[ad_1]

EUR/USD PRICE FORECAST:

Recommended by Zain Vawda

Get Your Free EUR Forecast

READ MORE: USD/CAD Forecast: 1.3000 Beckons as Dollar Index (DXY) Slide Continues

EUR/USD has been on a tear since the US CPI release this week reaching multi-month highs around the 1.1245 mark. The move has largely been facilitated by dollar weakness as the Dollar Index (DXY) broke below the psychological 100.00 level for the first time since April 2022. The index is on course for its worst week since November 2022.

DISINFLATION NARRATIVE TAKES HOLD OF THE DOLLAR

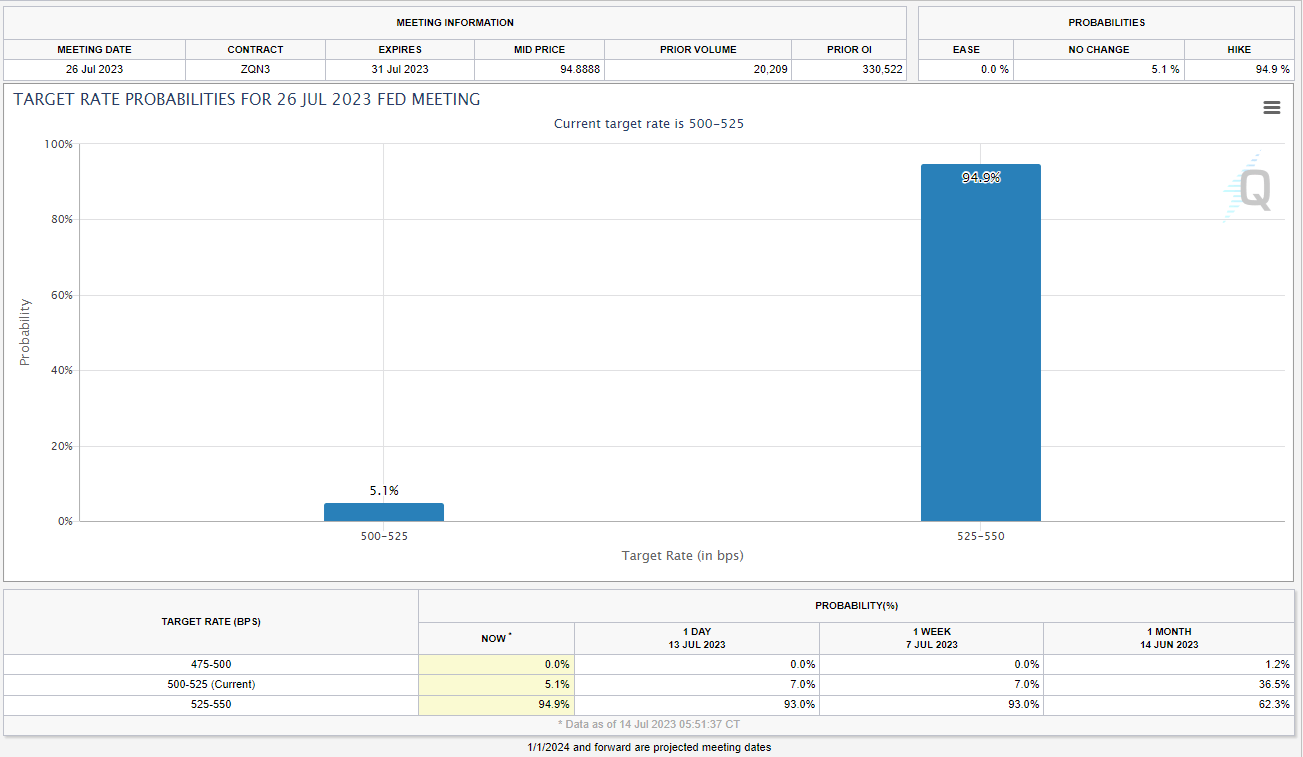

It would seem that the disinflation narrative has firmly gripped the Dollar given the selloff over the past few days. The FOMC meeting is on July 26 with the Fed currently in a blackout and not any significant data releases on the agenda ahead of the meeting the Dollar could face further selling pressure. Looking at CME FedWatch Tool below we can see market participants are still pricing in a 25bps hike at the July meeting.

