[ad_1]

EUR/USD and EUR/GBP Forecasts – Prices, Charts, and Analysis

Learn How to Trade the Euro versus the US Dollar

Recommended by Nick Cawley

How to Trade EUR/USD

Most Read – Euro Price Latest: EUR/USD Struggles Against a Robust US Dollar

The Euro is holding tis own against a strong US dollar, aided by higher Euro Zone bond yields, while the single currency is pushing higher against the British Pound as the latest BoE policy decision nears.

The Federal Reserve left interest rates untouched last night but chair Powell’s subsequent press conference suggested a hawkish hold by the US central bank with the possibility of one more, data-dependent, rate hike. While this was not unexpected – all central banks leave themselves a large degree of flexibility – the market reacted by pushing US bond yields to fresh multi-year peaks, driving the greenback higher.

Fed Pauses but Says Another Hike is Possible, Gold and US Dollar Go Separate Ways

Global bond yields continue to move higher with Euro Zone yields hitting multi-week and multi-month highs, while in the US, bond yields are touching levels last seen back in 2006 and 2007. Bond yields are volatile at the moment and currency pairs are being moved not just by market sentiment but also by widening/tightening of rate differentials.

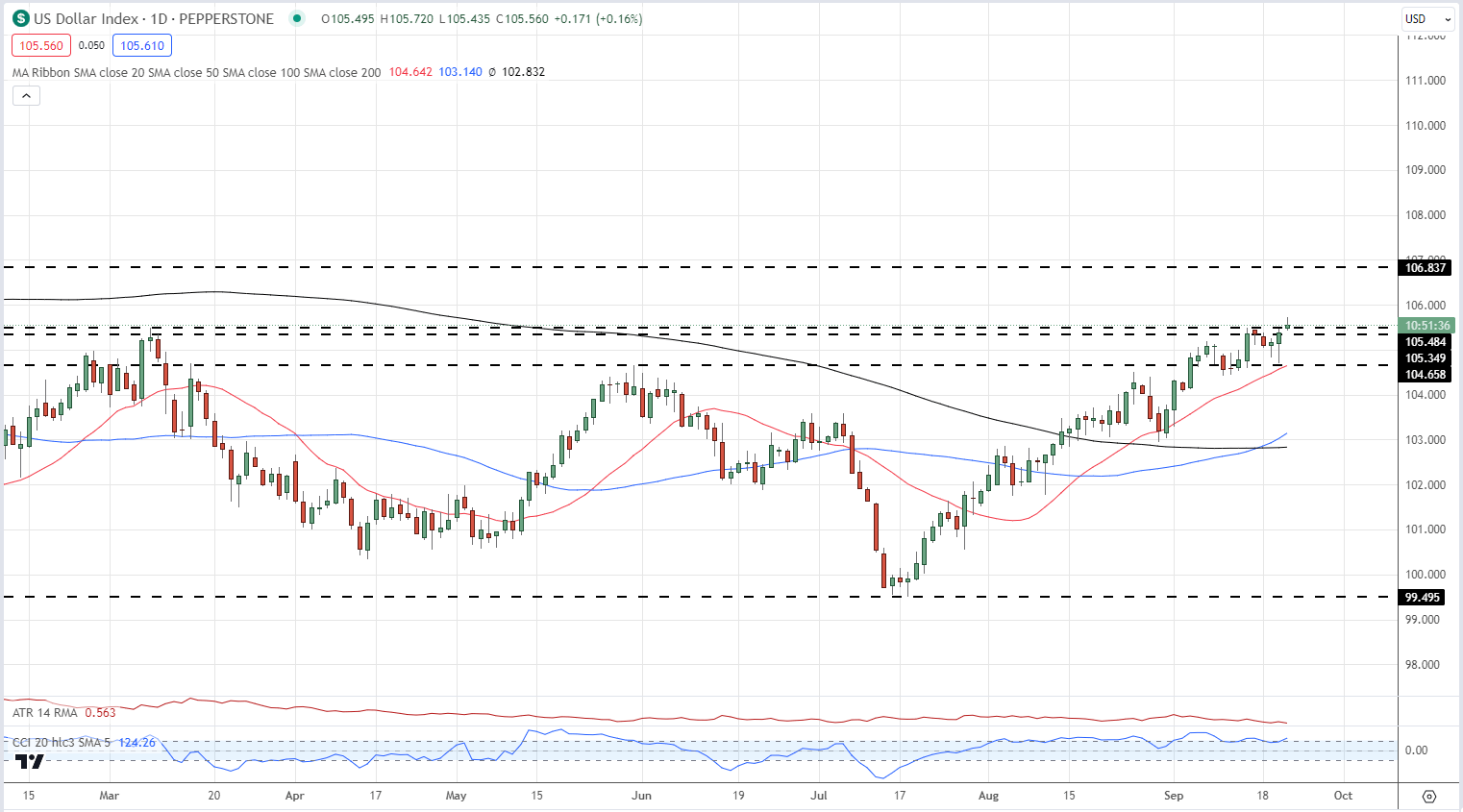

The US dollar remains firm and is trying to make a confirmed break above a recent area of resistance. While further upside is likely, the US dollar may start to struggle in the coming weeks unless economic data lends a helping hand.

