[ad_1]

Gold, Retail Trader Positioning, Technical Analysis – IGCS Update

- Gold prices aiming for worst month since February

- Retail traders continue to become more net-long

- XAU/USD at risk after breaking below trendline

Recommended by Daniel Dubrovsky

Get Your Free Gold Forecast

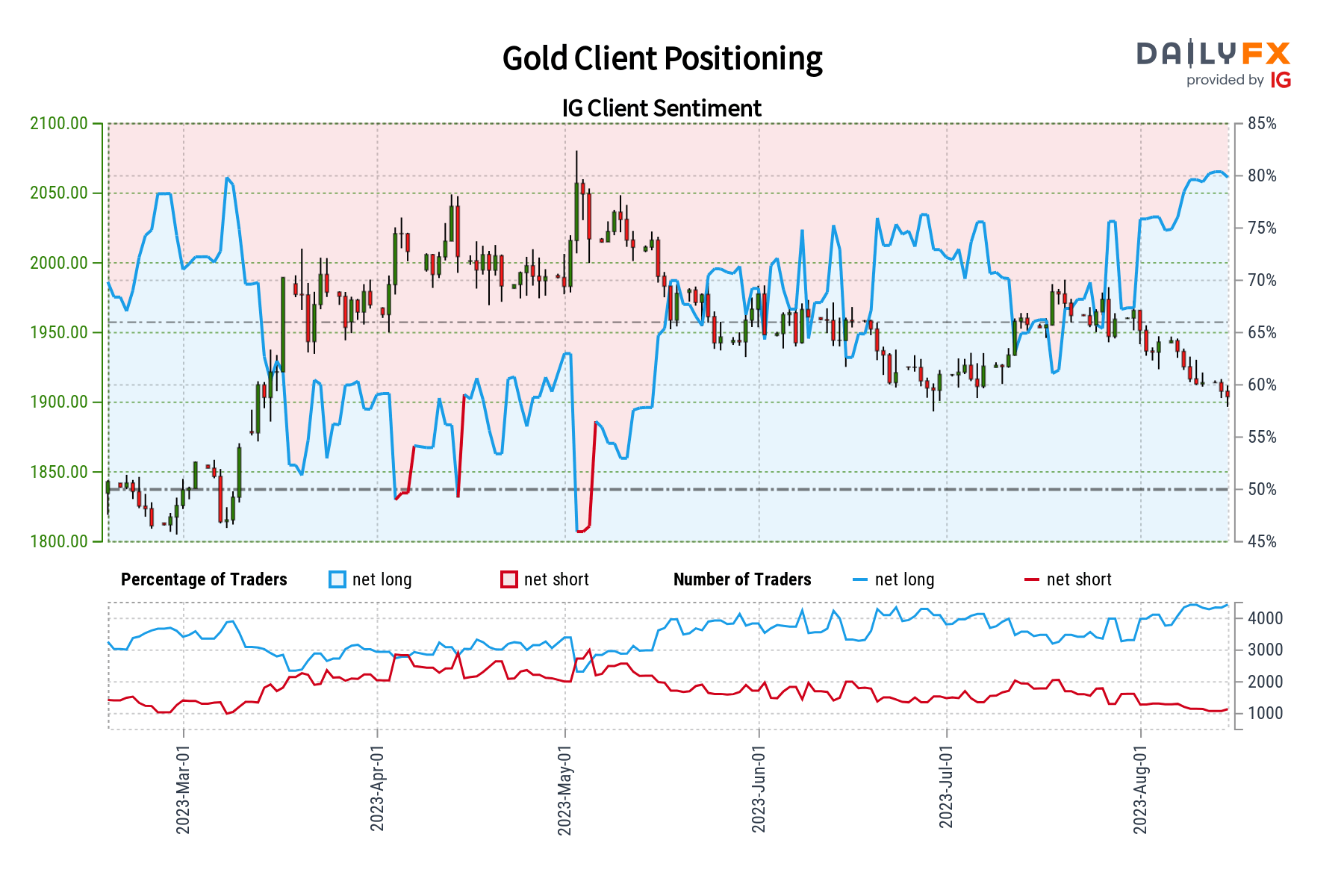

So far this month, gold prices have weakened about -3.2 percent as a combination of rising Treasury yields and a stronger US Dollar pressured the yellow metal. If losses are sustained, this could be the worst month for XAU/USD since February. In response, retail traders have continued to increase upside exposure. This can be seen via IG Client Sentiment (IGCS). The latter tends to function as a contrarian indicator, hinting that further pain might be in store for gold.

