[ad_1]

Fund managers are no longer forecasting a U.S. recession for the first time in a year and half, according to a closely followed survey.

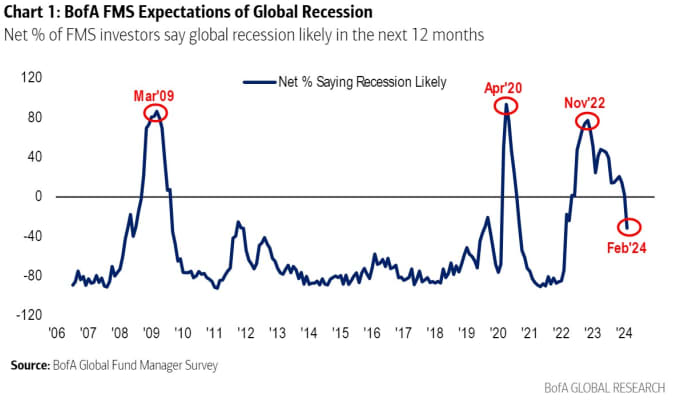

Bank of America’s monthly global fund manager survey finds the percentage expecting a global recession in the next 12 months has turned negative for the first time since April 2022.

The survey, which for February counted 249 panelists with $656 billion in assets under management, often is used not just as a representation of market views but as a source for contrarian ideas.

The percent expecting a stronger economy over the next 12 months is still negative, but at -25% is the most optimistic since Feb. 2022. Just 11% expect a hard landing, while about two-thirds still say a soft landing is the most likely case for the global economy.

With this economic optimism, fund managers taken their cash levels down to 4.2% in February from 4.8% in January, near the Bank of America contrarian sell signal when cash is at or below 4%.

The fund managers judge the “long Magnificent Seven” trade to be the most crowded one, which at 61% is the most crowded since 64% in Oct. 2022 said long the U.S. dollar was the most crowded trade.

The second most crowded trade is short Chinese equities, at 25%.

U.S. commercial real estate took the number-one spot for the most likely source of a systemic credit even after the recent warnings from New York Community Bancorp

NYCB,

Aozora Bank

8304,

AOZOY,

and Deutsche Pfandbriefbank

PBB,

The biggest change in allocations was a rotation into telecom, stocks more broadly, tech and the U.S., and out of emerging markets, real estate investment trusts, staples and cash.

Overall, investors are bullish tech, healthcare, stocks, U.S. and telecom and bearish U.K., REITs, utilities, energy and banks.

The S&P 500

SPX

ended Monday just shy of another record high and has advanced 21% over the last 52 weeks.

The yield on the 10-year Treasury

BX:TMUBMUSD10Y

has climbed 31 basis points this year on increasing optimism over the U.S. economy.

[ad_2]

Source link