US Dollar Index Daily Chart

Recommended by Nick Cawley

Get Your Free USD Forecast

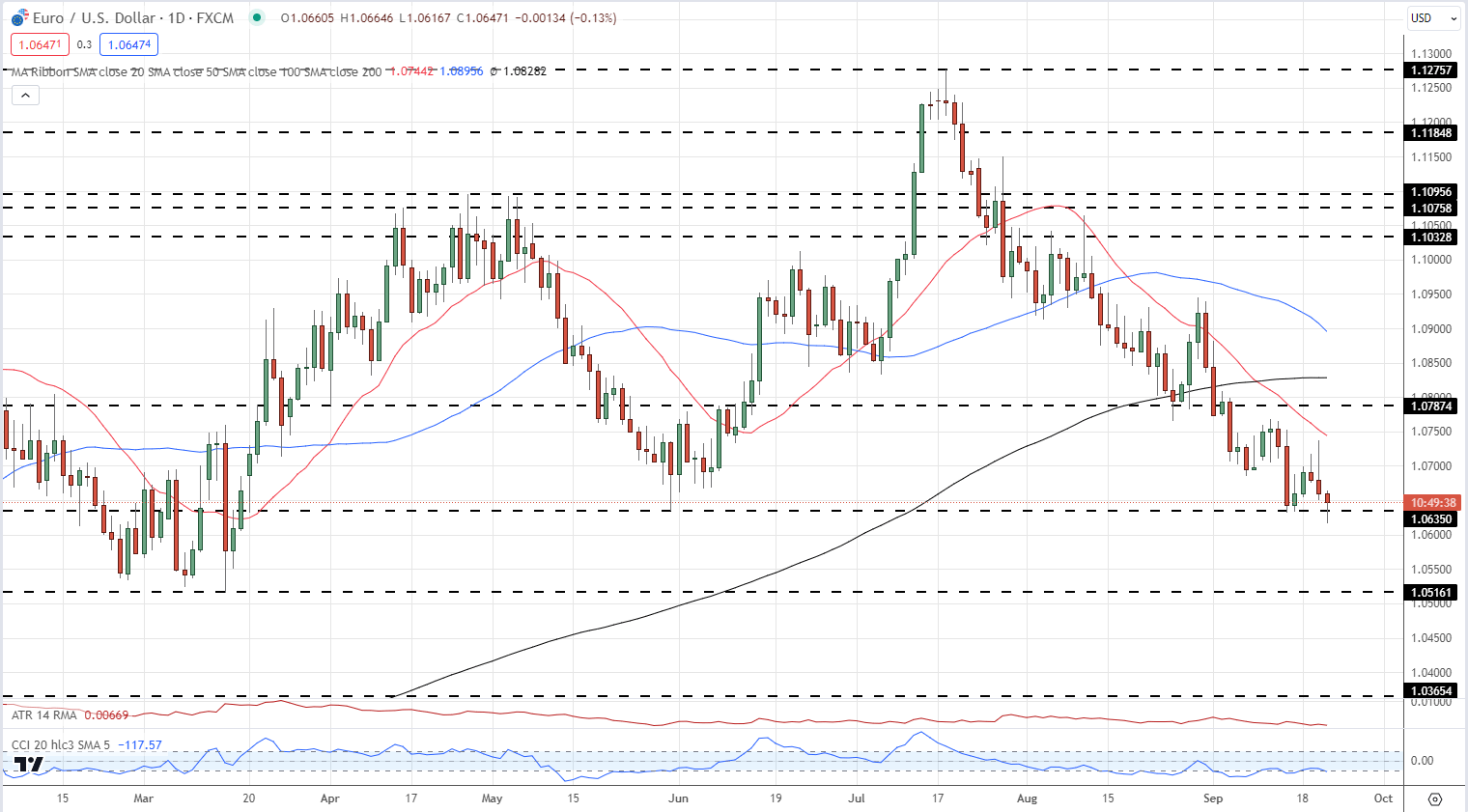

EUR/USD is probing a prior swing-low at 1.0635 made in late May and a confirmed break here would open the way to 1.0516. The chart looks negative but currently oversold, according to the CCI indicator, and this may temper any further move lower in the short term.

