[ad_1]

EUR/USD, EUR/GBP Analysis and Talking Points

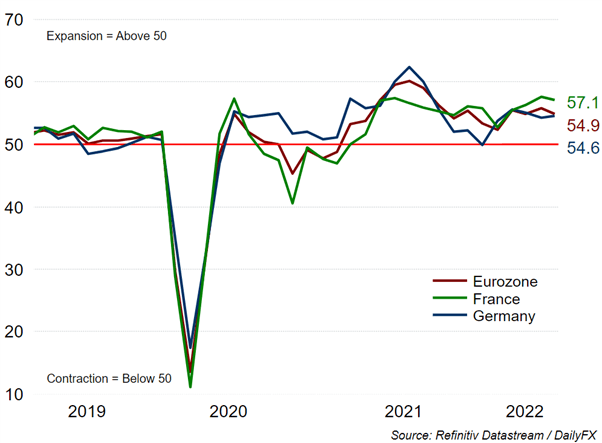

- Mixed Euro Zone PMI Amid Robust Services Sector

- ECB Rate Hike Chatter Underpins the Euro

- EUR/GBP Eying YTD Peak on Weak UK Services PMI

Main Point: Overall a relatively mixed set of flash Euro Zone PMI figures with the majority missing expectations. However, growth remained robust amid support from the services sector, while weakness appears concentrated in the manufacturing sector. As it stands, the PMI data signals Q2 growth at a modest 0.6%, although momentum is likely to slow as the cost of living squeeze weighs on the services sector, meanwhile spillover risks from a soft manufacturing sector is also a concern.

Eurozone PMI Signals Robust Growth Despite Slowing Momentum

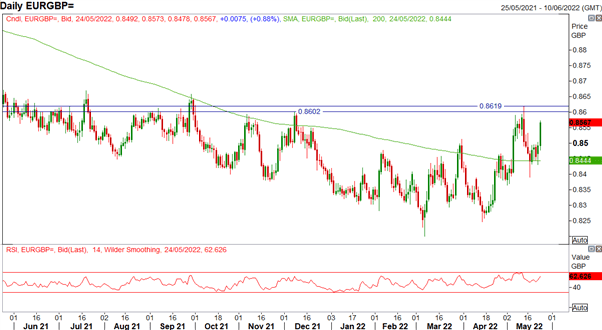

Market Reaction: In reaction to the mixed set of PMI figures, the Euro is relatively unchanged as the single currency maintains a foothold above the 1.07 handle. Two catalysts have remained a key driver for the Euro’s strength. Firstly, ECB President Lagarde had near enough pre-committed to an exit of negative interest rate policy by the end of Q3. While talk of the US potentially mulling a rollback of China tariffs to ease inflationary pressures had also benefitted the Euro. Elsewhere, EUR/GBP is eying a return to the YTD high of 0.8619 after a shocking UK services PMI.

EUR/GBP Chart: Daily Time Frame

Source: Refinitiv

[ad_2]

Source link