[ad_1]

GBP/USD PRICE, CHARTS AND ANALYSIS:

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

READ MORE: Bitcoin Q3 Fundamental Forecast: Still Standing After Regulatory Woes and Higher Rates

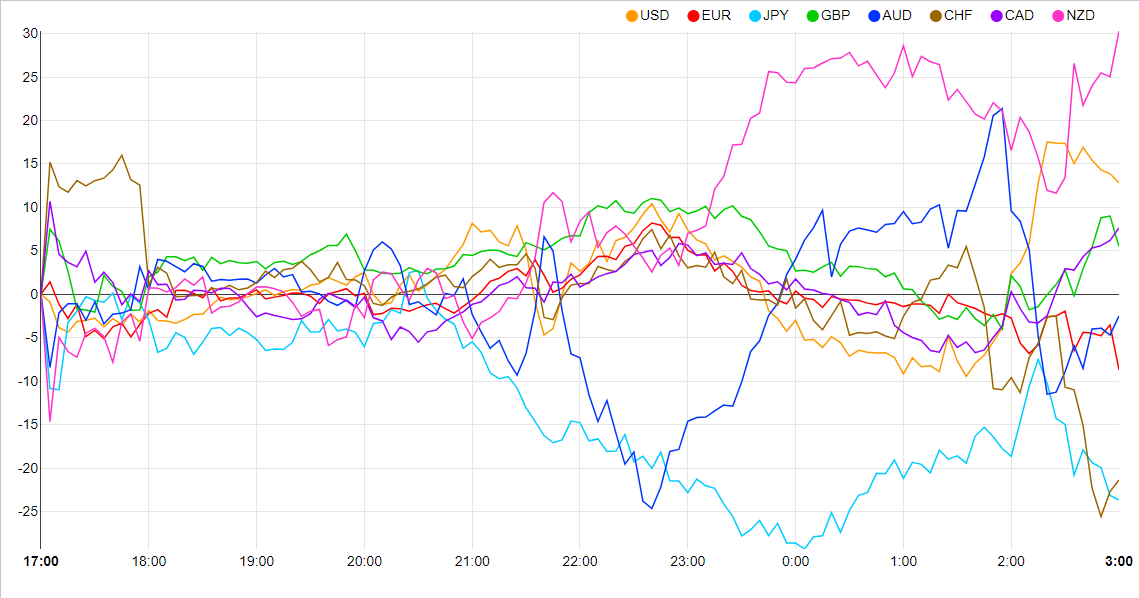

GBP/USD faced selling pressure following the European open as momentum for a deeper pullback continues to build. The 1.2700 level continues to prove a tough nut to crack for Cable bulls as a retest of the 50-day MA grows ever more likely. Looking at the currency strength chart below, GBP is in the middle of the pack as the NZD starts the week as the strongest currency.

Currency Strength Chart: Strongest – NZD, Weakest – JPY.

Source: FinancialJuice

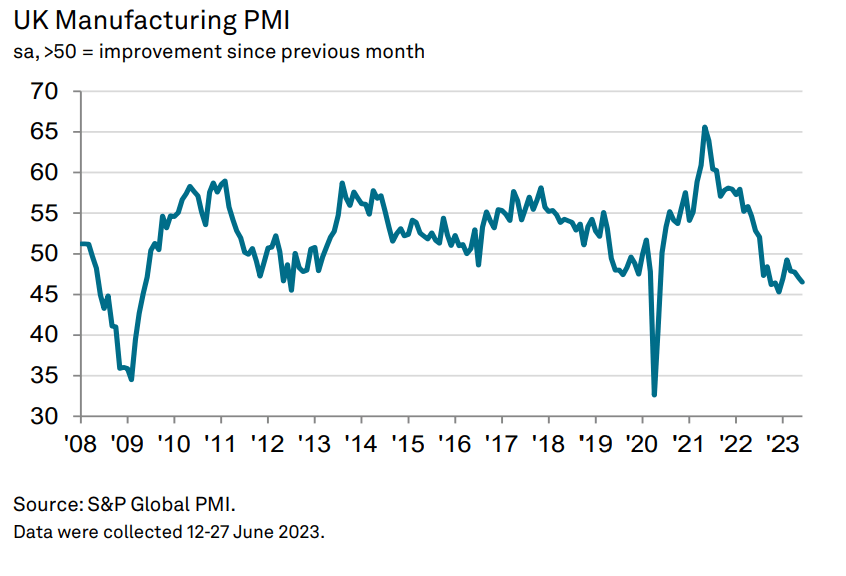

UK Manufacturing Final PMI numbers were released this morning which showed sign of a slowdown as output, new orders and employment all contracted. The print of 46.5 is the lowest of 2023 as the UK has thus far exceeded expectations around economic growth in a challenging environment. A positive from the data, could be the fall in both input prices and output charges which have fallen and should bode well for the UK inflation picture moving forward. The Bank of England (BoE) has remained extremely positive regarding an easing of inflationary pressures in the second half of 2023, and this could be the first sign that easing price pressures are on their way.