Gold Sentiment Outlook – Bearish

The IGCS gauge shows that about 80% of retail traders are net-long gold. Since most of them are biased to the upside, this suggests that prices may continue to fall down the road. Meanwhile, upside exposure has increased by 2.72% and 6.46% compared to yesterday and last week, respectively. With that in mind, the combination of overall positioning and recent shifts offers a stronger bearish contrarian trading bias.

Recommended by Daniel Dubrovsky

How to Trade Gold

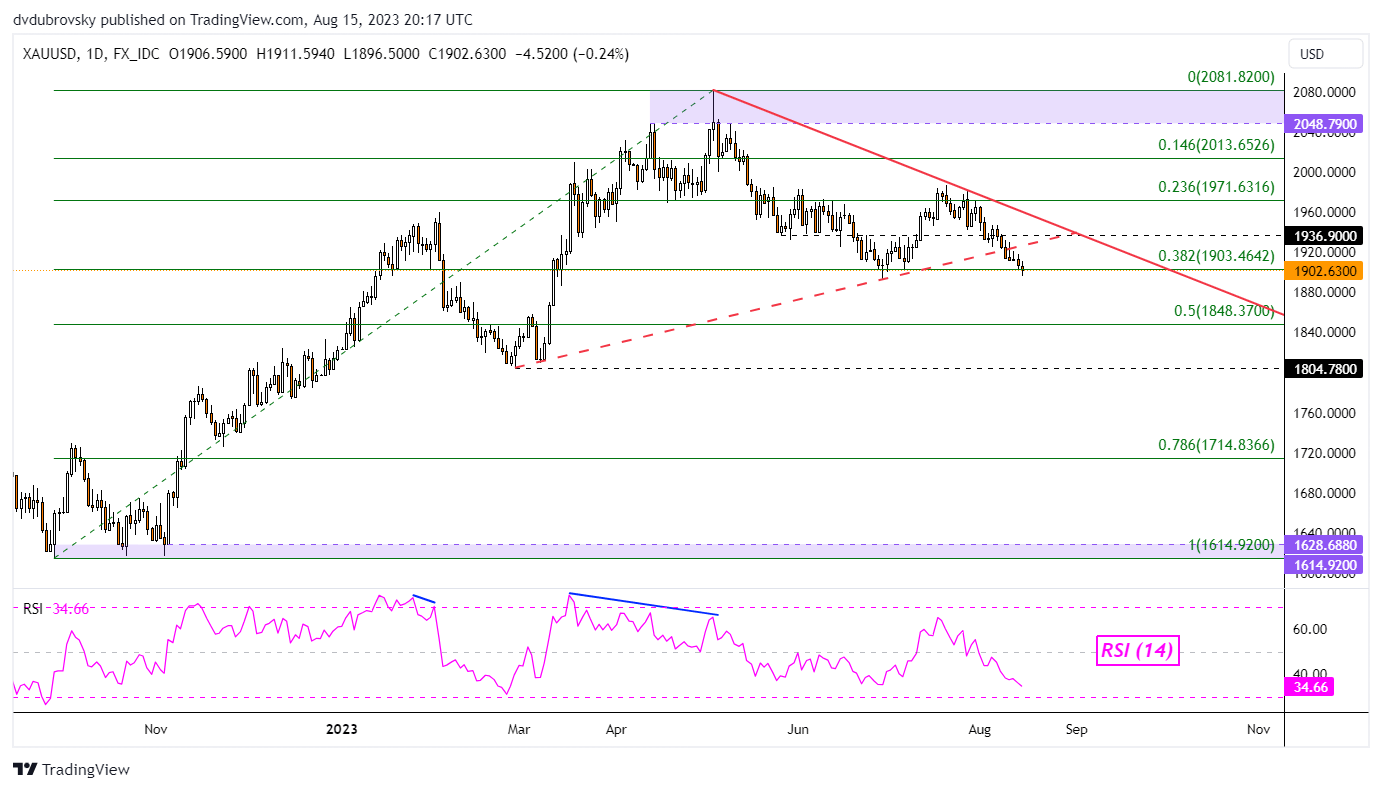

XAU/USD Daily Chart

On the daily chart, gold continues to make downside progress after breaking below the rising support line from February. This has continued to mark a meaningful shift away from what was the dominant uptrend between the end of last year and up until early April. With that in mind, the technical landscape is appearing increasingly bearish.

Immediate support is the 38.2% Fibonacci retracement level at 1903. A confirmatory close under this point exposes the midpoint at 1848. Otherwise, in the event of a turn higher, keep a close eye on the falling trendline from April (solid red line). This could hold as resistance, maintaining the near-term downside focus.

Recommended by Daniel Dubrovsky

How to Trade Gold

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

[ad_2]

Source link