[ad_1]

EUR/USD Rate Talking Points

EUR/USD appears to be stuck in a narrow range as it gives back the advance following the Federal Reserve interest rate decision, and the exchange rate may continue to consolidate over the coming days as a bear-flag formation takes shape.

Euro Forecast: EUR/USD Bear Flag Formation Takes Shape

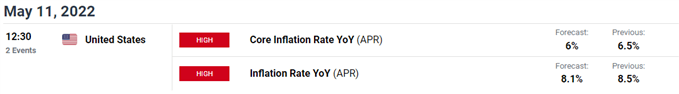

EUR/USD is little changed from the start of the week even as the Greenback benefits from the deterioration in risk appetite, but fresh data prints coming out of the US may produce headwind for the Dollar as the Consumer Price Index (CPI) is anticipated to show a slowdown in inflation.

The US CPI is expected to print at 8.1% in April after expanding 8.5% per annum the month prior, and evidence of easing price pressures may keep EUR/USD within a defined range as the data suggests the Federal Reserve’s effort to tame inflation are having the intended impact.

Nevertheless, the update may do little to deter the Federal Open Market Committee (FOMC) from normalizing monetary policy as New York Fed President John Williams, a permanent voting member on the FOMC, insists that the central bank will “move expeditiously in bringing the federal funds rate back to more normal levels this year,” with the official going onto say that the committee is on a “path of raising the target federal funds rate and reducing the balance sheet” while speaking at the NABE/Bundesbank International Economic Symposium.

The comments suggest the Fed is on a preset course as “there is a broad sense on the committee that additional 50 basis point increases should be on the table at the next couple of meetings,” and the diverging paths between the FOMC and European Central Bank (ECB) may limit the recent recovery in EUR/USD as President Christine Lagarde and Co. prepare an exit strategy.

In turn, EUR/USD may face range bound conditions ahead of the next FOMC rate decision on June 15 as a bear flag formation takes shape, but a further recovery in the exchange rate may continue to alleviate the tilt in retail sentiment like the behavior seen during the previous year.

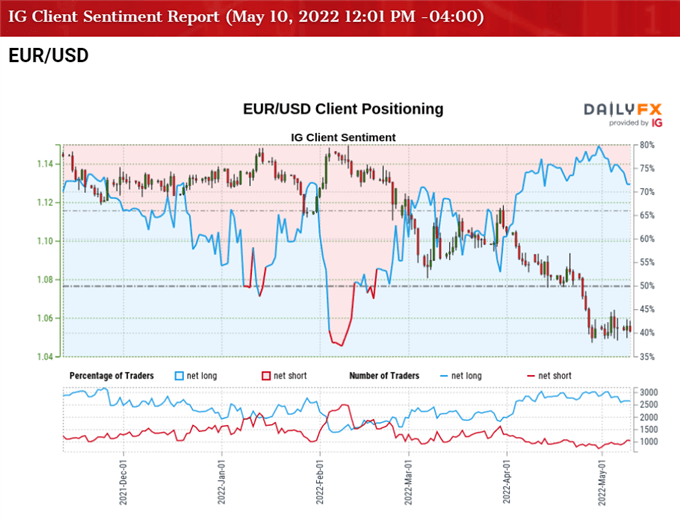

The IG Client Sentiment report shows 72.27% of traders are currently net-long EUR/USD, with the ratio of traders long to short standing at 2.61 to 1.

The number of traders net-long is 0.97% higher than yesterday and 6.43% lower from last week, while the number of traders net-short is 0.19% higher than yesterday and 3.06% higher from last week. The decline in net-long interest has helped to alleviate the crowding behavior as 76.01% of traders were net-long EUR/USD last week, while the rise in net-short position comes as the exchange rate gives back the advance following the FOMC meeting from earlier this month.

With that said, the update to the US CPI may keep EUR/USD within a defined range as inflation is expected to slowdown for the first time since August, but the consolidation may give way to a further decline in the exchange rate as a bear flag formation takes shape.

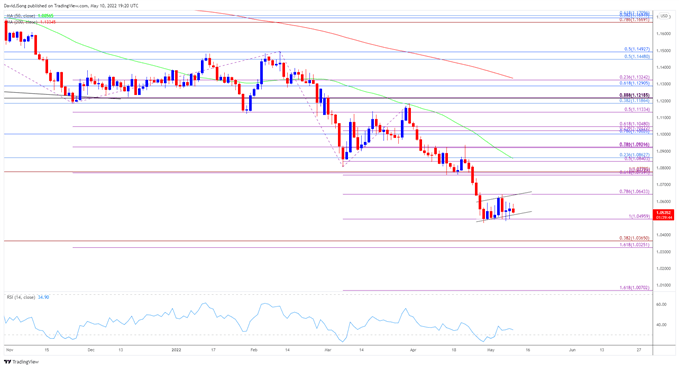

EUR/USD Rate Daily Chart

Source: Trading View

- The negative slope in both the 50-Day SMA (1.0856) and 200-Day SMA (1.1335) continues to cast a bearish outlook for EUR/USD, with the break of the 2020 low (1.0636) pushing the Relative Strength Index (RSI) into oversold territory as the exchange rate traded to a fresh yearly low (1.0471) in April.

- Nevertheless, a textbook buy signal materialized in the RSI as EUR/USD reversed ahead of the 2017 low (1.0340), but a bear flag formation has taken shape amid the lack of momentum to close above the 1.0640 (78.6% expansion) region.

- EUR/USD may trade within the continuation as it holds above the April low (1.0471), but a break/close below the 1.0500 (100% expansion) handle may push the exchange rate towards the Fibonacci overlap around 1.0330 (161.8% expansion) to 1.0370 (38.2% expansion), which lines up with the 2017 low (1.0340).

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

[ad_2]

Source link