[ad_1]

EUR/USD Technical Highlights:

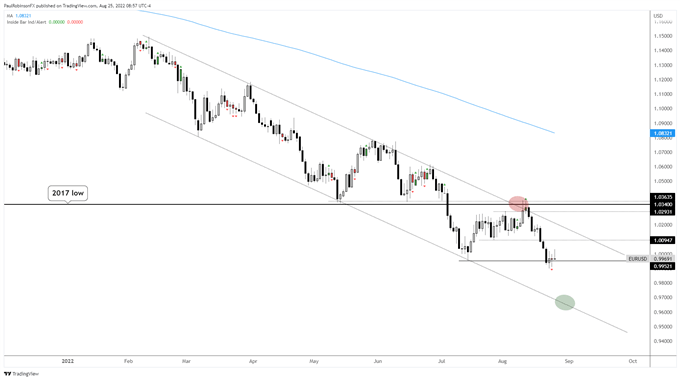

- EUR/USD came back to parity as anticipated and now looks ready to go much lower

- Dollar strength expected into the fall as risk markets head south

- EUR/USD at some point down the line seen as going towards 80c

Towards the middle of the month we looked at EUR/USD as it sat near resistance in the 10300s, and the anticipation was that we would at least come back to the parity, July low levels to test it before a possible bounce could occur.

We’ve gotten the down move, but thus far the euro is failing to garner much sponsorship in the 99s. The weak price action around the low suggests that more selling lies ahead. How much more in the near-term is hard to say.

It may be a marginal leg lower or it could be a big one. The thinking is, however, that the 2000 all-time low in the euro at 8231 will come into play at some point. This could take a little time, though, as it is a good distance lower.

With the summer rally in stocks looking like it’s over, and within the context of what I believe to be an extended bear market cycle in equities that started at the beginning of the year, a big dollar move could happen this fall.

This may or may not be enough to get the euro to the 2000 low, but it should be enough that the downside will be rather aggressive. This outlook favors selling rallies and congestion patterns that lead to breakdowns.

In the near-term the underside trend-line of the channel dating to the beginning of the year could act as support – it currently lies near 9600. If that underside trend-line breaks we could see a large amount of acceleration as an orderly decline turns disorderly.

Even if EUR/USD bounces from here, within the context of a strong downtrend, a rally is seen as likely to quickly fizzle out. It will take a strong move out of the downward channel and above the recent high at 10368 to shift the bias, and even then we would need to see any subsequent pullback show signs of wanting to hold.

EUR/USD Daily Chart

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

—Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX

[ad_2]

Source link