[ad_1]

US Dollar (DXY) Daily Price and Analysis

- EUR/USD testing 108.00 support after hitting 109.37 on Thursday.

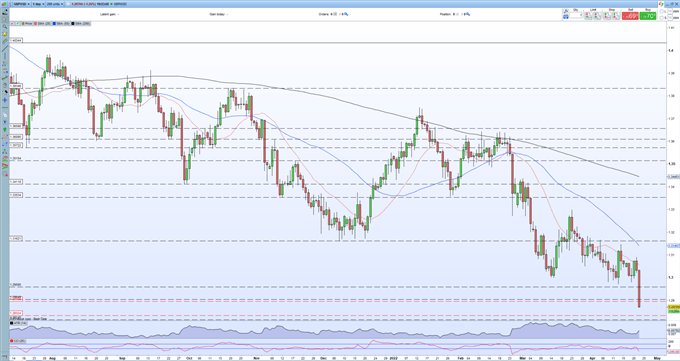

- GBP/USD prints a fresh 17-month low.

The multi-month US dollar rally shows no sign of abating with the greenback racking up impressive gains against all of its major rivals. Further confirmation from Fed chair Jerome Powell yesterday that the US central bank will act swiftly to stamp down inflation has given the DXY another boost higher and with little in the way of resistance, the move looks likely to extend further. Fed chair Powell all but confirmed that interest rates would be hiked by 50 basis points at the May meeting – confirming market pricing – and suggested that similar-sized hikes are likely in the coming months. Mr. Powell also said that ‘there’s something in the idea of front-end loading’, underpinning the belief that the US will hike rates by multiples of 50 basis points at the next few meetings. In addition, the US central bank’s plans to reduce its bulging balance sheet will be laid out at the May meeting, tightening monetary policy further.

Dow Jones, Nasdaq 100 Drop on Fed Powell Commentary. ASX Trendline Break Eyed.

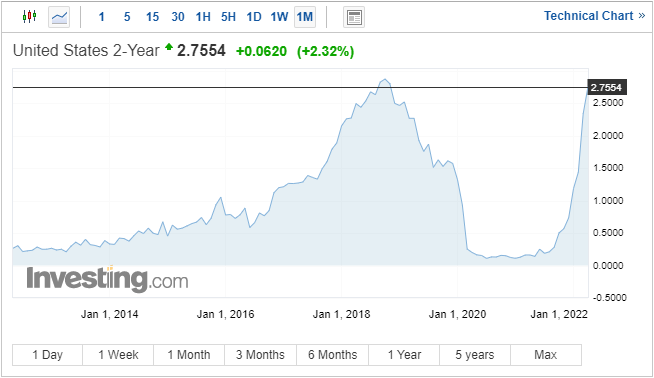

The yield on the interest-rate sensitive UST 2-year continues to push higher and is back at levels last seen in November 2018.

Chair Powell’s commentary has sparked a major reversal in a range of pairs, none more so than EUR/USD. On Thursday, hawkish commentary by ECB Vice-President Luis de Guindos sent the pair to a two-week high of 1.0937 before gains were paired ahead of chair Powell’s speech.

Euro Latest – EUR/USD Back Above 1.0900 on Further Hawkish Commentary

EUR/USD is now pressing down hard on 1.0800 big figure support and looks set to break lower. The next level of support for the pair is at 1.0758, the two-year low made on April 14. Below here the next level of support is seen at 1.0636, the March 2020 low.

EUR/USD Daily Price Chart – April 22, 2022

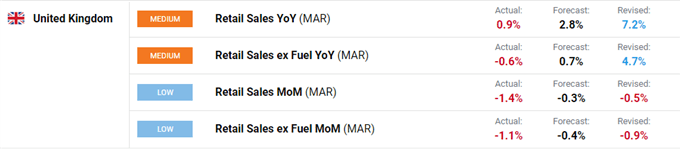

Earlier today official ONS retail trade data showed that UK consumers kept their hands in their pockets in March. Monthly UK retail sales fell by 1.4%, while annual sales grew by just 0.9% compared to expectations of 2.8%.

Today’s UK PMIs (April) also missed market expectations but all three readings remain comfortably in expansion territory.

For all market-moving data releases and events, see the DailyFX Economic Calendar.

A combination of weak economic data, further ‘partygate’ problems for PM Boris Johnson, and a rampant US dollar has pushed cable back down to levels last seen in November 2020. Today’s sell-off has been vicious with the pair currently 150 pips lower on the session so far. Support at 1.2834 is likely to be tested soon.

GBP/USD Daily Price Chart – April 22, 2022

What is your view on the US Dollar – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]

Source link