[ad_1]

EURUSD – Talking Points

- EURUSD continues to push away from YTD low around 0.9535

- Symmetrical triangle brewing as month-end comes into focus

- Federal Reserve terminal rate tops 5% as rate hike bets increase

Recommended by Brendan Fagan

Get Your Free EUR Forecast

The EURUSD exchange rate has seen an injection of life in recent sessions, having bounced sharply off the post-CPI lows from October 13. Risk sentiment has also improved since the hot inflation data crossed the wires, as the US earnings season has kicked off strongly. The US Dollar Index has cooled slightly from YTD highs around 114.77 despite market pricing of the Fed’s terminal rate now surpassing 5%. A light week in terms of economic data and Fedspeak coming out of the US may also be giving EURUSD a lift.

While EURUSD has pushed almost 300 pips off the yearly lows, the downtrend remains firmly intact. This week’s gain has held within descending trendline, but also marks a higher low which is significant. Next week’s European Central Bank (ECB) meeting will be crucial for the EURUSD rate, with the ECB slated to hike by 75 basis points. Rampant inflation in the EU means that the ECB will need to remain hawkish in order to return inflation to target, which may offer continued support for the Euro. Should price break above this key trendline resistance that has lingered for all of 2022, market participants may begin to feel that the tide may be turning.

EURUSD Weekly Chart

Chart created with TradingView

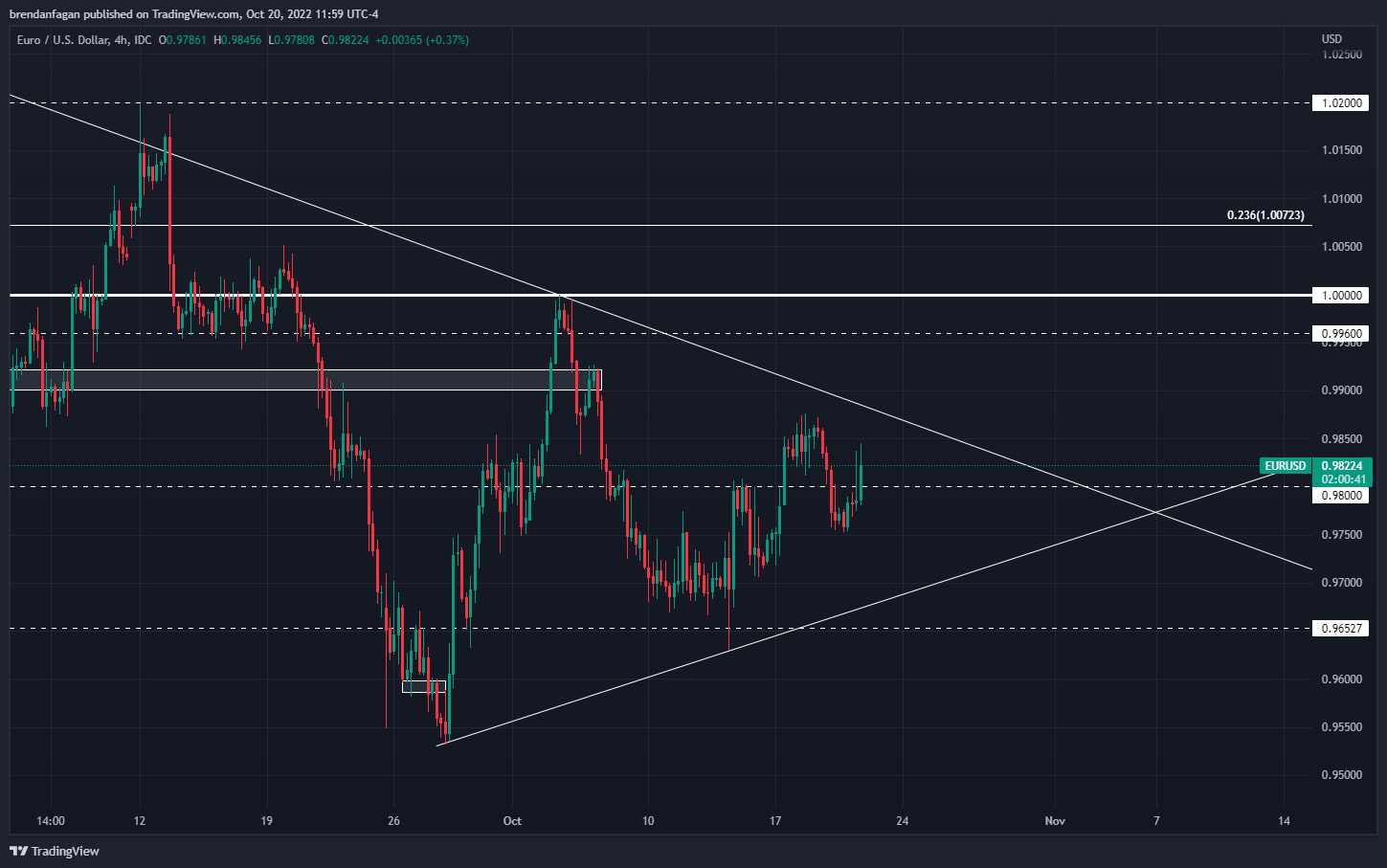

When we come down to a smaller timeframe, we can see there has been some serious chop in EURUSD. What catches my attention here is the lack of a “collapse,” given the presence of multiple key catalysts. Neither hawkish Fedspeak nor hot inflation data was able to take EURUSD back down to YTD lows. Now we see ECB rate hike bets increasing, as multiple policymakers this week have called for outsized rate hikes at the next few meetings.

It remains to be seen whether this recent perkiness in EURUSD is the pair attempting to bottom, or if we are just consolidating ahead of the next major move. A series of higher lows off of the September 28th low have offered trendline support that notably held during the brief US CPI sell-off. With a symmetrical triangle brewing, EURUSD may be setting up for a sharp move into month-end. Should the symmetrical triangle break to the upside, an immediate first target would be parity. EURUSD moving higher would certainly be the “max-pain” trade at the moment, given positioning and sentiment surrounding the EU.

EURUSD 4 Hour Chart

Chart created with TradingView

Retail trader data show that 59.27% of traders are net-long with the ratio of traders long to short at 1.46 to 1. The number of traders net-long is 13.92% higher than yesterday and 2.06% lower from last week, while the number of traders net-short is 13.58% lower than yesterday and 9.01% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggestsEUR/USDprices may continue to fall. Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a furthermixed EUR/USD trading bias.

| Change in | Longs | Shorts | OI |

| Daily | -2% | 4% | 0% |

| Weekly | 8% | 10% | 9% |

RESOURCES FOR FOREX TRADERS

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

— Written by Brendan Fagan

To contact Brendan, use the comments section below or @BrendanFaganFX on Twitter

[ad_2]

Source link

.png)