EUR/USD Daily Price Chart

Download the latest EUR/USD IG Sentiment Report

| Change in | Longs | Shorts | OI |

| Daily | -3% | -17% | -8% |

| Weekly | 3% | -11% | -2% |

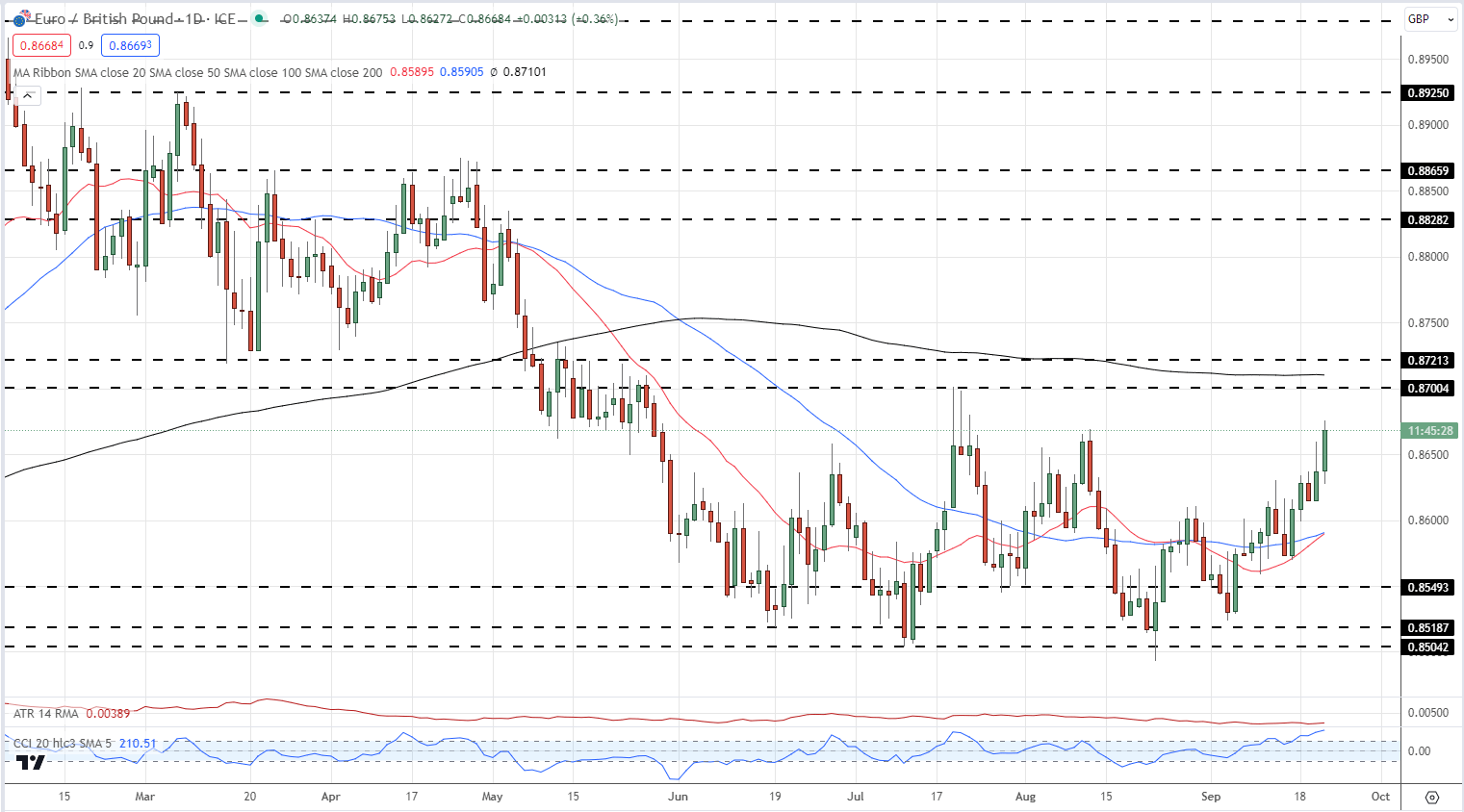

EUR/GBP is a different story with the single currency outperforming the British Pound. The pair traded as low as 0.8493 on August 23rd before turning higher. Sterling is currently weakening ahead of the latest Bank of England rate decision with a further 25 basis point hike now seen as a 50/50 call. Overhead resistance at 0.8700 may be tested in the short term. The CCI indicator is showing the pair as heavily overbought.

Bank of England Preview: GBP Hangs on by a Thread

EUR/GBP Daily Price Chart

Charts via TradingView

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]

Source link