[ad_1]

ECB Economic Bulletin: Main Talking Points

- Mixed to lower global GDP growth anticipated (Lower China activity, Russia/Ukraine effects and US slowdown)

- Inflation is intolerable and rate hikes will continue from the ECB in response

- Markets anticipate 50 bps in December and today’s US CPI print likely to influence short-term EUR/USD price action which hovers around parity

Recommended by Richard Snow

Get Your Free EUR Forecast

Mixed to Lower Global GDP Growth Anticipated

Despite an easing in supply chains shortages, the global economy is expected to deteriorate as a whole and is expected to continue in the near-term. A decline in activity in China as a result of its zero-COVID policy, the negative effects of Russia’s invasion of Ukraine and a modest contraction in the US has hampered global GDP (excluding the euro area).

Inflationary Pressures Remain Too High

OECD measures of inflation (excluding Turkey) showed a relatively stable 7.9% in August but core inflation (excluding volatile price items like food and energy) increased to 5.3% and remains elevated in contrast with headline measures which are declining as energy prices have eased. While lower energy prices are welcomed, it also points to a rather grim economic outlook as lower economic activity leads to lower demand for energy commodities and lower output gong forward. High inflation continues to dampen spending and production by reducing purchasing power and pushing up costs for firms

Financial Market Developments

Over the review period, euro assets remained volatile as market participants revised expectations of higher policy rates as evidenced by higher sovereign bind yields in the euro area. Since then yields have declined somewhat, as the economic risks of aggressive tightening begin to stack up and systemic risk arising from the UK have been largely isolated after reactive measures from the Bank of England and UK government policy reversals.

Recommended by Richard Snow

How to Trade EUR/USD

EUR/USD Technical Analysis

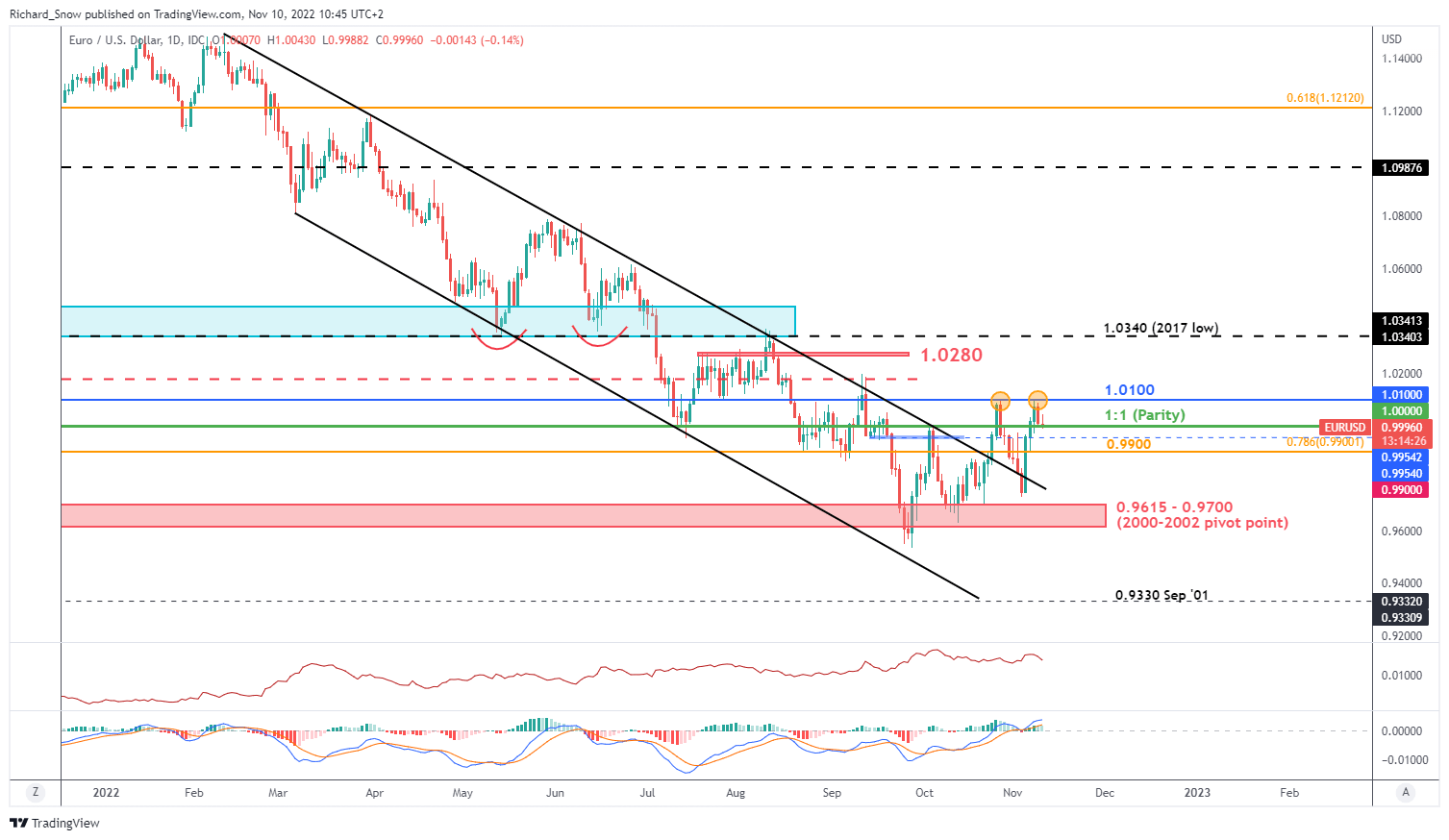

The daily chart shows EUR/USD struggling to break above parity with continued momentum, reversing at 1.1000 twice now. Today’s US CPI print is likely to influence EUR/USD direction in the event of a positive of negative surprise. A print in line with expectation is likely to leave the pair largely unchanged.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

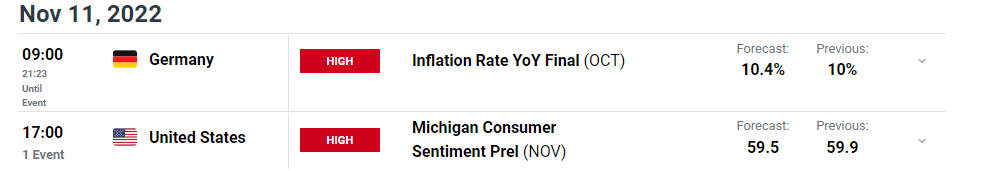

Markets are currently pricing in 56 basis points for the December ECB meeting. On the economic calendar this week we have the crucial US CPI report for October which has proven in the past to be a significant driver for the EUR/USD forex pair, particularly now after we have seen another test of parity after multiple rejections. Higher than expected inflation is likely to drive the pair lower while an undershoot could support the recent dollar decline as markets factor in the possibility of slower US rate hikes.

Customize and filter live economic data via our DaliyFX economic calendar

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]

Source link