[ad_1]

Euro, EUR/USD, US Dollar, ECB, Fed, RBNZ, NZD/USD – Talking Points

- Euro has been lifted by diverging language from ECB and Fed speakers

- APAC equities steadied after a mixed day in the US cash session

- ECB members responses could provide directional clues for EUR/USD

The Euro mostly held onto recent gains as markets digested ECB President Christine Lagarde’s hawkish commentary at a time when the Fed ponders its path.

Atlanta Federal Reserve President Raphael Bostic laid out the conditions for the Fed to pause their rate hike cycle in September.

He re-iterated Fed Chair Powell’s comments that there would need to be clear evidence that inflation is slowing. He also said that a cooling in growth could be factor as it too could lower price pressures.

As a result, Treasury yields went lower across the curve with the benchmark 10-year note yielding around 2.77%, down 10 basis points from yesterday. This helped to undermine the US Dollar.

While the Fed appeared to be back pedalling, the RBNZ hiked by 50 basis-points and NZD/USD rocketed higher. The monetary policy statement and the ensuing press conference from RBNZ Governor Adrian Orr made it clear that many more rate rises are coming.

Energy commodities have climber higher again, with WTI crude oil near US$ 111.00 bbl and the Brent contract approaching US$ 115.00 bbl. Gold is steady at US$ 1,863 an ounce.

The Nasdaq got smoked in the cash session, down 2.35%, but the S&P 500 and the Dow Jones held up ok. Wall Street futures are indicating a positive to start to their day. APAC equities are all flat to slightly up for the day.

Ahead, there are several ECB speakers that will be crossing the wires and their remarks will watched closely for reaction to President Lagarde’s comments. Germany’s GDP data will be followed by numbers on US MBA mortgage applications and durable goods orders.

The full economic calendar can be viewed here.

EUR/USD Technical Analysis

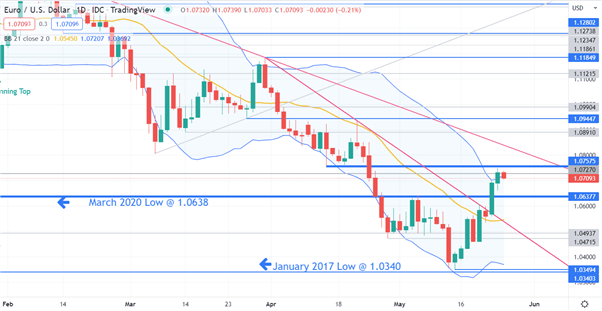

After failing to break below the January 2017 low of 1.0340, EUR/USD has staged a rally that has broken back above a descending trend line.

This move has seen the price set up a potential island reversal. While it has so far made a moved above a break point at 1.0638, a clean break above 1.0758 is needed to confirm the potential of the reversal.

Conversely, the price yesterday’s close was outside the upper band of 21-day simple moving average (SMA) basedBollinger Band. A close back inside that band might see a short-term reversal lower.

Support could be at 1.0638 or the previous lows of 1.0349 and 1.0340. On the topside, resistance might be 1.0758 and a descending trendline, currently intersecting at 1.0840.

— Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter

[ad_2]

Source link