[ad_1]

Euro Technical Price Outlook: EUR/USD Weekly Trade Levels

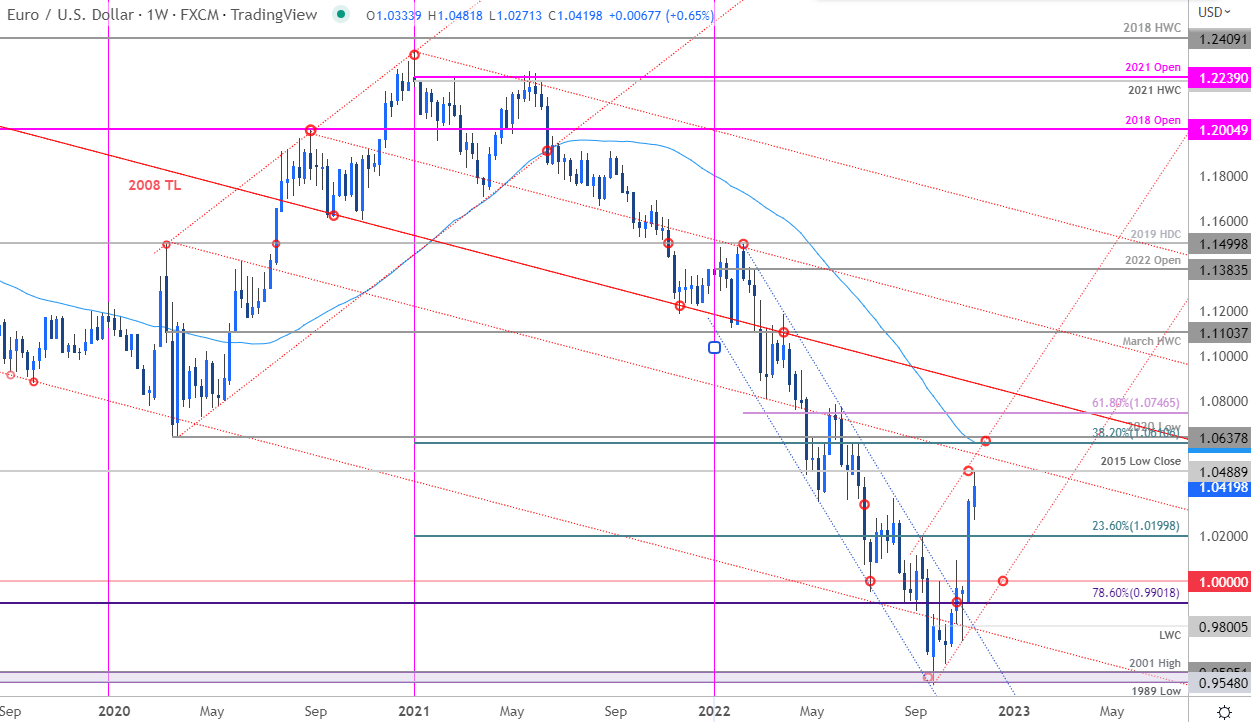

- Euro updated technical trade levels & sentiment – Weekly Chart

- EUR/USD breakout of yearly downtrend approaching initial resistance hurdles

- Weekly support 1.0200, 1.0000, 9901- Resistance 1.0489, 1.0610/38, 1.0746

Euro is attempting to rally for a fifth-consecutive week against the US Dollar with a breakout of the yearly downtrend taking EUR/USD to highest levels since June. While the medium-term outlook remains weighted to the topside, the immediate advance is now approaching initial resistance objectives and the threat for near-term exhaustion / price inflection rises on a stretch towards 1.06. These are the updated targets and invalidation levels that matter on the EUR/USD weekly price chart. Review my latest Weekly Strategy Webinar for an in-depth breakdown of this Euro technical setup and more.

Recommended by Michael Boutros

Download Our Latest Quarterly Euro Price Forecasts!

Euro Price Chart – EUR/USD Weekly

Chart Prepared by Michael Boutros, Technical Strategist; EUR/USD on Tradingview

Notes: In last month’s Euro Weekly Price Forecast I noted that EUR/USD was, “testing confluent resistance at the yearly downtrend- looking for a reaction here. From at trading standpoint, a good zone to reduce portions of long-exposure / raise protective stops – losses should be limited to 9700 IF price is heading higher on this stretch with a close above parity needed to clear the way for a larger recovery.” A topside breach of the yearly downtrend into the open of November fueled a breakout of more than 5.7% with Euro now threatening a larger trend reversal.

Initial weekly resistance eyed at the 2015 low- close at 1.0489 backed by a more significant technical confluence at 1.0610/38– a region defined by the 38.2% retracement of the 2021 decline, the 52-week moving average and the 2020 swing low. A breach / close above this threshold would be needed to suggest a more significant low was registered back in September with such a scenario exposing the 61.8% retracement of the 2022 yearly range at 1.0746.

Support rests at the 1.02-handle with bullish invalidation now raised to parity (1.0000). Ultimately, a close below the last week’s low / the 78.6% retracement at 9901 would be needed to mark resumption of the broader downtrend.

