[ad_1]

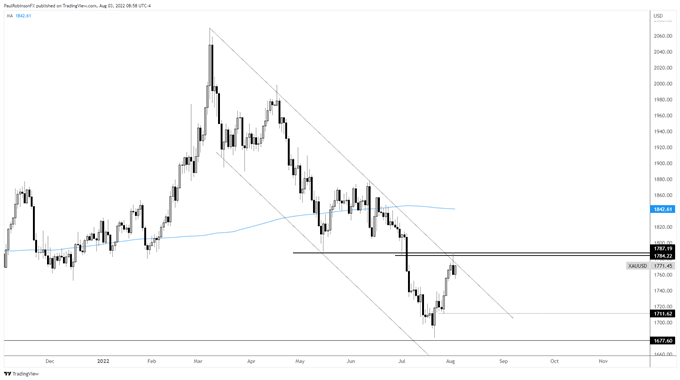

Gold/Silver Technical Outlook:

- Gold pulling back after posting reversal candle at resistance

- Silver doing similar, looking to see if both metals can hold a rally

Spot gold (XAU/USD) has recently rallied strongly from around longer-term support, which as of yesterday brought into play a trend-line from March and a meaningful swing-low from May. The May low was also further validated on July 1 as a good level before gold melted down.

At any rate, resistance was met yesterday and a strong reaction occurred off of it; not too surprising given that the run off the low had yet run into any kind of meaningful opposition. Yesterday’s candle points to the beginning of a testing period for the bounce off the low.

Since the beginning of the year gold has been in a firm downward trend and rallies have failed, but this time around could play out differently. What I will be watching for is a retracement of the rally off the July low and whether buyers step in without too much of a decline developing.

There is a channel in play on the 4-hr worth watching, with 1739 as a horizontal level to keep an eye on. A drop to that point might be a bit much to keep the upside intact, though. Ideally, we see gold meander sideways for a short while and then try and break out above 1787 resistance. If we see resistance overcome then a rally could develop well into the 1800s, or higher.

Gold (XAU/USD) Price Daily Chart

Gold (XAU/USD) Price 4-hr Chart

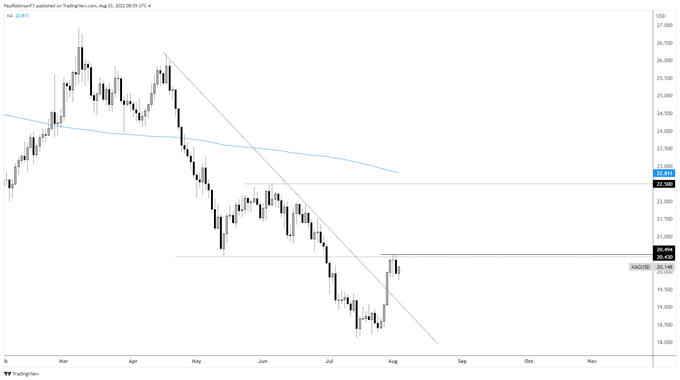

Silver (XAG/USD) is in a similar boat, of course, and on that I will be watching the same type of price action to play out. A climb above 20.49 will have resistance broken and silver trading into open space again. Before doing so it would be good to see it digest recent gains without much of a retracement.

Silver (XAG/USD) Price Daily Chart

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

—Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX

[ad_2]

Source link