[ad_1]

Euro Technical Price Outlook: EUR/USD Weekly Trade Levels

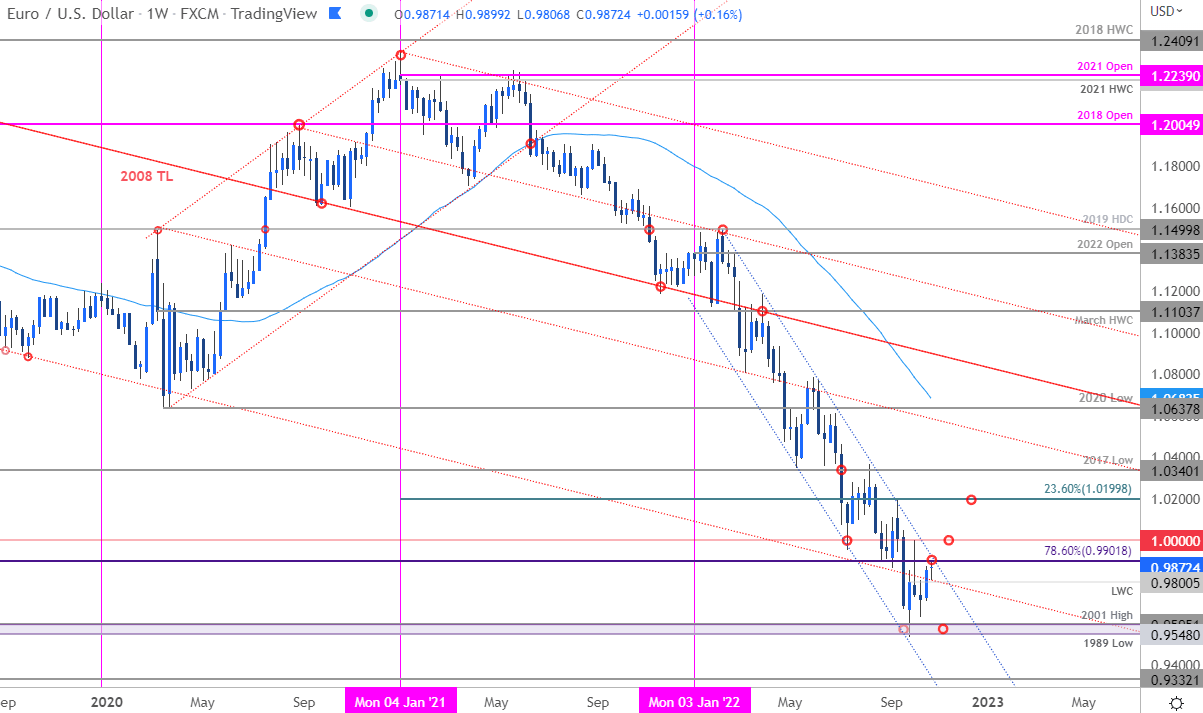

- Euro updated technical trade levels & sentiment – Weekly Chart

- EUR/USD rebound off key support approaching yearly downtrend- risk for price inflection

- Weekly support 9800, 9700, 9548/95 (key); Resistance 99, 1.0000 (key), 1.0200

Euro rallied more than 2.7% off the monthly low against the US Dollar with EUR/USD now approaching yearly downtrend resistance. The focus is on a reaction into this key zone in the days ahead with major Eurozone & US event risk on tap this week. These are the updated targets and invalidation levels that matter on the EUR/USD weekly price chart. Review my latest Weekly Strategy Webinar for an in-depth breakdown of this Euro technical setup and more.

Starts in:

Live now:

Oct 31

( 12:10 GMT )

Live Weekly Strategy Webinars on Mondays at 12:30GMT

Short-term Trading Strategy Webinar

Euro Price Chart – EUR/USD Weekly

Chart Prepared by Michael Boutros, Technical Strategist; EUR/USD on Tradingview

Notes: In last month’s Euro Weekly Price Forecast I noted that EUR/USD was, “testing confluent support at 9548/95 into the close of the month / quarter – respect the weekly close. From at trading standpoint, a good zone to reduce portions of short-exposure / lower protective stops – rallies should be limited by parity IF price is heading lower on this stretch with a close below needed to fuel the next leg of the downtrend.” Euro registered a low at 9535 that week before reversing sharply higher with EUR/USD rallying more than 4.8% for a test of Parity.

The October opening-range is preserved heading into the final week with Euro trading just below yearly channel resistance- looking for possible price inflection here into confluence resistance at the 99-handle with a breach / weekly close above parity still needed to suggest a more significant low was registered last month. Initial support rests with the yearly low-week close at 9800 with a break below last week’s low needed to fuel another run on 9548/95- weakness beyond this threshold would threaten resumption of the broader downtrend towards 9332.

Recommended by Michael Boutros

Download Our Latest Quarterly Euro Price Forecasts!