US FACTORS, FOMC MINUTES, NFP AND JOBS DATA

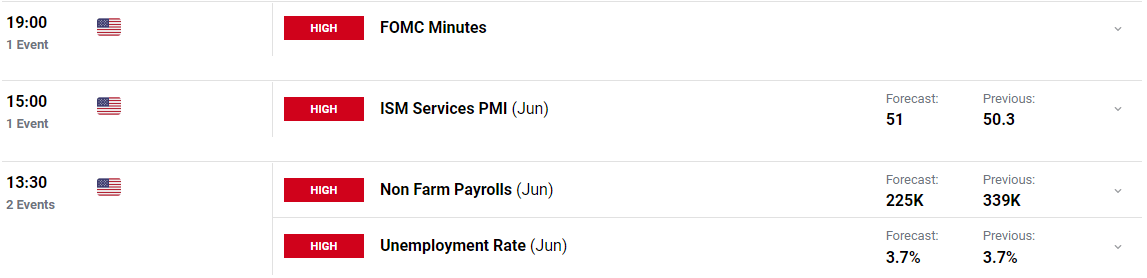

The rest of the week is expected to be largely US Dollar dominated as we do have a host of high impact data from Wednesday onward. Tomorrow of course is the US Independence Day holiday with thin liquidity and volume expected before attention will turn to the FOMC Minutes release.

The week will be wrapped with the NFP jobs data which could provide the Fed with further ammunition ahead of the Federal Reserve’s July meeting.