Source: CME FedWatch Tool

I for one do expect the Federal Reserve to continue with its hiking cycle on July 26 with any surprise likely to be about the size of said hike. Fed Chair Powell in testimony before Congress stated that as the Fed nears their goal, pauses and a potential slowdown in the size of hikes may be needed. Market participants seem to believe that the Fed will not raise beyond the July meeting while the Dollar is likely to be extremely sensitive toward lackluster data out of the US. Any signs of a slowdown in the US economy could be interpreted by market participants as a sign that the Fed may be able to cut rate sooner than expected which could further weigh on the dollar.

Talk has now pivoted to a potential ‘soft landing’, a word which had irked market participants for a long time. Interesting times ahead for the US Dollar and of course markets as a whole as we head toward the July FOMC meeting and beyond.

Recommended by Zain Vawda

Get Your Free Top Trading Opportunities Forecast

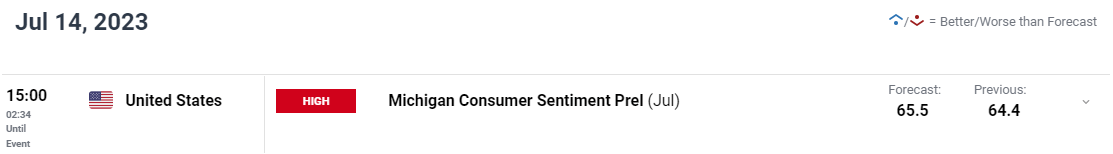

RISK EVENTS AHEAD

Today we do have the preliminary Michigan Consumer Sentiment release which could stoke some volatility around the dollar. Looking ahead to next week and we only have US retail sales and preliminary building permit data on the docket, neither of which are likely to alter the US Dollars outlook at the moment. It seems the Dollar Index could be in for a bumpy ride ahead of the FOMC meeting.

For all market-moving economic releases and events, see the DailyFX Calendar

TECHNICAL OUTLOOK AND FINAL THOUGHTS

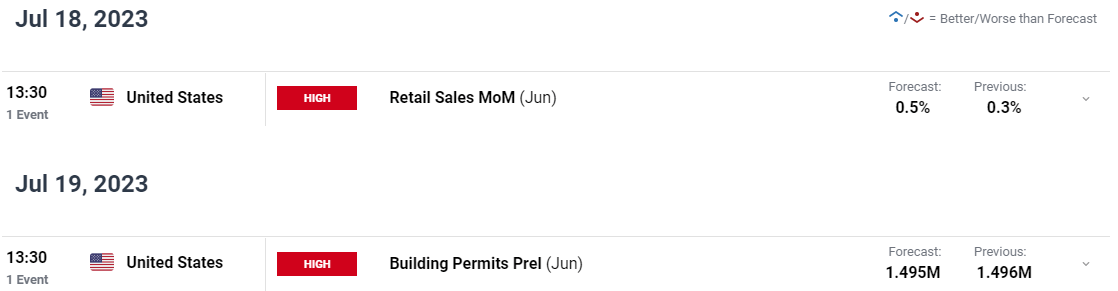

Looking at EURUSD from a technical perspective and we are trading at levels last se in February 2022.The dollar is staging a small come back today up around 0.20% at the time of writing. We have seen a slight pullback from the highs in EURUSD as the US session approaches.

The RSI is in overbought territory, hinting at a potential retracement with the 1.1200 likely to be key. The daily and weekly candle close will be of particular interest as a close above 1.1200 may embolden bulls as the new week kicks off. The MAs on the weekly are setting up for a golden cross pattern as well which doesn’t bode well for a potential retracement. Technicals are flashing some mixed signals however the age-old adage of ‘the trend is your friend’ has never been truer. Trying to pick a top at this stage is a rather foolish endeavor with the smart play being a pullback to allow potential bulls an opportunity to get involved.

EUR/USD Daily Chart – July 14, 2023

Source: TradingView

Key Levels to Keep an Eye On

Support Levels

Resistance Levels

IG CLIENT SENTIMENT DATA

IGCSshows retail traders are currently SHORT on EURUSD, with 76% of traders currently holding SHORT positions. At DailyFX we typically take a contrarian view to crowd sentiment, and the fact that traders are short suggests that EURUSD may enjoy a short pullback before continuing to higher toward the 1.1400 handle.

Discover what kind of forex trader you are

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]

Source link