[ad_1]

EUR/USD News and Analysis

- ECB’s bank supervisor Enria notes Deutsche Bank concern as enhanced supervision continues where required.

- EUR/USD to be guided by rate differentials in a week of little high importance economic data.

- Event risk: EU and German Inflation data.

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

How to Trade EUR/USD

ECB’s Top Supervisor Andrea Enria Backs EU Banks, Notes Deutsche Bank Concern

The Chair of the European Central Bank’s (ECB) Supervisory Board, Andrea Enria has weighed in with further updates on the EU banking system, supporting the need for, “strong, demanding supervision”, which he says is needed now more than ever. In addition, Enria emphasized the importance of, “a structured escalation of our supervisory interventions where banks’ progress is lagging”.

He went on to provide further updates relating to Credit Suisse, saying that direct exposure to the beleaguered lender is relevant but manageable. When asked about the fall in share price of Deutsche Bank, Mr. Enria replied that, “disquiet among investors is a concern”. Shares of the German bank have largely clawed back some gains yesterday but trade lower once again today as investors attempt to gauge if there is any clear signs of distress for the rather profitable bank.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

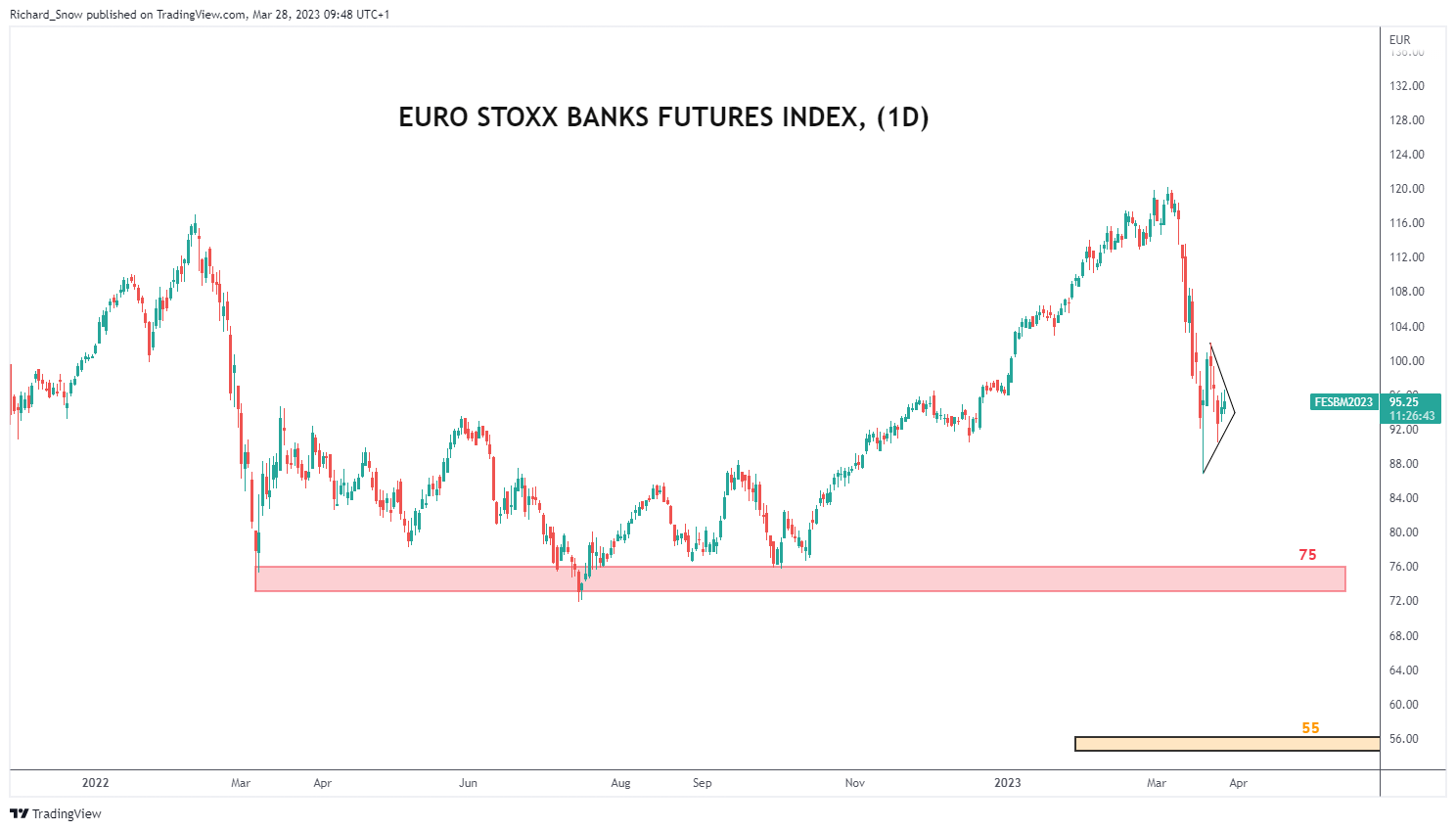

EU Banks Halt the Decline

EU banking stocks were up in general, although the move has not exactly filled anyone with confidence that the worst is behind us. In fact, looking at the technical landscape of the chart below, the emergence of what appears to be a bearish pennant, looks ominous and opens the door to a continued sharp move lower if the pattern plays out.

