[ad_1]

NOVEMBER FOMC DECISION KEY POINTS

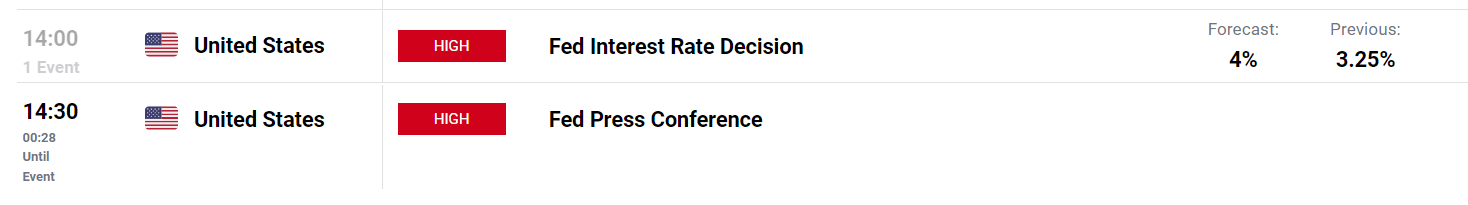

- The Fed raises its benchmark interest rate by three-quarters of a percentage point to 3.75%-4.00%, in line with expectations

- The FOMC statement alters forward-guidance to note that it will take into account the cummulative effects of tightening in setting policy

- Powell’s press conference at 2:30 ET may help clear up doubts about the tightening outlook, setting the tone for the U.S. dollar

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Most Read: The Federal Reserve Bank – A Forex Trader’s Guide

The Federal Reserve concluded its November meeting this afternoon, approving another front-loaded tightening measure in its quest to tame sky-high inflation running at the fastest pace in 40 years.

At the end of the two-day gathering on Wednesday, the FOMC voted to raise borrowing costs by 75 basis points to 3.75%-4.00%, in line with expectations, marking the sixth successive adjustment and the fourth consecutive three-quarters of a percentage point hike during this cycle.

Today’s move brings the FOMC’s target rate to the highest and most restrictive level since early 2008, a sign that the central bank will not relent in their efforts to restore price stability. The decision was reached unanimously, suggesting policymakers remain in broad agreement on the need for a forceful policy response to address elevated inflationary pressures in the economy.

Source: DailyFX Economic Calendar

Related: Central Banks and Monetary Policy – How Central Bankers Set Policy

FOMC STATEMENT HIGHLIGHTS

The November statement provided few new hints about the economy, reiterating earlier comments that recent indicators point to modest growth in spending and production. Elsewhere, the committee’s characterization of the labor market continued to be broadly positive, emphasizing that jobs gains have been robust and that the unemployment rate is low.

On the consumer prices front, the assessment was unchanged, with policymakers repeating that inflation remains elevated and that they are highly attentive to its risks. In terms of future actions, the institution kept language indicating that “ongoing increases in the target range will be appropriate”, but added that the bank will take into account the cumulative effects of the tightening in setting policy.

The change in forward-guidance suggests that the Federal Reserve may be contemplating slowing the pace of hikes to allow more time to assess how its restrictive stance is playing out in the real economy (considering its lag) and to better respond to incoming data amid rapidly cooling activity.

The softer tone, however, does not amount to a policy pivot and therefore should not be interpreted as a signal of an earlier end to the normalization cycle or a lower terminal rate. In any case, Powell could clear up doubts about the bank’s next steps during his press conference, but so far there is no reason to believe that today’s posture shift will fundamentally alter the bullish outlook for the U.S. dollar.

Recommended by Diego Colman

Get Your Free USD Forecast

EDUCATION TOOLS FOR TRADERS

- Are you just getting started? Download the beginners’ guide for FX traders

- Would you like to know more about your trading personality? Take the DailyFX quiz and find out

- IG’s client positioning data provides valuable information on market sentiment. Get your free guide on how to use this powerful trading indicator here.

—Written by Diego Colman, Market Strategist for DailyFX

[ad_2]

Source link