[ad_1]

EUR/USD News and Analysis

- EUR/USD prints largest one day rise since 2020 after large USD repositioning

- EUR/USD shows little sign of fatigue after powering through crucial 1.0100

- ECB members talk tough on rate hikes in contrast to the Fed

Recommended by Richard Snow

Get Your Free EUR Forecast

EUR/USD Prints Largest One Day Rise Since 2020

Yesterday’s lower US CPI print filled the market with optimism as traders and investors alike now heavily anticipate a 50 basis point hike next month and a lower terminal rate for the Federal funds rate (around 4.9%). The shift in positioning has sent US yields and the dollar sharply lower, boosting equity markets in the process. The lower dollar, measured via the dollar index DXY, tends to have an inverse effect on EUR/USD which saw its largest single day rise since 2020.

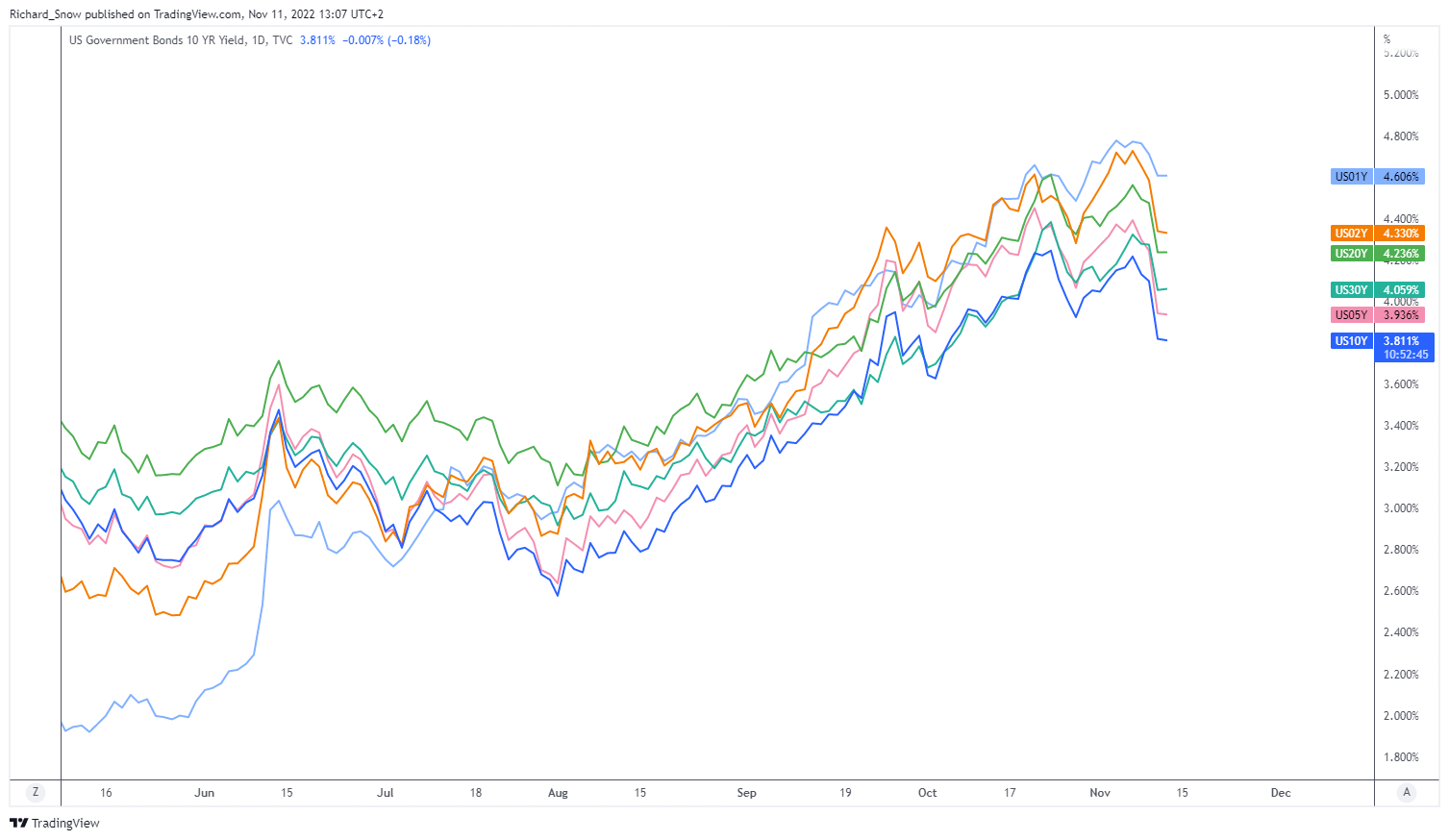

US Treasury Yields Dropping Across the Board

Source: TradingView, Prepared by Richard Snow

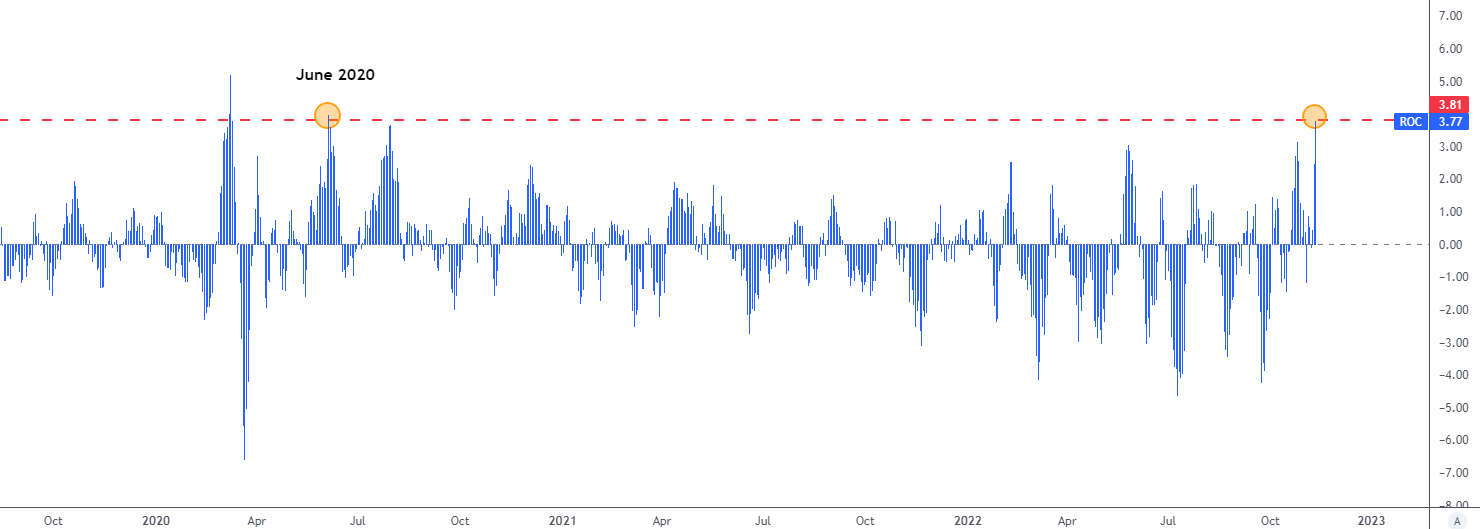

The rate of change indicator shows just how significant yesterday’s price action was but another interesting takeaway is how extreme recent positive and negative moves have become – underscoring just how volatile the forex pair is right now.

Rate of Change (RoC) Indicator (EUR/USD)

