[ad_1]

Euro (EUR/USD) Analysis

- ECB Governing Council explicitly addresses the possibility of a rate cut

- Robust US data likely to keep the Fed on hold for longer

- EUR/USD plummets – on track for largest drop in 18 months

- Enhance your trading edge by getting your hands on the Euro Q2 outlook today for exclusive insights into key market catalysts that should be on every trader’s radar:

Recommended by Richard Snow

Get Your Free EUR Forecast

ECB Governing Council Explicitly Addresses the Possibility of a Rate Cut

While the ECB stated that there will be no pre-commitment regarding the timing of the first interest rate cut, there was a sign that interest rate cuts could materialise soon. The ECB statement read as follows, ‘if the Governing Council’s updated assessment of the inflation outlook, the dynamics of underlying inflation and the strength of monetary policy transmission were to further increase its confidence that inflation is converging to the target in a sustained manner, it would be appropriate to reduce the current level of monetary policy restriction”.

In addition, multiple ECB members have stated a preference for June with the latest statement providing some form of insurance against what looks like a miniscule chance of a reacceleration in prices. The ECB has been holding onto relatively hot wage growth data as justification of keeping interest rates so high for so long. Overall, stagnant economic growth and encouraging inflation data has brought the prospect of rate cuts closer, while the opposite can be said for the Fed.

Robust US Data Likely to Keep the Fed on Hold for Longer

The Atlanta Fed’s GDPNow forecast sees US GDP for the first quarter coming in at 2.4%, a notable way off the 4.9% figure in Q3 2023 and 3.4% in Q4 but it continues to show a resilience throughout the world’s largest economy.

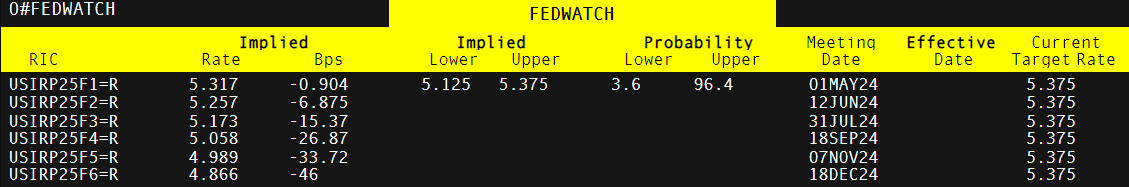

Additionally, the March NFP data posted a massive surprise with 303k jobs being added versus estimates of just 200k, proving that the labour market is not just robust but strong. US CPI earlier this week beat estimates across the board as inflationary pressures appear to be making a comeback. Markets trimmed expectations of Fed rate cuts this year to just under two – a massive change from six, even seven cuts initially anticipated at the end of 2023. US yields and the dollar have shot up at a time when the euro is likely to come under pressure as the ECB prepares to step in and lower interest rates.

Market-Implied Basis Point Cuts Derived from Fed Funds Futures

Source: Refinitiv prepared by Richard Snow

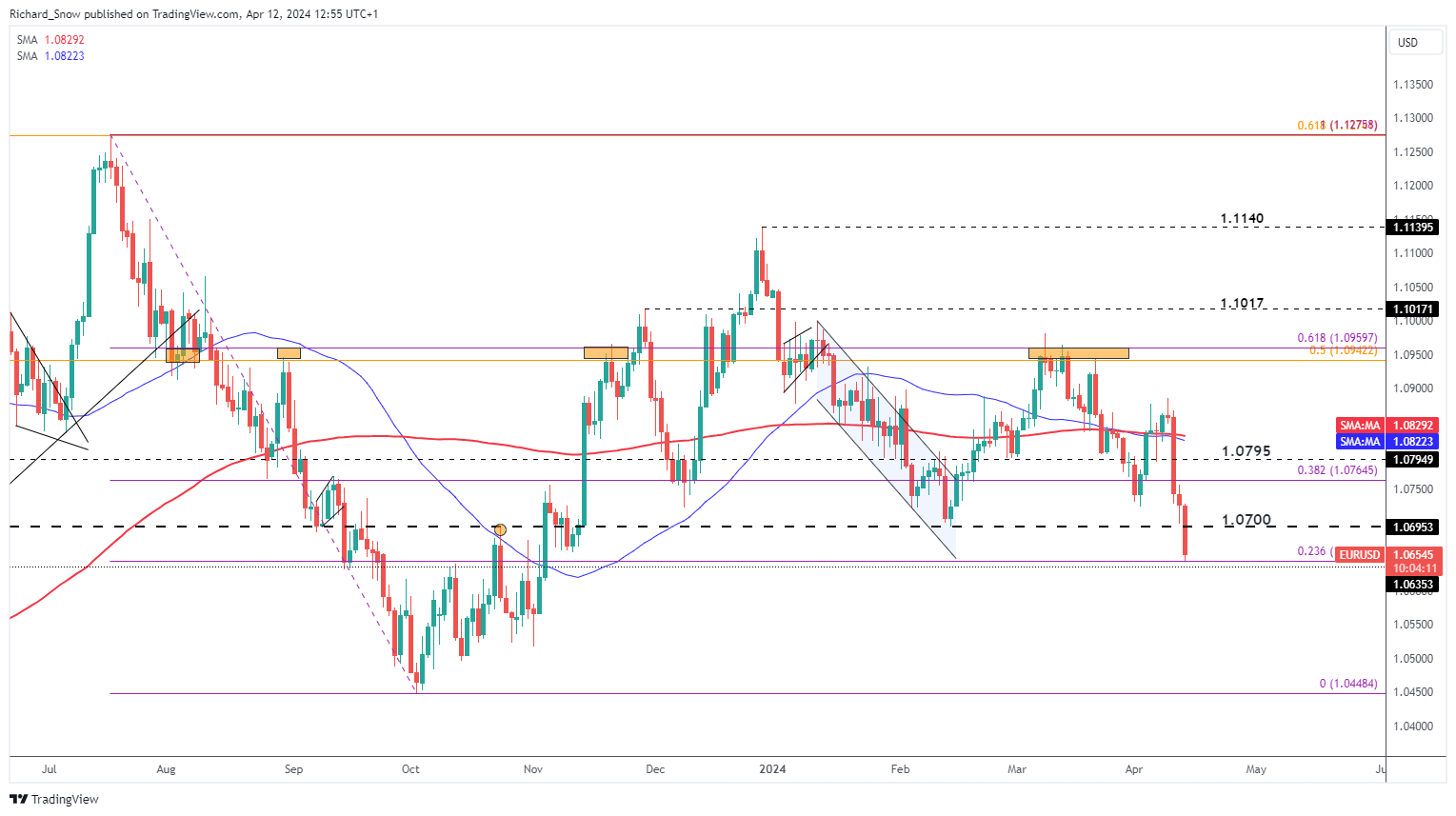

EUR/USD Plummets, On Track for its Largest Weekly Drop in 18 Months

EUR/USD dropped massively on Wednesday when US CPI data confirmed hotter, more stubborn inflation pressures. The shorter-term measures of inflation like the month-on-month comparisons revealed what appears to be hotter price pressures with added momentum.

As such, the pair continues to plummet, gaining acceleration on Friday as the pair traded through 1.0700 with ease, now testing the 28.6% retracement of the 2023 decline at 1.0644. At this rate, there doesn’t appear to be much that could hold up the recent decline but the 1.0644 provides an imminent test before eying a potential full retracement of that broader 2023 decline.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

Looking for actionable trading ideas? Download our top trading opportunities guide packed with insightful tips for the second quarter!

Recommended by Richard Snow

Get Your Free Top Trading Opportunities Forecast

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]

Source link