[ad_1]

USD/JPY News and Analysis

- ‘Decisive steps’ to be considered by Japan’s Finance Ministry

- USD/JPY flirts with danger – trading perilously close to the 152.00 marker

- Lower liquidity over the Easter holidays may provide a suitable opportunity to strengthen the yen but timing remains unclear

- Learn how to setup for market moving news and data by implementing this easy to use approach:

Recommended by Richard Snow

Trading Forex News: The Strategy

‘Decisive Steps’ to be Considered by Japan’s Finance Ministry

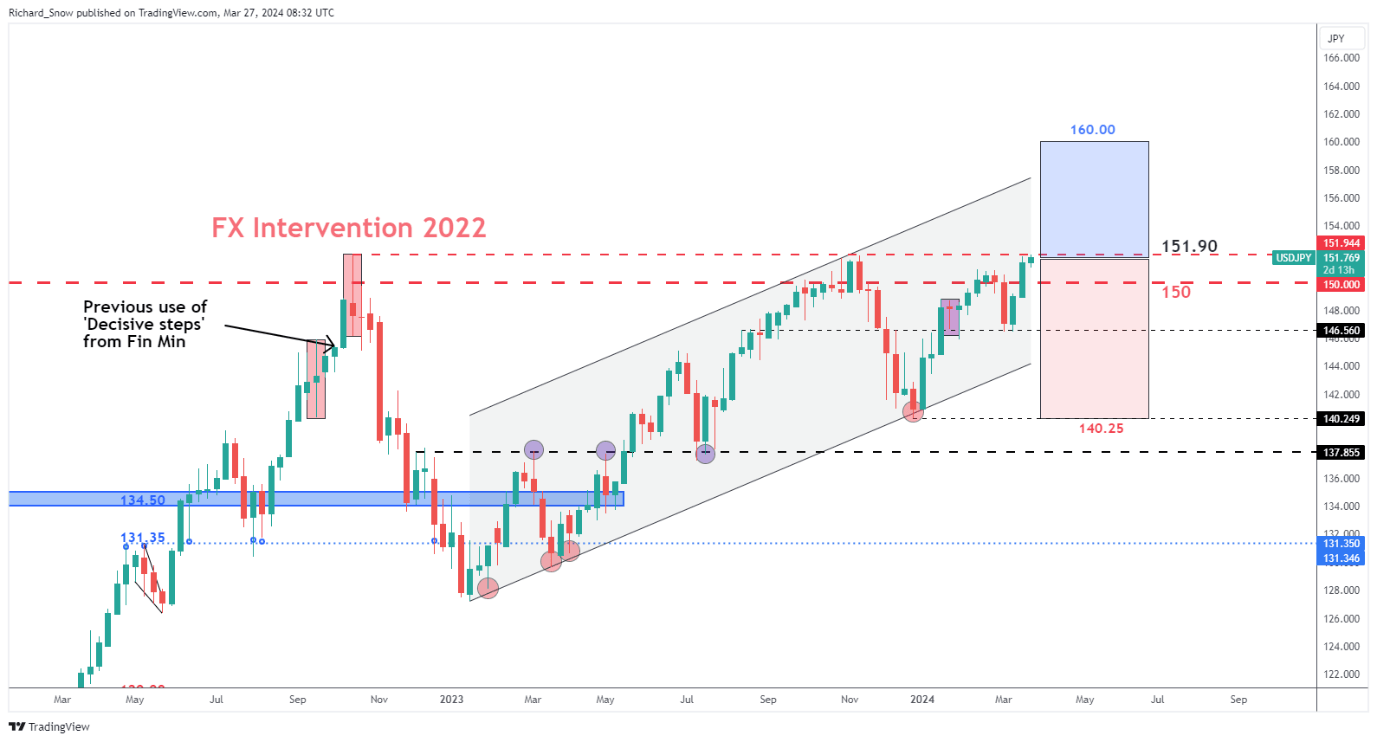

Japan’s minister of finance Shunichi Suzuki stated that authorities could take ‘decisive steps’ in his strongest warning to the FX market this year. Recent USD/JPY price action reached a new cycle high, just below the 152.00 level, warranting a step up in the rhetoric surrounding another round of FX intervention from authorities in collaboration with the Bank of Japan.

The last time authorities intervened in the FX market was October 21st, 2022, where the Bank was instructed to sell a large quantity of dollars in exchange for yen in an effort to strengthen the local currency. Previously, the words ‘decisive steps’ appeared on October 3rd 2022 when USD/JPY reached 145.00 but the yen was allowed to rise another 700 pips before action was ultimately taken.

Given that we are already flirting with the 152.00 marker, there may not be as much leeway as previously suggested. If authorities saw it fit to intervene, they may eye low liquidity environment likely to result from the Easter holiday period which gets under way this Friday until next Monday.

