[ad_1]

UK (Flash) PMI Data Analyzed

- UK Manufacturing PMI 46.2 vs exp 45.8 (46.2 prior)

- UK Services Sector PMI 48.8 vs exp 48 (48.8 prior)

- Manufacturing dips due to lower global demand, services see boost from GBP depreciation

Recommended by Richard Snow

Introduction to Forex News Trading

Customize and filter live economic data via our DaliyFX economic calendar

Lower Foreign Demand Hits the UK Manufacturing Sector, Services Declines at Slower Pace

The services sector declined at a slower rate than the manufacturing sector as companies cited cutbacks to non-essential spending in response to rising costs and overall economic conditions. The services sector had helped stem the deteriorating outlook until last month’s PMI figures confirmed that the sector had finally entered into a contractionary period alongside the manufacturing sector.

Lower volumes of new business from foreign territories weighed on order books thus far in November, with the most alarming stat registering the fastest decline in export sales since May 2020, a period synonymous with global lockdowns. Brexit-related constraints and an unfavorable global back drop were also cited as challenges but the recent depreciation in the pound provided a boost for exporting companies.

Pound Sterling Reaction (GBP)

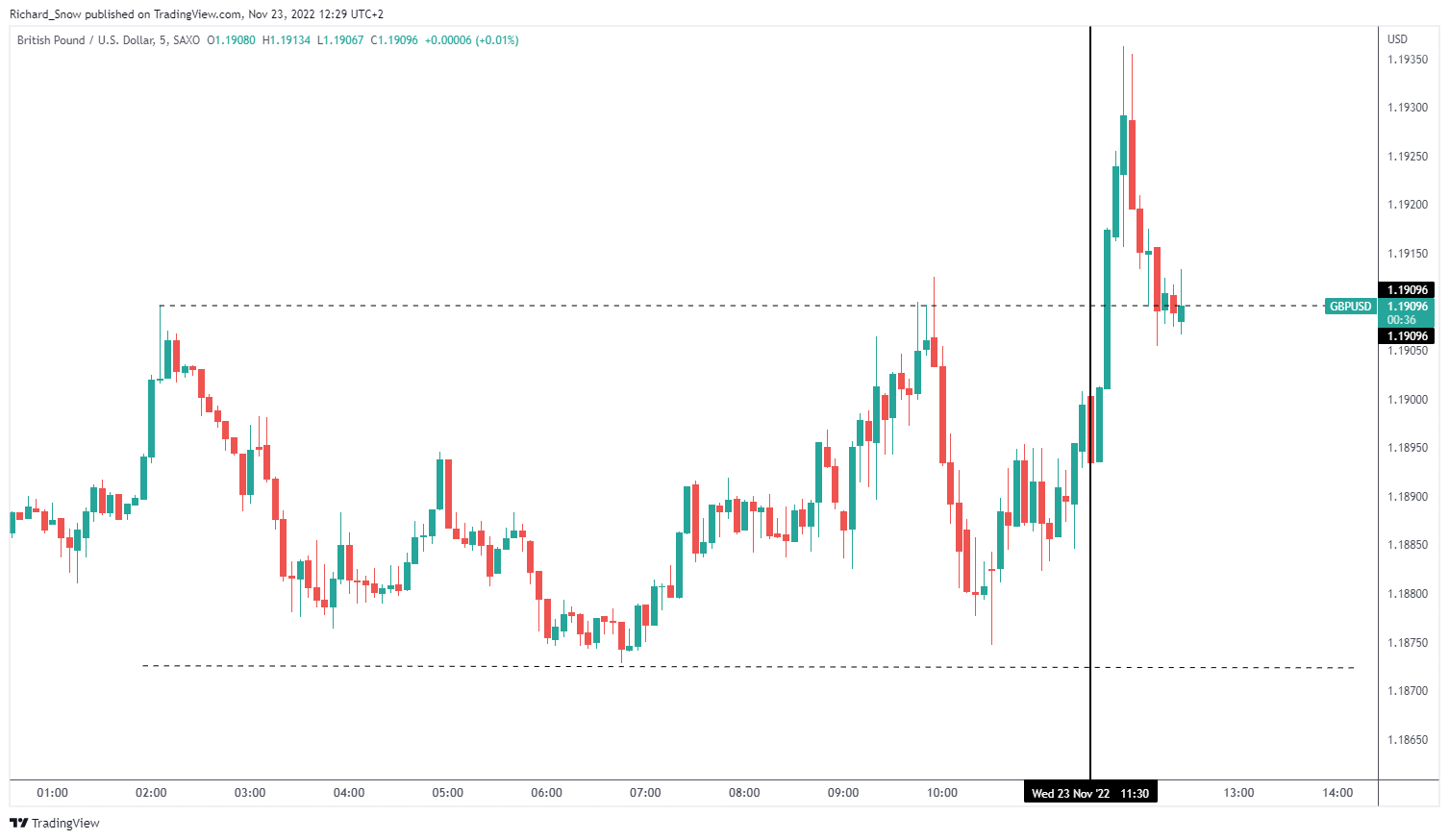

Cable saw a rise in the pair (GBP strength) immediately after the release although the US dollar, via the US dollar basket (DXY), has been weakening during the morning of the London session and ay have attributed to some of the gains. Since then, GBP/USD has traded moderately lower, returning to the high of the daily range which has developed thus far.

GBP/USD 5 minute chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

How to Trade GBP/USD

— Written by Richard Snow for DailyFX.com

[ad_2]

Source link