Starts in:

Live now:

Nov 21

( 13:11 GMT )

Live Weekly Strategy Webinars on Mondays at 13:30GMT

Short-term Trading Strategy Webinar

Bottom line: Euro has broken out of the 2022 downtrend with the advance now approaching initial resistance objectives. From a trading standpoint, a good zone to reduce portions of long-exposure / raise protective stops- losses should be limited to the September channel IF price is heading higher on this stretch with a breach / close above 1.0638 needed to fuel the next leg higher. I’ll publish an updated Euro Short-term Price Outlook once we get further clarity on the near-term EUR/USD technical trade levels.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

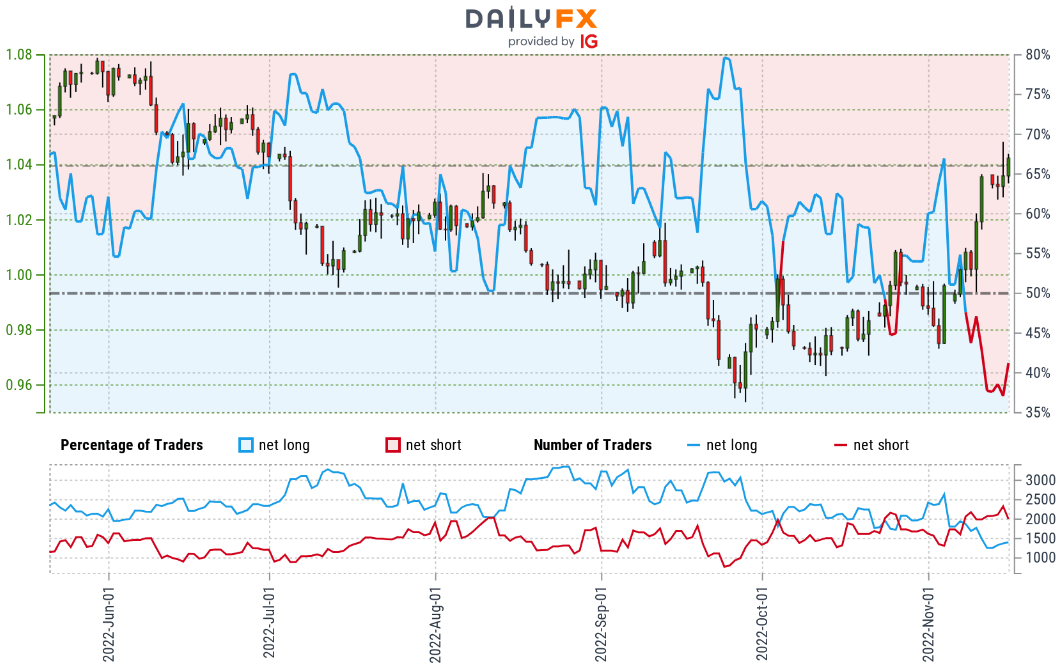

Euro Trader Sentiment – EUR/USD Price Chart

- A summary of IG Client Sentiment shows traders are net-short EUR/USD – the ratio stands at -1.42 (41.35% of traders are long) – typically a bullish reading

- Long positions are 2.41% higher than yesterday and 15.57% lower from last week

- Short positions are 4.92% lower than yesterday and 3.83% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise. Traders are less net-short than yesterday but more net-short from last week. The combination of current positioning and recent changes gives us a further mixed EUR/USD trading bias from a sentiment standpoint.

| Change in | Longs | Shorts | OI |

| Daily | 1% | 10% | 6% |

| Weekly | -18% | 9% | -4% |

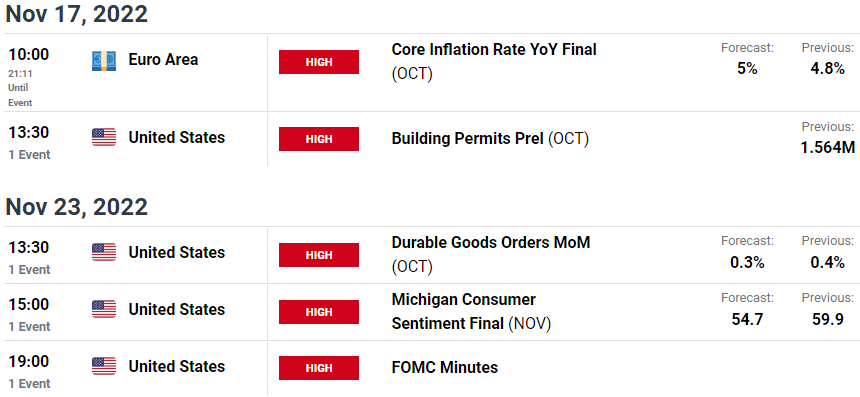

Eurozone / US Economic Calendar

Economic Calendar – latest economic developments and upcoming event risk.

Previous Weekly Technical Charts

— Written by Michael Boutros, Technical Strategist with DailyFX

Follow Michael on Twitter @MBForex

[ad_2]

Source link