Source: TradingView, prepared by Richard Snow

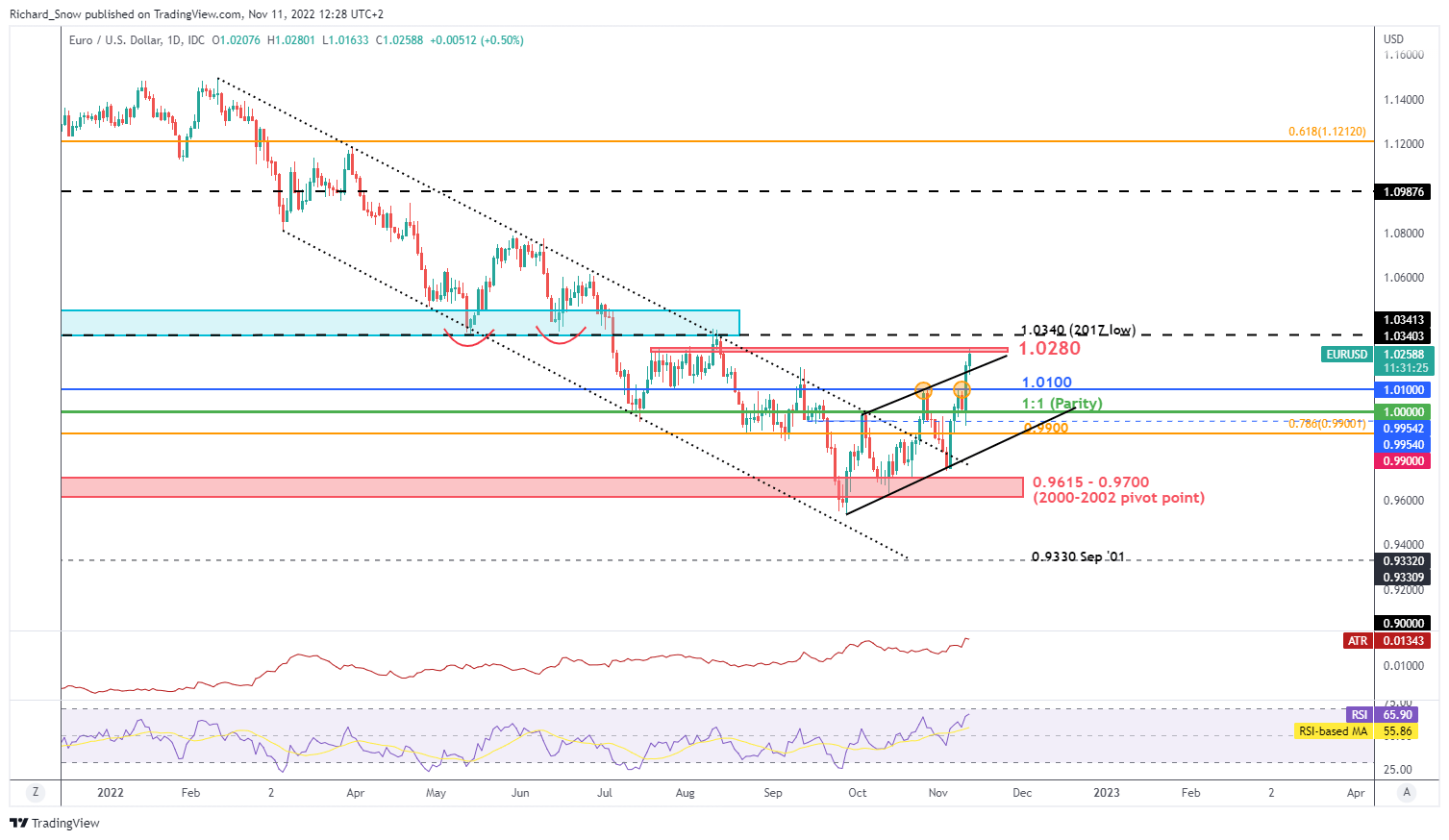

EUR/USD Price Action

The EUR/USD forex pair broke above the ascending channel and now contends with a prior level of resistance around the 1.0280 level. This is after soaring past the 1.0100 level of resistance that had proven too stern a challenge in recent weeks. Its not unusual to see a pullback after such an advance but price action shows a continuation in the bullish momentum which highlights 1.0340 as the next level of resistance.

In the event 1.0280 proves too much of a challenge, a pullback towards the upper side of the channel or even back to that crucial 1.01000 level.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

Building Confidence in Trading

ECB Members Talk Tough on Rate Hikes in Contrast to the Fed

At a time when various Fed members are referring to the appropriateness of slowing the pace of future rate hikes, ECB members continue to talk tough on inflation which may see the relative interest rate differential between the two diverge. Schnabel mentioned the need to raise rates into restrictive territory while Vasle communicated that inflation is more and more broad based.

