[ad_1]

POUND STERLING TALKING POINTS

- Weak UK economic data has left the pound vulnerable..

- U.S. data under the spotlight.

- 200-day SMA breach could suggest further downside to come.

Recommended by Warren Venketas

Get Your Free GBP Forecast

GBP FUNDAMENTAL BACKDROP

The British pound is trading marginally higher this Friday on the back of a slightly weaker U.S. dollar. Yesterday’s miss on UK GDP (both YoY and QoQ) brought about the first quarter of negative growth for the UK economy in 2022 and will bring much focus on the Q4 release next year – a technical recessions consists of 2 consecutive quarters of negative growth. In addition, strike action in the UK, dishing household income in the midst of elevated inflation makes conditions tough for the Bank of England (BoE) but may likely end rate hikes sooner than the Federal Reserve giving the 2023 outlook for cable in favor of the greenback.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

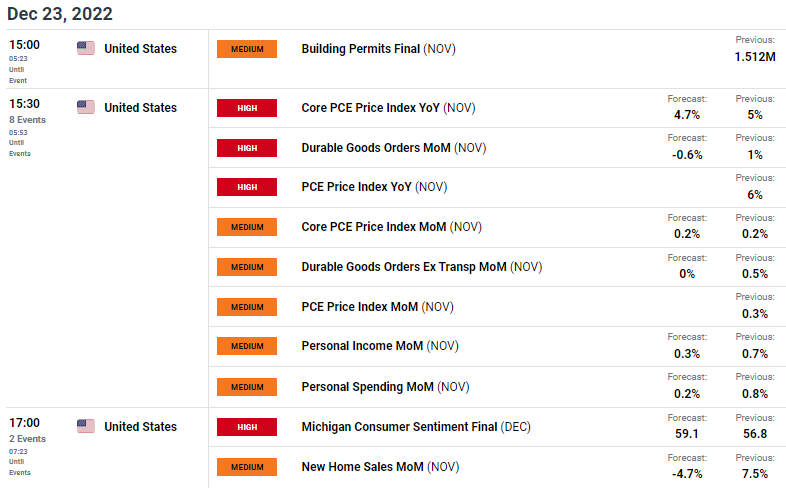

On the economic calendar today, the focus is solely on U.S. economic data (see calendar below), Both durable goods orders and core PCE data are anticipated lower for November and could weigh on the USD should actual data come in worse or in line with expectations. On the other hand, Michigan consumer sentiment for December looks to be far more optimistic and may close off the trading week on the front foot for the dollar against the pound.

ECONOMIC CALENDAR

Source: DailyFX Economic Calendar

TECHNICAL ANALYSIS

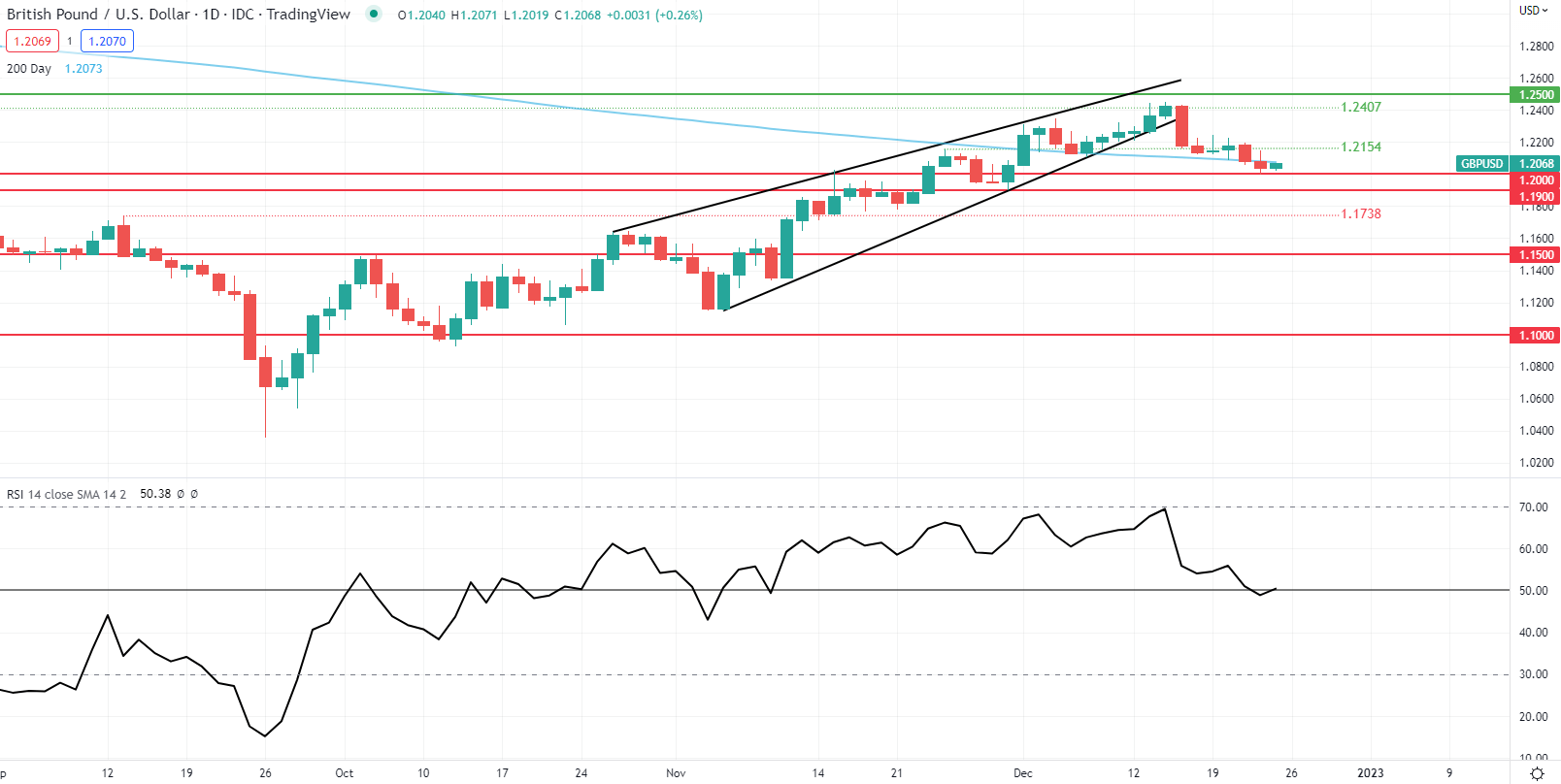

GBP/USD DAILY CHART

Chart prepared by Warren Venketas, IG

The daily GBP/USD chart above has price action flirting with the 200-day SMA (blue) after yesterday’s daily close below and even briefly pushing below the 1.2000 psychological handle. The fundamental catalyst later today if favorable for the USD could find the pair testing subsequent support around the 1.9000 level. I expect prices to how minimal movement leading up to these releases with increased volatility pre and post announcement considering the low levels of liquidity.

Key resistance levels:

Key support levels:

BEARISH IG CLIENT SENTIMENT

IG Client Sentiment Data (IGCS) shows retail traders are currently LONG on GBP/USD, with 52% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment resulting in a short-term upside bias.

Contact and followWarrenon Twitter:@WVenketas

[ad_2]

Source link