[ad_1]

The Federal Reserve’s plan outlined on Wednesday to shrink its nearly $9 trillion balance sheet will result in a nearly $3 trillion reduction in its record size over the next three years, according to a tally by BofA Global strategists.

The process, called “quantitative tightening,” aims to reduce some of the pandemic-era liquidity sloshing through markets, at the same time the Fed seeks to quickly raise interest rates to fight inflation at 40-year highs.

To start, the Fed plans to reduce its Treasury and agency mortgage-bond holdings by $47.5 billion a month starting in June, but to increase its asset reductions in September at a steady pace of $95 billion a month.

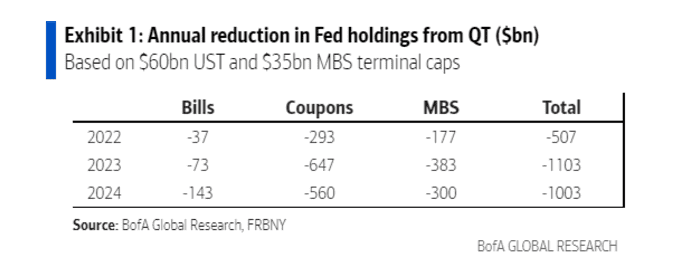

The BofA team broke out how that pace would reduce its holdings (see chart) of Treasury bills, coupons and mortgages bonds each year, through 2024.

Fed plan to slash almost $3 trillion in assets from its holdings.

BofA Global Research, FRBNY

Fed Chairman Jerome Powell said higher rates are the cure to dulling the pain of a surge in the cost of living, in a Wednesday afternoon news conference following the Fed’s first 50-basis-point rate increase since 2020.

The BofA team expects the Fed’s policy rate to hit 3.25% to 3.5% by May 2023, from its current range of 0.75% to 1%.

While reiterating the need to quickly raise rates, Powell also spoke to the potential for wide-ranging effects by shrinking the Fed’s balance sheet.

“You know, we run these models, and everyone does in this field, and make estimates of what will be the — how do you measure, you know, a certain quantum of balance-sheet shrinkage compared to quantitative easing?” he said, according to a transcript of the news conference.

“And you know, these are very uncertain. I really can’t be any clearer,” he said.

Stocks surged Wednesday after Powell signaled support for 50-basis-point rate hikes at the next two meetings, but ruled out a bigger 75-basis-point hike. The Dow Jones Industrial Average

DJIA,

advanced 2.8% for its best day since November 2020, while the S&P 500 index

SPX,

surged 3%.

The climb in the 10-year Treasury rate

TMUBMUSD10Y,

was near 2.914%.

Read next: The Fed’s plan to rapidly slash its balance sheet is out. Here’s what happens to money in the system.

[ad_2]

Source link