EU Stoxx Banks Futures Index

Source: TradingView, prepared by Richard Snow

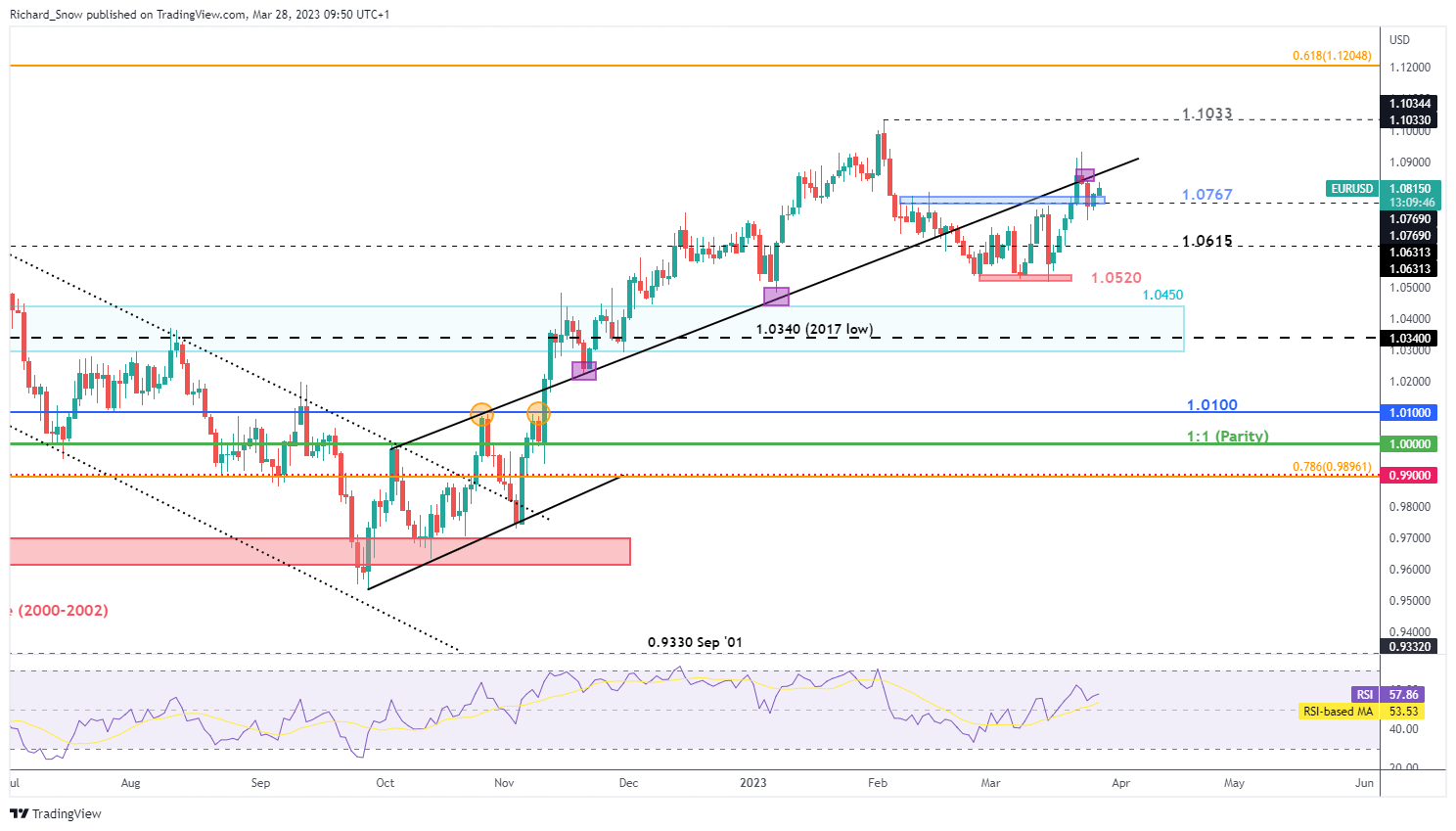

EUR/USD Technical Analysis: Trendline in Focus, Now as Resistance

EUR/USD has put in a rather solid performance on the back of a general dollar decline, as markets anticipate a potential Fed pause and the start of US rate cuts in the second half of the year.

In the absence of high importance economic data this week, markets may be led by underlying sentiment (which favors the Euro) as a sense of calm prevailed on Monday which saw the S&P 500 recover and move closer to the 4000 mark while gold (with its safe haven appeal) saw some weakness.

After breaching the long-term trendline to the upside, EUR/USD fell back beneath it, finding support around 1.0770 before posting another charge at the significant trendline resistance. Prior pivots have been marked in purple, where price action respected the trendline. Therefore, another approach could see the pair trade towards 1.0860. Longer-term resistance appears at the yearly high of 1.1033, a move that could be supported by a divergence in US-EU rates as US cuts become priced in and ECB hikes remain on the cards. Support remains at 1.0767 followed by 1.0615.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

