[ad_1]

EUR/USD Forecast – Prices, Charts, and Analysis

Learn how to trade EUR/USD with our complimentary guide:

Recommended by Nick Cawley

How to Trade EUR/USD

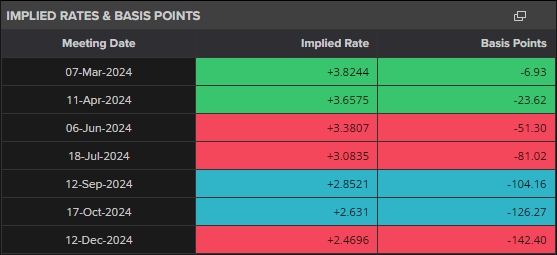

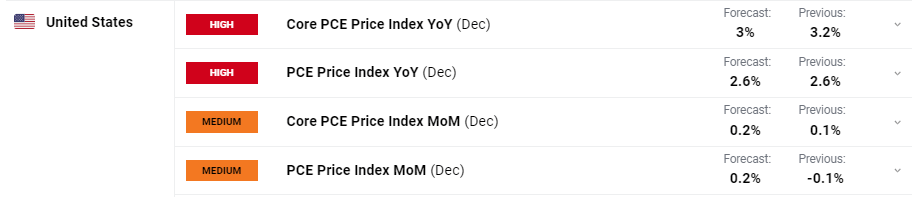

The Euro weakened after Thursday’s ECB press conference despite President Lagarde giving little away. The central bank left all policy levers untouched yesterday, repeated that any change in monetary policy is data dependent, and gave no hint of any timetable for future action. The markets however are now the ECB to cut rates earlier, and by more, with weak Euro Area growth and falling inflation the drivers behind the move. Both before and straight after the central bank meeting, the market was forecasting 125 basis points of cuts in the Euro Area this year with the first move seen at the end of H1. The market is now looking for more than 142 basis points of cuts with a 76% probability of the first cut being announced in April.

ECB Implied Rates and Basis Points

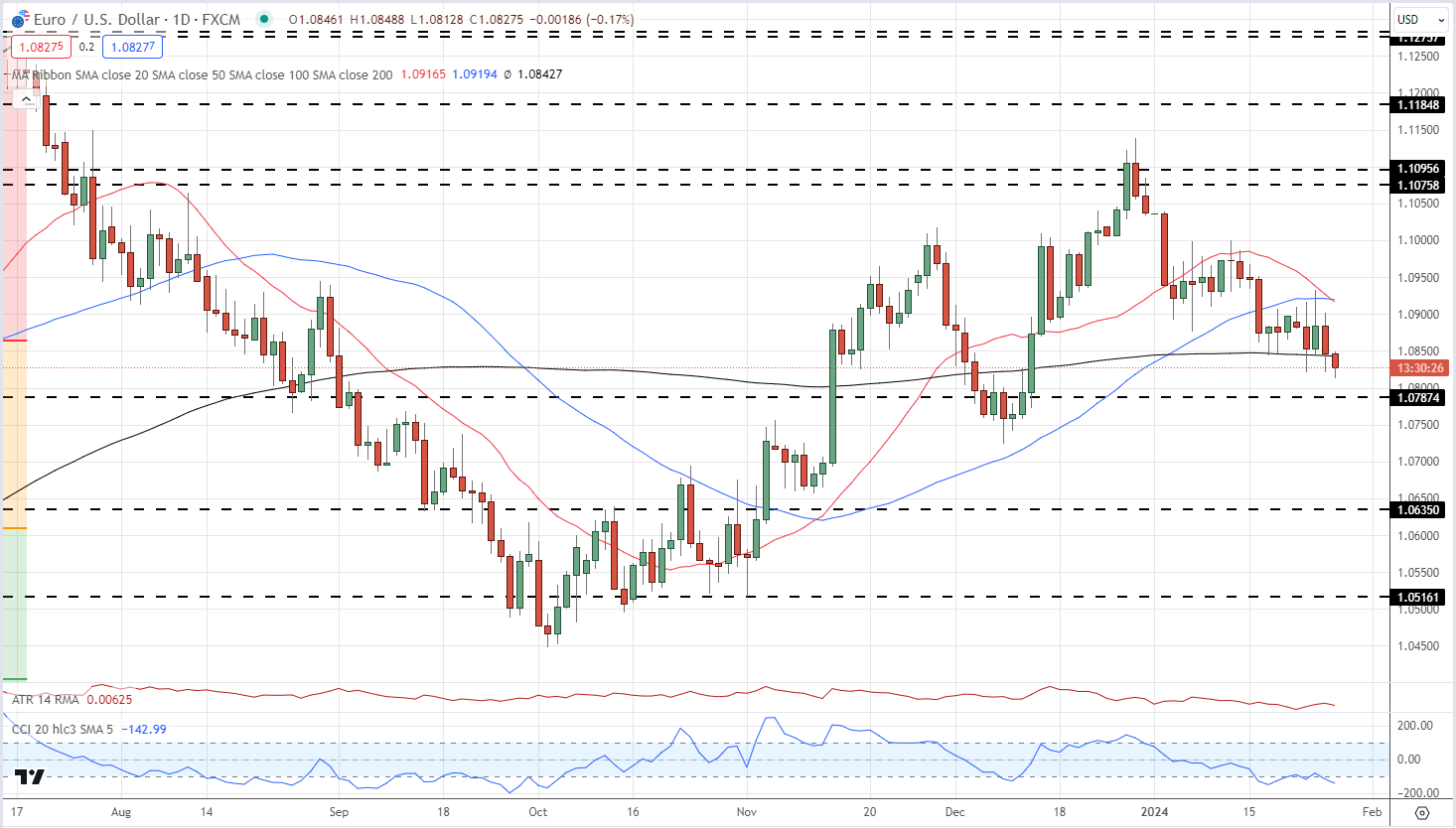

The latest bout of Euro weakness has seen EUR/USD slip to a fresh multi-week low and continue a short-term series of lower highs and lower lows. The 200-day simple moving average is also being tested a close and open below this indicator will likely see EUR/USD slip below 1.0800 and head towards a cluster of prior lows on either side of 1.0750. Later today see the release of the latest US Core PCE data. This is the Federal Reserve’s preferred measure of inflation and any deviation from expectations will steer the US dollar, and EUR/USD, going into the weekend.

EUR/USD Daily Chart

| Change in | Longs | Shorts | OI |

| Daily | 19% | -18% | 0% |

| Weekly | 15% | -18% | -1% |

Charts Using TradingView

IG retail trader data show 58.93% of traders are net-long with the ratio of traders long to short at 1.43 to 1.The number of traders net long is 22.58% higher than yesterday and 17.36% higher than last week, while the number of traders net short is 15.04% lower than yesterday and 15.65% lower than last week.

To See What This Means for EUR/USD, Download the Full Retail Sentiment Report Below:

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]

Source link