[ad_1]

GOLD PRICE KEY POINTS:

- Gold prices turn lower on Wednesday, pressured by broad-based U.S. dollar strength and strong rebound in U.S. Treasury yields

- Better-than-expected U.S. economic data backs case for Fed to remain on hawkish path

- XAU/USD pivots lower after failing to clear trendline resistance

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Most Read: S&P 500, Nasdaq 100, Dow Jones Forecast – Bear Bounce or Fed Pivot?

Bond yields corrected lower in recent days on speculation that the Fed could pivot to a less aggressive stance in the near future amid growing stress in financial markets and fears of a global economic accident, paving the way for the U.S. dollar to pull back from its multi-decade highs set late last month. This situation bolstered gold and silver prices, triggering a sharp rally over the past week.

However, the situation changed on Wednesday after the U.S. currency managed to stage a solid comeback, supported by a jump in Treasury rates in the wake of stronger-than-anticipated U.S. economic data. Together, the moves in the FX and fixed income space took the oxygen out of precious metals, prompting a swift bearish reversal, with XAU/USD down about 0.7% and XAG/USD off by more than 2.5% from its previous session close at the time of writing.

With the U.S. labor market extremely tight and the economy holding up better than expected despite higher borrowing costs and other challenges, the Fed has no reason to deviate from its hawkish course, at least for now. This means that policymakers will likely press ahead with their plans for further hikes in the coming months to weaken demand pressures in their effort to bring inflation, which remains more than 4% times above the central bank’s 2% target.

In the short term, the scenario described above should keep the greenback and real rates supported, creating a hostile environment for non-yielding assets, even more so if they are priced in US dollars. Against this backdrop, the outlook for gold and silver is still bearish, suggesting that both commodities remain vulnerable and could suffer additional losses in the coming days and weeks, especially if U.S. economic data continues to surprise to the upside (good numbers mean no central bank pivot).

Recommended by Diego Colman

Our Fourth Quarter Gold Forecast is Ready for Download!

GOLD PRICES TECHNICAL ANALYSIS

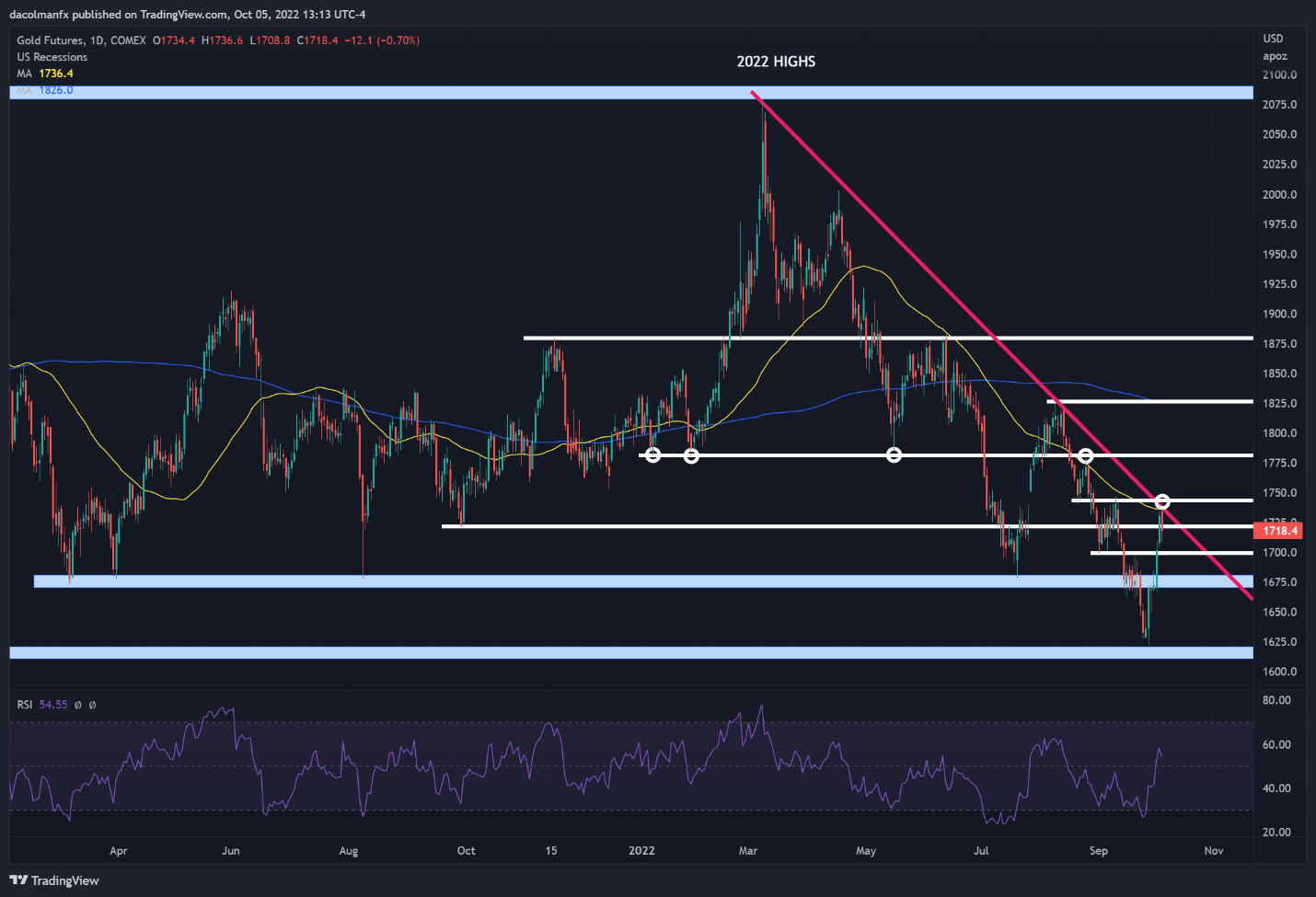

After a strong rally in recent days, gold prices stalled at trendline resistance near $1,740/$1,745, turning lower from those levels as bears regained control of the market. If selling pressure accelerates in the coming sessions, initial support lies at $1,700, followed by $1,680/$1,670. On the flip side, if downside momentum eases and dip-buyers swoop in to spark a reversal, the first ceiling to watch appears at $1,740. If this barrier is breached, XAU/USD may go on to challenge the $1,780area.

| Change in | Longs | Shorts | OI |

| Daily | -5% | 4% | -2% |

| Weekly | -12% | 16% | -6% |

GOLD (XAU/USD) TECHNICAL CHART

Gold Prices Chart Prepared Using TradingView

EDUCATION TOOLS FOR TRADERS

- Are you just getting started? Download the beginners’ guide for FX traders

- Would you like to know more about your trading personality? Take the DailyFX quiz and find out

- IG’s client positioning data provides valuable information on market sentiment. Get your free guide on how to use this powerful trading indicator here.

—Written by Diego Colman, Market Strategist for DailyFX

[ad_2]

Source link