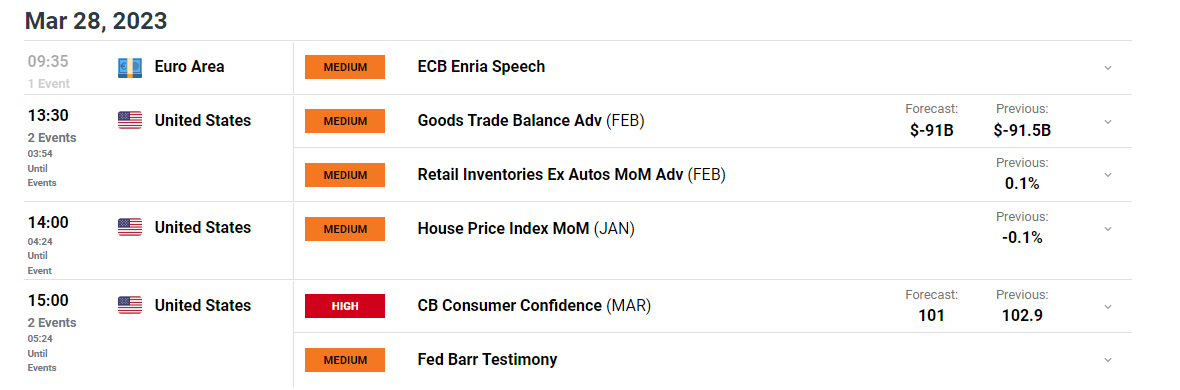

Main Risk Events Today

This week presents a significant downshift in tier 1 economic data but the unfolding situation around the European and US banking industries, as well as commentary from their respective regulatory bodies, is still likely to provide pockets of volatility. This morning we heard from the European Central Bank’s Andrea Enria which will be followed later this afternoon by the Fed’s Michael Barr, the Federal Reserve Vice Chair for Supervision as he provides updates.

At the same time (15:00 UK time), US consumer confidence data is to be released to get an idea of how the recent goings on is being perceived from a consumer level. Consumer confidence affects economic activity and is therefore necessary to keep a close eye on.

Customize and filter live economic data via our DailyFX economic calendar

Introduction to Technical Analysis

Technical Analysis Chart Patterns

Recommended by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]

Source link

.jpg)