USD/JPY Weekly Chart

Source: TradingView, prepared by Richard Snow

Lower liquidity over the Easter Holidays May Provide Suitable Conditions for Intervention but Timing Remains Unclear

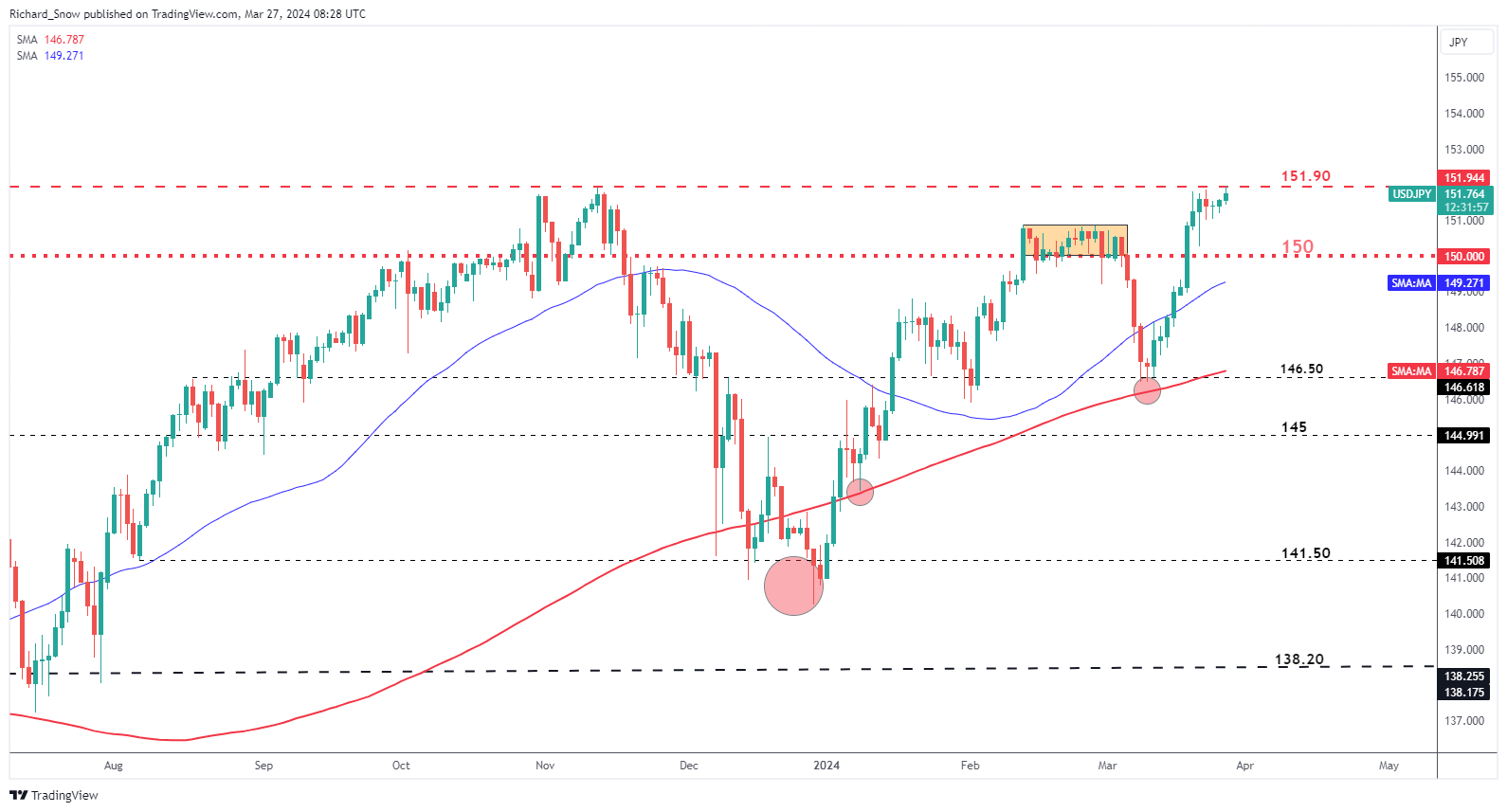

USD/JPY comes perilously close to the 152.00 level as markets test the resolve of currency officials. Despite the rate hike issued by the Bank of Japan, the yen continues its downward spiral as the ‘carry trade’ remains a popular strategy for those chasing higher yielding currencies like the pound or US dollar.

Long trades from here are fraught with risk and do not offer up an acceptable risk/reward profile. Should intervention, or any effective warning of intervention, result in a stronger yen, levels of note to the downside include 150 and 146.50.

USD/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

USD/JPY is one of the most liquid FX pairs and carries significance from a global trade and interest rate perspective. Read up on the nuances of the currency pair that all traders ought to know:

Recommended by Richard Snow

How to Trade USD/JPY

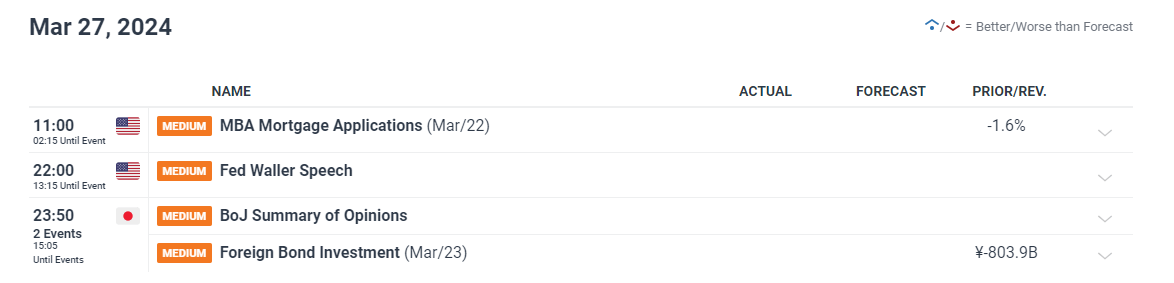

Risk Events into the end of the Week

The BoJ summary of opinions (inflation and growth forecasts) are due just before midnight this evening and ought to add to ongoing speculation around the path of interest rates for Japan after the Bank voted to lift rates out of negative territory earlier this month.

Tomorrow, the final Q4 GDP data for the US is due and on Good Friday US PCE will provide further insight into the inflation dynamic in the US.

Customize and filter live economic data via our DailyFX economic calendar

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]

Source link