[ad_1]

Ford Motor Co.’s credit is a step closer to returning to investment grade after Moody’s upgraded it to Ba1 from Ba2, placing it at the highest level of speculative-grade status.

The upgrade reflects the expectation “that Ford can sustain a marked improvement in its automotive [earnings before interest, taxes and depreciation] margin and automotive cash flow,” the rating agency said Thursday.

“Meaningful improvements in its Ford Blue and Ford Pro segments underpin a higher EBITA margin, despite considerable losses at Ford’s electric vehicle segment, Model e, and will allow the company to generate sustained positive free cash flow,” Moody’s said.

Still, Moody’s cautioned that execution risk around the company’s electric-vehicle transition “continues to be significant.”

Ford has been working to electrify its fleet for several years and is targeting an annual production pace of 600,000 electric vehicles by the end of this year, ramping up to 2 million by the end of 2026. It has also promised to make EVs half of its mix globally by 2030.

“Key risks for automakers, including Ford, include loss of market share, inability to earn adequate profits and returns on electric vehicles, as well as inability to manufacture vehicles due to potential constraints in the supply of critical materials,” Moody’s said.

Ford’s

F,

credit was downgraded to speculative-grade, or “junk,” status in 2020 amid concerns that a shutdown of its North American factories related to the COVID-19 pandemic would hurt margins and cash flow.

The carmaker had returned to investment grade in 2012, after the 2008 financial crisis pushed all of the major U.S. carmakers into turmoil.

A return to investment grade would likely boost demand for Ford’s bonds, which have seen net buying in recent days. A higher credit rating would make the cost of borrowing cheaper.

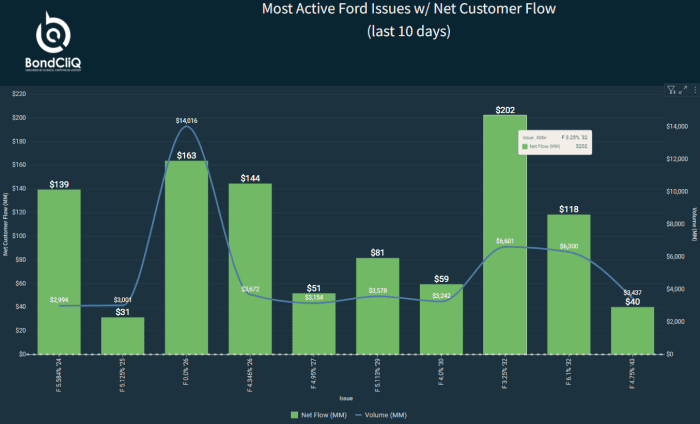

As the following chart from BondCliQ Media Solutions shows, the company’s most active bonds over the last 10 days have all enjoyed better net buying. The 3.25% notes that mature in 2032 have seen $202 million of net buying in the period. The blue line shows total volume for each issue.

The most active Ford issues with net customer flow over the last 10 days.

BondCliQ Media Solutions

Moody’s said Ford’s early success with a turnaround plan and favorable industry conditions have given it the flexibility to absorb the hit to earnings caused by the high costs of the EV transition.

“Importantly, Ford is no longer reliant on dividends from Ford Motor Credit Company LLC (Ford Credit) to help fund capital expenditures, even after a considerable step-up in capital spending in the next several years related to the company’s transition to electric vehicles,” the agency said.

Other positives include strong liquidity and modest leverage, which should help the company withstand a possible strike at its factories when a new labor contract is negotiated later this year.

See: Ford’s U.S. sales rise 11% in latest quarter

The company had cash and marketable securities of $28.6 billion as of March 31 and $17.6 billion available under committed credit facilities. It has limited debt maturities through 2025 and expects free cash flow of $1.4 billion this year, excluding dividends.

The ratings could be upgraded again if Ford can keep its automotive EBITA margin above 5%, if it shows it can fund capital expenditures and dividends from the cash flow generated by the automotive business and if it can show signs of commercial success and profitability trends for its battery EVs, Moody’s said.

The stock has gained 29% in the year to date, outperforming the S&P 500’s

SPX,

17% gain.

Read also: Tesla’s EV charging standard is becoming widely adopted, in another boost for the stock

[ad_2]

Source link