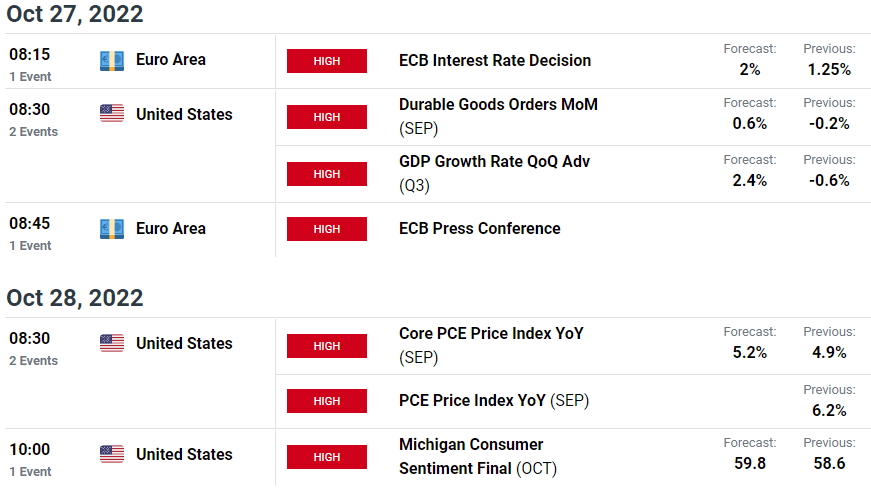

Bottom line: The Euro recovery is testing confluent resistance at the yearly downtrend- looking for a reaction here. From at trading standpoint, a good zone to reduce portions of long-exposure / raise protective stops – losses should be limited to 9700 IF price is heading higher on this stretch with a close above parity needed to clear the way for a larger recovery. Keep in mind the European Central Bank (ECB) interest rate decision and key US inflation data (Core PCE) is on tap this week- expect volatility and stay nimble here. I’ll publish an updated Euro Short-term Price Outlook once we get further clarity on the near-term EUR/USD technical trade levels.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

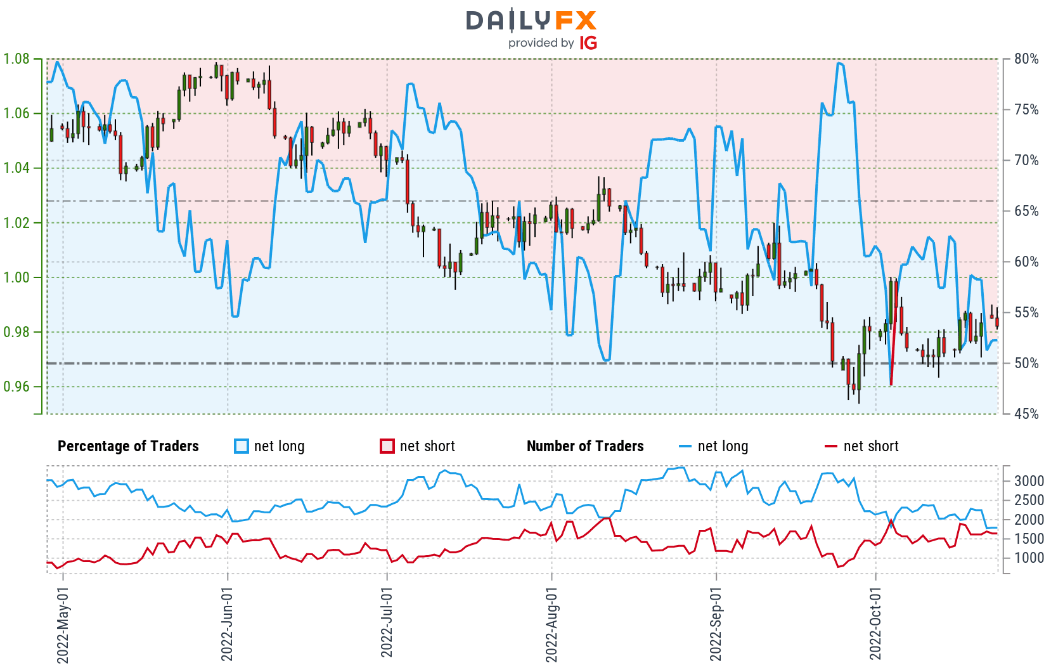

Euro Trader Sentiment – EUR/USD Price Chart

- A summary of IG Client Sentiment shows traders are net-long EUR/USD – the ratio stands at +1.12 (52.79% of traders are long) – typically a neu reading

- Long positions are 9.40% higher than yesterday and 10.71% lower from last week

- Short positions are 10.56% higher than yesterday and 13.78% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. From a sentiment standpoint, the recent changes in positioning warn that the current EUR/USD price trend may soon reverse higher despite the fact traders remain net-long.

| Change in | Longs | Shorts | OI |

| Daily | 9% | 21% | 15% |

| Weekly | -2% | 11% | 4% |

Eurozone / US Economic Calendar

Economic Calendar – latest economic developments and upcoming event risk.

Previous Weekly Technical Charts

— Written by Michael Boutros, Technical Strategist with DailyFX

Follow Michael on Twitter @MBForex

[ad_2]

Source link