The ECB and the Fed now appear likely to hike by a slower 50 basis points in December. The November CPI print is due hours before the December Fed meeting and so another potential drop in inflation could see further downward revisions in the dollar into year end.

Signs of Hope Emerging in Europe?

With natural gas storage well above target (95.3% as of 9 Nov) in Europe and no obvious signs of a colder than normal winter, European fundamentals appear a little more optimistic – although inflation is still terribly high.

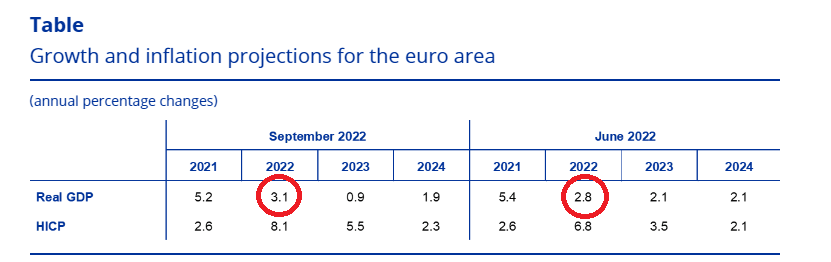

The ECB has also raised its staff projections for GDP inline with the IMF’s figure for 2022 to 3.1%, up from 2.9% in its June projection. The balancing act of avoiding a recession while tightening financial conditions remains a major challenge – shown by the massive drop off in GDP for 2023. Disappointing PMI data confirmed a contraction in services as well as the manufacturing sectors and consumer sentiment remains extremely low. Positive signs for the region appear few and far between.

Source, ECB

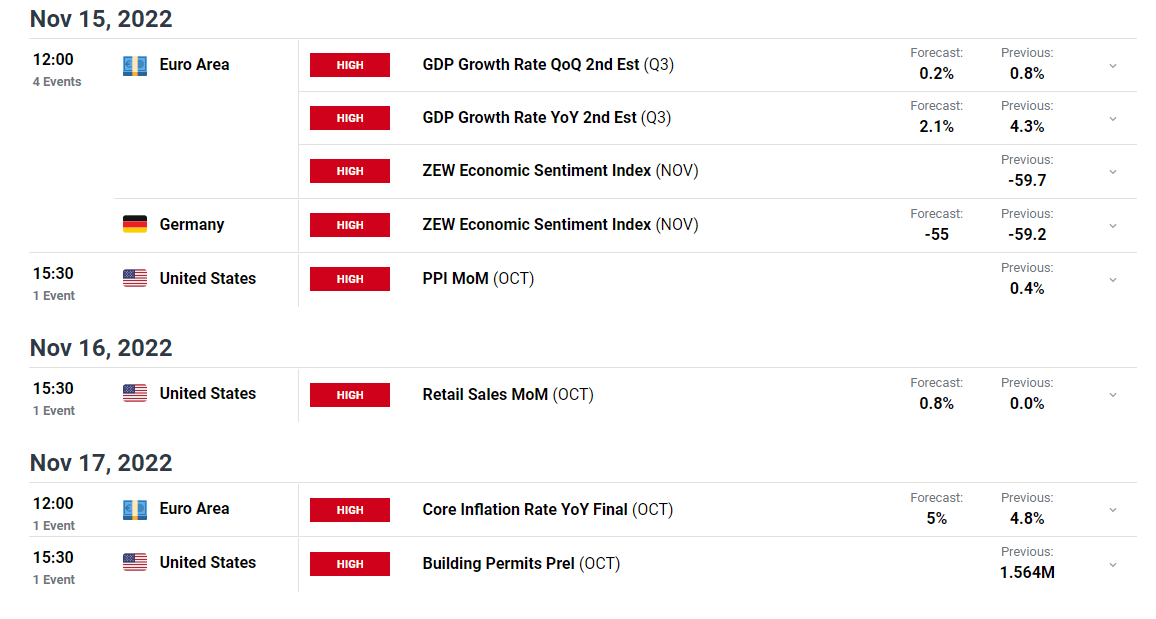

Major Risk Events Ahead

Customize and filter live economic data via our DaliyFX economic calendar

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

[ad_2]

Source link