For all market-moving economic releases and events, see the DailyFX Calendar

Recommended by Zain Vawda

How to Trade GBP/USD

TECHNICAL OUTLOOK AND FINAL THOUGHTS

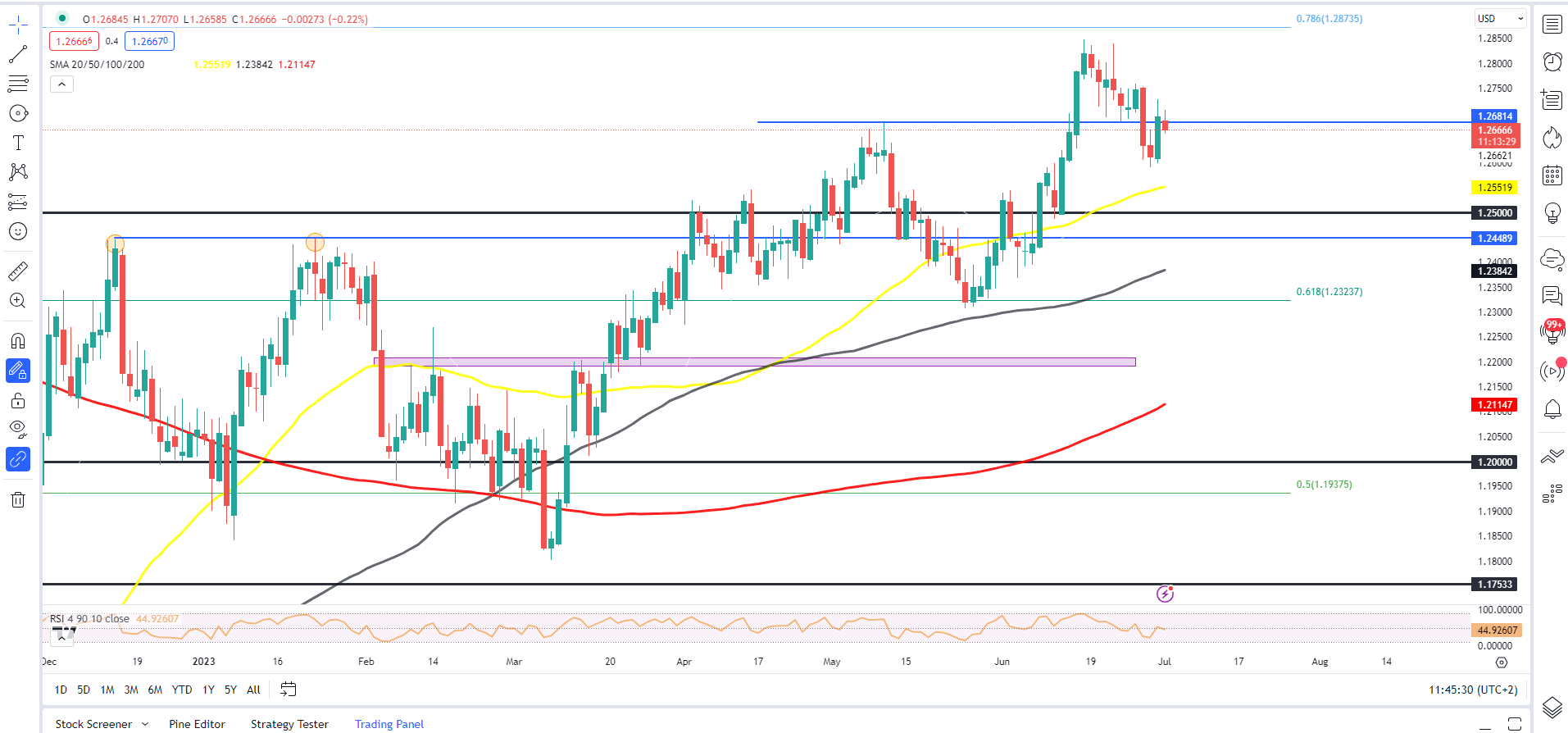

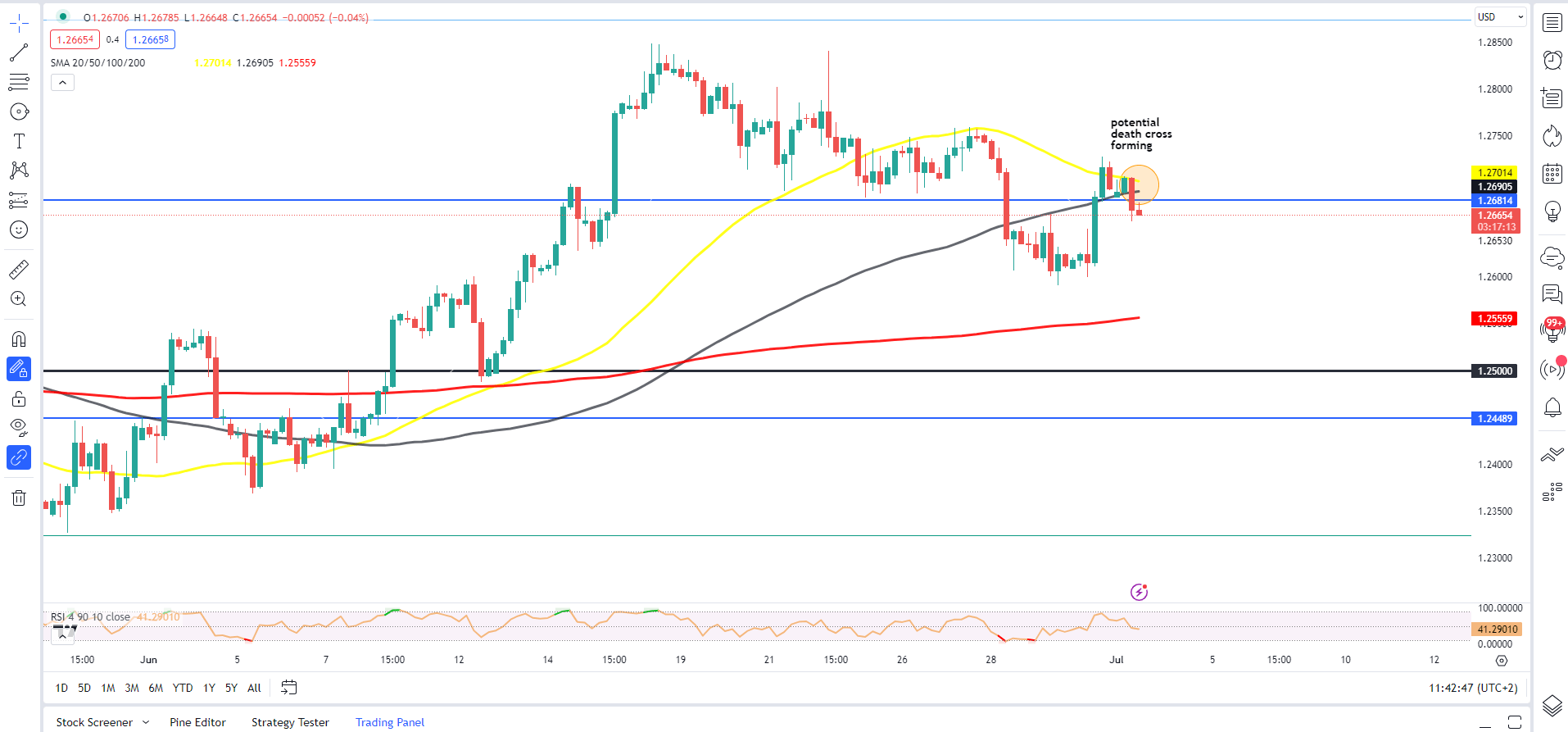

On the daily timeframe GBPUSD has printed a fresh lower low last week Thursday before a bullish engulfing close to end the week hinting at a bullish start to the week. Cable has however struggled this morning, with key resistance area around the 1.2680-1.2700 holding firm at present.

GBP/USD Daily Chart – July 3, 2023

Source: TradingView

Looking at the H4 chart however and we can clearly see GBPUSD is firmly in a downtrend with a death cross imminent as the 50-day MA is about to cross below the 100-day MA which could push Cable lower as the week progresses. For now, though 1.2700 holds the key with a break above likely leading to a retest of the YTD high while a deeper retracement may provide potential longs with a better opportunity to get involved.

Key Intraday Levels to Keep an Eye Out For

Resistance levels:

Key support levels:

GBP/USD Four-Hour Chart – July 3, 2023

Source: TradingView

Recommended by Zain Vawda

Get Your Free Top Trading Opportunities Forecast

Written by: Zain Vawda, Markets Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]

Source link