the months ahead. This commentary should act as a level of support for the Euro but it seems that this is not the case currently. The pair sit squarely in oversold territory, using the CCI indicator, while volatility in the pair remains low. If EUR/GBP continues to fade lower, support should be seen around 0.8600 and 0.8550.

EUR/GBP Daily Price Chart – May 10, 2023

Chart via TradingView

| Change in | Longs | Shorts | OI |

| Daily | 6% | 6% | 6% |

| Weekly | 87% | -30% | 24% |

Big Weekly Shift in Retail Trader Positioning

Retail trader data show 72.40% of traders are net-long with the ratio of traders long to short at 2.62 to 1.The number of traders net-long is 0.70% lower than yesterday and 77.36% higher from last week, while the number of traders net-short is 10.04% lower than yesterday and 38.04% lower from last week. We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/GBPprices may continue to fall.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/GBP-bearish contrarian trading bias.

What is your view on the EUR/GBP – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]

Source link